Department Of Defense Agency Financial Report 2007 - Section 2: Financial Information Page 62

ADVERTISEMENT

Department of Defense Agency Financial Report 2007

Section 2: Financial Information

7

The model’s resulting projections were analyzed to ensure the estimates were reliable. The analysis was based on four tests:

(1) a sensitivity analysis of the model of economic assumptions, (2) a comparison of the percentage change in the liability

amount by agency to the percentage change in the actual incremental payments, (3) a comparison of the incremental paid

losses (the medical component in particular) in CBY 2007 (by injury cohort) to the average pattern observed during the prior

three charge back years, and (4) a comparison of the estimated liability per case in the 2007 projection to the average pattern

for the projections for the most recent three years.

Voluntary Separation Incentive (VSI) Program

The P.L. 102-190 established the VSI program to reduce the number of military personnel on active duty. The VSI Board of

Actuaries approved the assumed annual interest rate of 4.5% used to calculate the actuarial liability. Since the VSI program

is no longer offered, the actuarial liability is expected to continue to decrease with benefit outlays and increase with interest

cost. The liability is calculated annually at the present value of all remaining payments.

Market Value of Investments in Market-based and Marketable Securities: $573.1 million

DoD Education Benefits Fund (EBF)

The P.L. 98-525 established the EBF program to recruit and retain military members and aid in the readjustment of military

members to civilian life. The EBF Board of Actuaries approved the assumed interest rate of 5% used to calculate the actuarial

liability.

Market Value of Investments in Market-based and Marketable Securities: $1.4 billion

Other Federal Employment Benefits

Other Federal Employment Benefits primarily consists of accrued pensions and annuities and an estimated liability for

Incurred But Not Reported medical claims not processed prior to fiscal year end.

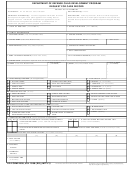

Note 18. General Disclosures Related to the Statement of Net Cost

Intragovernmental Costs and Exchange Revenue

As of September 30

2007

2006 Restated

(amounts in millions)

Intragovernmental Costs

$

27,266.6

$

31,990.6

Public Costs

640,871.8

602,553.4

Total Costs

668,138.4

634,544.0

Intragovernmental Earned Revenue

(20,465.9)

(24,327.1)

Public Earned Revenue

(25,220.5)

(24,168.6)

Total Earned Revenue

(45,686.4)

(48,495.7)

Net Cost of Operations

$

622,452.0

$

586,048.3

The Statement of Net Cost (SNC) represents the net cost of programs and organizations of the Federal Government supported

by appropriations or other means. The intent of the SNC is to provide gross and net cost information related to the amount

of output or outcome for a given program or organization administered by a responsible reporting entity. The Department’s

current processes and systems do not capture and report accumulated costs for major programs based upon the performance

measures as required by the Government Performance and Results Act. The Department is in the process of reviewing

available data and developing a cost reporting methodology as required by the Statement of Federal Financial Accounting

Standard No. 4, “Managerial Cost Accounting Concepts and Standards for the Federal Government.”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82