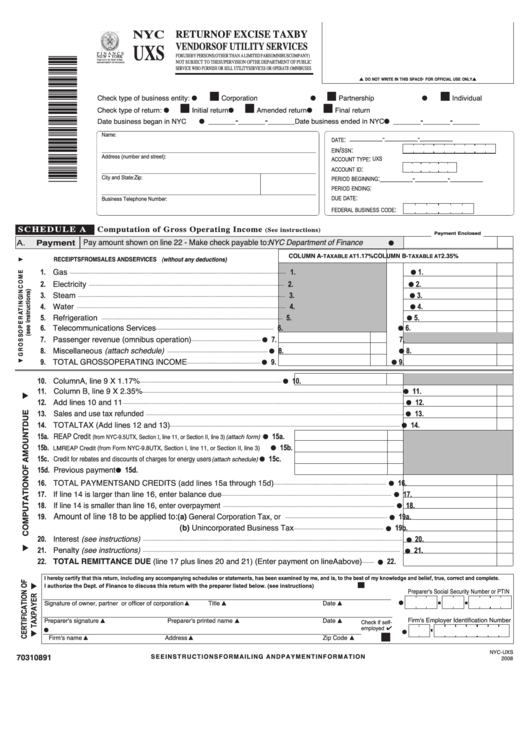

Form Nyc-Uxs - Return Of Excise Tax By Vendors Of Utility Services

ADVERTISEMENT

UXS

NYC

RETURN OF EXCISE TAX BY

VENDORS OF UTILITY SERVICES

FOR USE BY PERSONS (OTHER THAN A LIMITED FARE OMNIBUS COMPANY)

F I N A N C E

NEW

YORK

NOT SUBJECT TO THE SUPERVISION OF THE DEPARTMENT OF PUBLIC

G

THE CITY OF NEW YORK

SERVICE WHO FURNISH OR SELL UTILITY SERVICES OR OPERATE OMNIBUSES

DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

-

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

L

L

I I

I I

I I

Check type of business entity:.... G

Corporation

Partnership

Individual

G

G

I I

I I

I I

Check type of return: .................. G

Initial return

Amended return

Final return

G

G

Date business began in NYC ..... G _______ - _______ - _______

G _______ - _______ - _______

Date business ended in NYC

:............................. _________-_________-_________

Name:

DATE

/

:.........................

EIN

SSN

__________________________________________________________________________________________

.............

:

Address (number and street):

UXS

ACCOUNT TYPE

:...................

ACCOUNT ID

__________________________________________________________________________________________

:

_________-_________-_________

...........

City and State:

Zip:

PERIOD BEGINNING

: .............. _________-_________-_________

PERIOD ENDING

__________________________________________________________________________________________

: ...................... _________-_________-_________

DUE DATE

Business Telephone Number:

:

FEDERAL BUSINESS CODE

S C H E D U L E A

Computation of Gross Operating Income

(See instructions)

Payment Enclosed

Pay amount shown on line 22 - Make check payable to: NYC Department of Finance ............

Payment

A.

G

COLUMN A -

1.17%

COLUMN B -

2.35%

TAXABLE AT

TAXABLE AT

RECEIPTS FROM SALES AND SERVICES (without any deductions)

1. Gas

1.

1.

G

··································································································································································

2. Electricity

2.

2.

G

··················································································································································

3. Steam

3.

3.

G

···························································································································································

4. Water

4.

4.

G

····························································································································································

5. Refrigeration

5.

5.

G

·······································································································································

6. Telecommunications Services

6.

6.

G

························································································

7. Passenger revenue (omnibus operation)

7.

7.

G

····················································

8. Miscellaneous (attach schedule)

8.

8.

G

G

···········································································

9. TOTAL GROSS OPERATING INCOME

9.

9.

G

G

·······················································

10. Column A, line 9 X 1.17%

10.

G

··········································································································

11. Column B, line 9 X 2.35%

11.

G

··································································································································································································

12. Add lines 10 and 11

12.

G

···················································································································································································································

13. Sales and use tax refunded

13.

G

·································································································································································································

14. TOTAL TAX (Add lines 12 and 13)

14.

G

············································································································································································

15a. REAP Credit

(from NYC-9.5UTX, Section I, line 11, or Section II, line 3) (attach form)

15a.

G

......

15b.

LMREAP Credit (from Form NYC-9.8UTX, Section I, line 11, or Section II, line 3)

15b.

G

.........

Credit for rebates and discounts of charges for energy users

(attach schedule)

15c.

15c.

G

.........

15d. Previous payment

15d.

G

..............................................................................................................................

16. TOTAL PAYMENTS AND CREDITS (add lines 15a through 15d)

16.

G

····················································································

17. If line 14 is larger than line 16, enter balance due

17.

G

·······························································································································

18. If line 14 is smaller than line 16, enter overpayment

18.

G

································································································································

Amount of line 18 to be applied to:

(a) General Corporation Tax, or

19.

19a.

G

············································································

(b) Unincorporated Business Tax

19b.

G

···································································

20. Interest (see instructions)

20.

G

··································································································································································································

21. Penalty (see instructions)

21.

G

································································································································································································

22. TOTAL REMITTANCE DUE (line 17 plus lines 20 and 21) (Enter payment on line A above)

22.

G

·········

I hereby certify that this return, including any accompanying schedules or statements, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete.

I I

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .................YES

Preparer's Social Security Number or PTIN

Signature of owner, partner or officer of corporation L

Title L

Date L

G

Firm's Employer Identification Number

Preparer's signature L

Preparerʼs printed name L

Date L

Check if self-

employed

I I

G

G

Firm's name L

Address L

Zip Code L

70310891

NYC-UXS

S E E I N S T R U C T I O N S F O R M A I L I N G A N D PAY M E N T I N F O R M AT I O N

2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4