Department Of Defense Agency Financial Report 2007 - Section 2: Financial Information Page 63

ADVERTISEMENT

Section 2: Financial Information

Department of Defense Agency Financial Report 2007

75

Intragovernmental costs and revenues represent transactions made between two reporting entities within the Federal

Government. Public costs and revenues are exchange transactions made between the reporting entity and a nonfederal

entity.

The Department’s systems do not track intragovernmental transactions by customer at the transaction level. Buyer-side

expenses are adjusted to agree with internal seller-side revenues. Expenses are generally adjusted by reclassifying amounts

between federal and nonfederal expenses.

The SNC presents information based on budgetary obligation, disbursement, and collection transactions. Amounts are

adjusted for accruals based on data from nonfinancial feeder systems for major items such as payroll expenses, accounts

payable, and environmental liabilities. The General Fund data is generally derived from budgetary transactions (obligations,

disbursements, and collections) from nonfinancial systems, and accruals made for major items. While Working Capital

Funds generally record transactions on an accrual basis, the systems do not always capture actual costs in a timely manner.

The majority of the Department’s accounting systems do not capture information relative to heritage assets separately and

distinctly from normal operations. Where it was able to identify the cost of acquiring, constructing, improving, reconstructing

or renovating heritage assets, the Department has identified $2.0 million for the fiscal year.

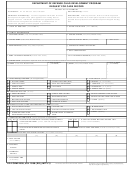

Note 19. Disclosures Related to the Statement of Changes in Net Position

As of September 30

2007

2006 Restated

Cumulative Results of

Unexpended

Cumulative Results of

Unexpended

(amounts in millions)

Operations

Appropriations

Operations

Appropriations

Prior Period Adjustments Increases (Decreases) to Net Position Beginning Balance

Changes in Accounting Standards

$

(4,230.9)

$

3,745.5

$

0.0

$

0.0

Errors and Omissions in Prior Year

Accounting Reports

0.0

0.0

(8,034.3)

(0.5)

Total Prior Period Adjustments

(4,230.9)

3,745.5

(8,034.3)

(0.5)

Imputed Financing

Civilian CSRS/FERS Retirement

1,429.4

0.0

1,553.8

0.0

Civilian Health

2,784.7

0.0

2,646.5

0.0

Civilian Life Insurance

8.4

0.0

26.1

0.0

Judgment Fund

198.8

0.0

183.2

0.0

Total Imputed Financing

$

4,421.3

$

0.0

$

4,409.6

$

0.0

The Department recognized a net prior period adjustment of ($485.4) million in FY 2007 and restated cumulative results

of operations by ($4.2) billion and unexpended appropriations by $3.7 billion. The adjustment relates to a change in

reporting parent/child allocation transfers, and is presented as a change in accounting principle. The change affects the

Balance Sheet and the Statement of Changes in Net Position. Parent/child reporting is intended to consolidate the complete

financial reporting of delegated activities and funds within the parent’s financial statements for overall performance reporting.

In accordance with Office of Management and Budget (OMB) Circular A-136, “Financial Reporting Requirements,” the

Department, as the parent agency, reports the financial activity carried out by the child agencies who received transfer

appropriations from the Department. When the Department performs as the child, it does not report any information

relating to transfer appropriations received from other agencies except for Treasury-Managed Trust funds and funds for which

the Executive Office of the President (EOP) is the parent. The OMB Circular A-136 makes exceptions for these transfer

appropriations. The Department includes transfer appropriations received from the EOP whereby the EOP is the parent. The

EOP delegates authority to the Department for foreign military sales, and the Department reports the related activity in its

financial statements on behalf of the EOP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82