Checklist Of Labor Law Requirements

ADVERTISEMENT

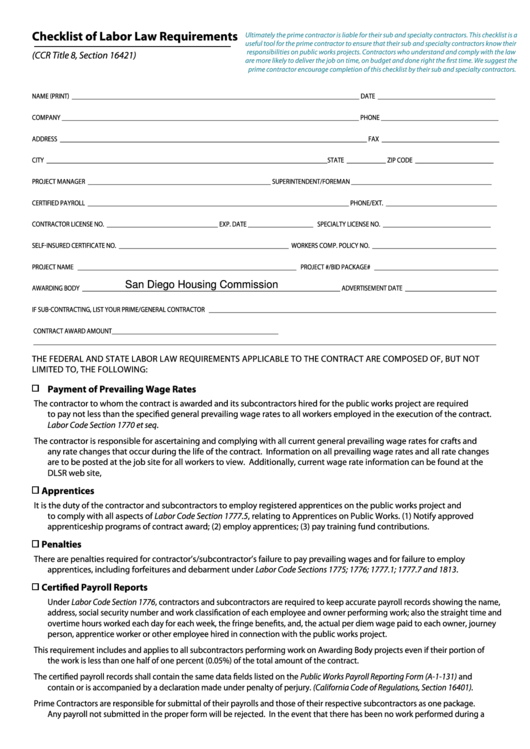

Checklist of Labor Law Requirements

Ultimately the prime contractor is liable for their sub and specialty contractors. This checklist is a

useful tool for the prime contractor to ensure that their sub and specialty contractors know their

responsibilities on public works projects. Contractors who understand and comply with the law

(CCR Title 8, Section 16421)

are more likely to deliver the job on time, on budget and done right the first time. We suggest the

prime contractor encourage completion of this checklist by their sub and specialty contractors.

NAME (priNt) ________________________________________________________________________________________

DAtE ____________________________________

COMpANY ___________________________________________________________________________________________ pHONE ____________________________________

ADDrESS ______________________________________________________________________________________________ FAx ____________________________________

CitY ______________________________________________________________________________________ StAtE ____________

Zip CODE ________________________

prOjECt MANAgEr ________________________________________________________ SupEriNtENDENt/FOrEMAN ___________________________________________

CErtiFiED pAYrOLL ________________________________________________________________________________ pHONE/Ext. __________________________________

CONtrACtOr LiCENSE NO. __________________________________ Exp. DAtE ____________________ SpECiALtY LiCENSE NO. _________________________________

SELF-iNSurED CErtiFiCAtE NO. ____________________________________________________ WOrkErS COMp. pOLiCY NO. ______________________________________

prOjECt NAME ___________________________________________________________________ prOjECt #/BiD pACkAgE# ______________________________________

San Diego Housing Commission

AWArDiNg BODY _______________________________________________________________________________ ADvErtiSEMENt DAtE ____________________________

iF SuB-CONtrACtiNg, LiSt YOur priME/gENErAL CONtrACtOr ________________________________________________________________________________________

CONtrACt AWArD AMOuNt___________________________________________________

tHE FEDErAL AND StAtE LABOr LAW rEQuirEMENtS AppLiCABLE tO tHE CONtrACt ArE COMpOSED OF, But NOt

LiMitED tO, tHE FOLLOWiNg:

Payment of Prevailing Wage Rates

the contractor to whom the contract is awarded and its subcontractors hired for the public works project are required

to pay not less than the specified general prevailing wage rates to all workers employed in the execution of the contract.

Labor Code Section 1770 et seq.

the contractor is responsible for ascertaining and complying with all current general prevailing wage rates for crafts and

any rate changes that occur during the life of the contract. information on all prevailing wage rates and all rate changes

are to be posted at the job site for all workers to view. Additionally, current wage rate information can be found at the

DLSr web site,

Apprentices

it is the duty of the contractor and subcontractors to employ registered apprentices on the public works project and

to comply with all aspects of Labor Code Section 1777.5, relating to Apprentices on public Works. (1) Notify approved

apprenticeship programs of contract award; (2) employ apprentices; (3) pay training fund contributions.

Penalties

there are penalties required for contractor’s/subcontractor’s failure to pay prevailing wages and for failure to employ

apprentices, including forfeitures and debarment under Labor Code Sections 1775; 1776; 1777.1; 1777.7 and 1813.

Certified Payroll Reports

under Labor Code Section 1776, contractors and subcontractors are required to keep accurate payroll records showing the name,

address, social security number and work classification of each employee and owner performing work; also the straight time and

overtime hours worked each day for each week, the fringe benefits, and, the actual per diem wage paid to each owner, journey

person, apprentice worker or other employee hired in connection with the public works project.

this requirement includes and applies to all subcontractors performing work on Awarding Body projects even if their portion of

the work is less than one half of one percent (0.05%) of the total amount of the contract.

the certified payroll records shall contain the same data fields listed on the Public Works Payroll Reporting Form (A-1-131) and

contain or is accompanied by a declaration made under penalty of perjury. (California Code of Regulations, Section 16401).

prime Contractors are responsible for submittal of their payrolls and those of their respective subcontractors as one package.

Any payroll not submitted in the proper form will be rejected. in the event that there has been no work performed during a

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2