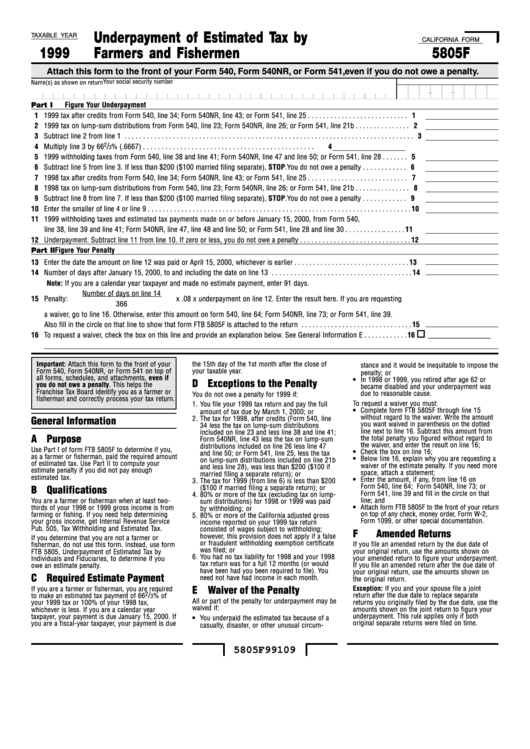

Underpayment of Estimated Tax by

TAXABLE YEAR

CALIFORNIA FORM

1999

Farmers and Fishermen

5805F

Attach this form to the front of your Form 540, Form 540NR, or Form 541, even if you do not owe a penalty.

Your social security number

Name(s) as shown on return

-

-

Part I Figure Your Underpayment

1 1999 tax after credits from Form 540, line 34; Form 540NR, line 43; or Form 541, line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 1999 tax on lump-sum distributions from Form 540, line 23; Form 540NR, line 26; or Form 541, line 21b . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

2

/

4 Multiply line 3 by 66

% (.6667) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

3

5 1999 withholding taxes from Form 540, line 38 and line 41; Form 540NR, line 47 and line 50; or Form 541, line 28 . . . . . . . 5

6 Subtract line 5 from line 3. If less than $200 ($100 married filing separate), STOP. You do not owe a penalty . . . . . . . . . . . . 6

7 1998 tax after credits from Form 540, line 34; Form 540NR, line 43; or Form 541, line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 1998 tax on lump-sum distributions from Form 540, line 23; Form 540NR, line 26; or Form 541, line 21b . . . . . . . . . . . . . . . 8

9 Subtract line 8 from line 7. If less than $200 ($100 married filing separate), STOP. You do not owe a penalty . . . . . . . . . . . . 9

10 Enter the smaller of line 4 or line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 1999 withholding taxes and estimated tax payments made on or before January 15, 2000, from Form 540,

line 38, line 39 and line 41; Form 540NR, line 47, line 48 and line 50; or Form 541, line 28 and line 30 . . . . . . . . . . . . . . . . . 11

12 Underpayment. Subtract line 11 from line 10. If zero or less, you do not owe a penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Part II Figure Your Penalty

13 Enter the date the amount on line 12 was paid or April 15, 2000, whichever is earlier . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Number of days after January 15, 2000, to and including the date on line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Note: If you are a calendar year taxpayer and made no estimate payment, enter 91 days.

Number of days on line 14

15 Penalty:

x .08 x underpayment on line 12. Enter the result here. If you are requesting

366

a waiver, go to line 16. Otherwise, enter this amount on form 540, line 64; Form 540NR, line 73; or Form 541, line 39.

Also fill in the circle on that line to show that form FTB 5805F is attached to the return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

____________

16 To request a waiver, check the box on this line and provide an explanation below. See General Information E . . . . . . . . . . . . 16

Important: Attach this form to the front of your

the 15th day of the 1st month after the close of

stance and it would be inequitable to impose the

Form 540, Form 540NR, or Form 541 on top of

your taxable year.

penalty; or

all forms, schedules, and attachments, even if

• In 1998 or 1999, you retired after age 62 or

D Exceptions to the Penalty

you do not owe a penalty. This helps the

became disabled and your underpayment was

Franchise Tax Board identify you as a farmer or

due to reasonable cause.

You do not owe a penalty for 1999 if:

fisherman and correctly process your tax return.

To request a waiver you must:

1. You file your 1999 tax return and pay the full

• Complete form FTB 5805F through line 15

amount of tax due by March 1, 2000; or

without regard to the waiver. Write the amount

2. The tax for 1998, after credits (Form 540, line

General Information

you want waived in parenthesis on the dotted

34 less the tax on lump-sum distributions

line next to line 16. Subtract this amount from

included on line 23 and less line 38 and line 41;

A Purpose

the total penalty you figured without regard to

Form 540NR, line 43 less the tax on lump-sum

the waiver, and enter the result on line 16;

distributions included on line 26 less line 47

Use Part I of form FTB 5805F to determine if you,

• Check the box on line 16;

and line 50; or Form 541, line 25, less the tax

as a farmer or fisherman, paid the required amount

• Below line 16, explain why you are requesting a

on lump-sum distributions included on line 21b

of estimated tax. Use Part II to compute your

waiver of the estimate penalty. If you need more

and less line 28), was less than $200 ($100 if

estimate penalty if you did not pay enough

space, attach a statement;

married filing a separate return); or

estimated tax.

• Enter the amount, if any, from line 16 on

3. The tax for 1999 (from line 6) is less than $200

Form 540, line 64; Form 540NR, line 73; or

($100 if married filing a separate return); or

B Qualifications

Form 541, line 39 and fill in the circle on that

4. 80% or more of the tax (excluding tax on lump-

You are a farmer or fisherman when at least two-

line; and

sum distributions) for 1998 or 1999 was paid

• Attach form FTB 5805F to the front of your return

thirds of your 1998 or 1999 gross income is from

by withholding; or

on top of any check, money order, Form W-2,

farming or fishing. If you need help determining

5. 80% or more of the California adjusted gross

Form 1099, or other special documentation.

your gross income, get Internal Revenue Service

income reported on your 1999 tax return

Pub. 505, Tax Withholding and Estimated Tax.

consisted of wages subject to withholding;

F Amended Returns

however, this provision does not apply if a false

If you determine that you are not a farmer or

or fraudulent withholding exemption certificate

fisherman, do not use this form. Instead, use form

If you file an amended return by the due date of

was filed; or

your original return, use the amounts shown on

FTB 5805, Underpayment of Estimated Tax by

6. You had no tax liability for 1998 and your 1998

Individuals and Fiduciaries, to determine if you

your amended return to figure your underpayment.

tax return was for a full 12 months (or would

If you file an amended return after the due date of

owe an estimate penalty.

have been had you been required to file). You

your original return, use the amounts shown on

C Required Estimate Payment

need not have had income in each month.

the original return.

If you are a farmer or fisherman, you are required

E Waiver of the Penalty

Exception: If you and your spouse file a joint

2

/

return after the due date to replace separate

to make an estimated tax payment of 66

% of

3

All or part of the penalty for underpayment may be

your 1999 tax or 100% of your 1998 tax,

returns you originally filed by the due date, use the

waived if:

amounts shown on the joint return to figure your

whichever is less. If you are a calendar year

underpayment. This rule applies only if both

taxpayer, your payment is due January 15, 2000. If

• You underpaid the estimated tax because of a

original separate returns were filed on time.

you are a fiscal-year taxpayer, your payment is due

casualty, disaster, or other unusual circum-

5805F99109

FTB 5805F 1999

1

1