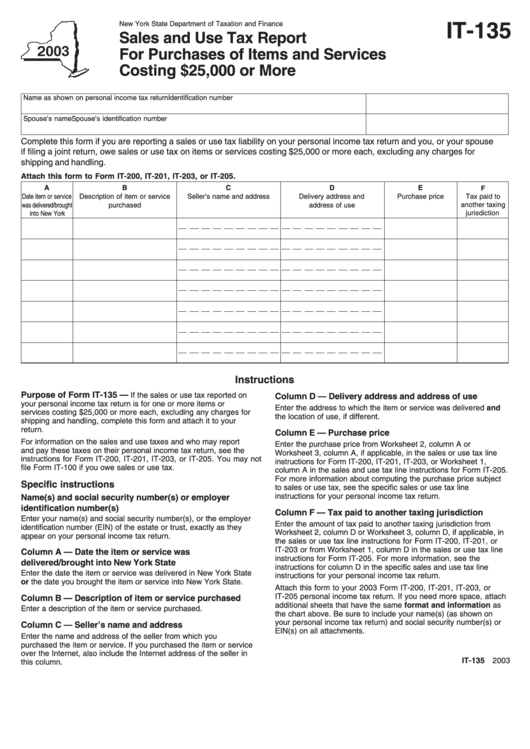

Form It-135 - Sales And Use Tax Report For Purchases Of Items And Services Costing 25,000 Or More - 2003

ADVERTISEMENT

New York State Department of Taxation and Finance

IT-135

Sales and Use Tax Report

For Purchases of Items and Services

Costing $25,000 or More

Name as shown on personal income tax return

Identification number

Spouse’s name

Spouse’s identification number

Complete this form if you are reporting a sales or use tax liability on your personal income tax return and you, or your spouse

if filing a joint return, owe sales or use tax on items or services costing $25,000 or more each, excluding any charges for

shipping and handling.

Attach this form to Form IT-200, IT-201, IT-203, or IT-205.

A

B

C

D

E

F

Date item or service

Description of item or service

Seller’s name and address

Delivery address and

Purchase price

Tax paid to

was delivered/brought

purchased

address of use

another taxing

jurisdiction

into New York

Instructions

Purpose of Form IT-135 —

If the sales or use tax reported on

Column D — Delivery address and address of use

your personal income tax return is for one or more items or

Enter the address to which the item or service was delivered and

services costing $25,000 or more each, excluding any charges for

the location of use, if different.

shipping and handling, complete this form and attach it to your

return.

Column E — Purchase price

For information on the sales and use taxes and who may report

Enter the purchase price from Worksheet 2, column A or

and pay these taxes on their personal income tax return, see the

Worksheet 3, column A, if applicable, in the sales or use tax line

instructions for Form IT-200, IT-201, IT-203, or IT-205. You may not

instructions for Form IT-200, IT-201, IT-203, or Worksheet 1,

file Form IT-100 if you owe sales or use tax.

column A in the sales and use tax line instructions for Form IT-205.

For more information about computing the purchase price subject

Specific instructions

to sales or use tax, see the specific sales or use tax line

instructions for your personal income tax return.

Name(s) and social security number(s) or employer

identification number(s)

Column F — Tax paid to another taxing jurisdiction

Enter your name(s) and social security number(s), or the employer

Enter the amount of tax paid to another taxing jurisdiction from

identification number (EIN) of the estate or trust, exactly as they

Worksheet 2, column D or Worksheet 3, column D, if applicable, in

appear on your personal income tax return.

the sales or use tax line instructions for Form IT-200, IT-201, or

IT-203 or from Worksheet 1, column D in the sales or use tax line

Column A — Date the item or service was

instructions for Form IT-205. For more information, see the

delivered/brought into New York State

instructions for column D in the specific sales and use tax line

Enter the date the item or service was delivered in New York State

instructions for your personal income tax return.

or the date you brought the item or service into New York State.

Attach this form to your 2003 Form IT-200, IT-201, IT-203, or

IT-205 personal income tax return. If you need more space, attach

Column B — Description of item or service purchased

additional sheets that have the same format and information as

Enter a description of the item or service purchased.

the chart above. Be sure to include your name(s) (as shown on

your personal income tax return) and social security number(s) or

Column C — Seller’s name and address

EIN(s) on all attachments.

Enter the name and address of the seller from which you

purchased the item or service. If you purchased the item or service

over the Internet, also include the Internet address of the seller in

IT-135 2003

this column.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1