Department Of Defense Agency Financial Report 2007 - Section 2: Financial Information Page 69

ADVERTISEMENT

Section 2: Financial Information

Department of Defense Agency Financial Report 2007

1

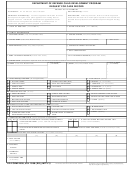

Medicare Eligible

BALANCE SHEET

Military Retirement

Other Earmarked

Retiree Health Care

Eliminations

Total

As of September 30, 2007

Fund

Funds

Fund

(amounts in millions)

STATEMENT OF NET COST

For the Year Ended September 30, 2007

Program Costs

$

105,253.0

$

(13,945.8)

$

3,242.8

$

(2,542.8)

$

92,007.2

Less Earned Revenue

(53,311.2)

(31,539.3)

(1,082.0)

70,427.7

(15,504.8)

Net Program Costs

51,941.8

(45,485.1)

2,160.8

67,884.9

76,502.4

Net Cost of Operations

$

51,941.8

$

(45,485.1)

$

2,160.8

$

67,884.9

$

76,502.4

STATEMENT OF CHANGES IN NET POSITION

For the period ended September 30, 2007

Net Position Beginning of the Period

$

(758,661.4)

$

(453,467.9)

$

5,371.4

$

0.0

$

(1,206,757.9)

Net Cost of Operations

51,941.8

(45,485.1)

2,160.8

67,884.9

76,502.4

Budgetary Financing Sources

0.0

186.0

3,154.8

(414.2)

2,926.6

Other Financing Sources

0.0

0.0

221.5

13.1

234.6

Change in Net Position

(51,941.8)

45,671.1

1,215.5

(68,286.0)

(73,341.2)

Net Position End of Period

$

(810,603.2)

$

(407,796.8)

$

6,586.9

$

(68,286.0)

$

(1,280,099.1)

Other Disclosures

The Statement of Federal Financial Accounting Standards (SFFAS) No. 27, “Identifying and Reporting Earmarked Funds,”

requires the disclosure of Earmarked Funds separately from All Other Funds on the Statement of Changes in Net Position

and Balance Sheet. Funds must meet three criteria to be classified as earmarked: (1) a statute committing use of specifically

identified revenues for designated purposes, (2) explicit authority to retain the revenues, and (3) a requirement to account

and report on the revenues. The Department’s earmarked funds are either special or trust funds and use both receipt and

expenditure accounts to report activity to the U.S. Treasury. There have been no changes in legislation during or subsequent

to this reporting period that significantly changed the purposes of any of the following funds.

The Total column is shown as consolidated and relates only to Earmarked Funds. The Eliminations column includes

eliminations associated with Earmarked Funds and excludes the offsetting eliminations from All Other Funds. This exclusion

causes assets to not equal liabilities and net position in the note. However, the amounts in the Total column equal the

amounts reported for Earmarked Funds on the Balance Sheet. The SFFAS No. 27 requires the presentation of gross amounts

of Earmarked Funds separate from All Other (nonearmarked) Funds. Cumulative Results of Operations ending balances for

Earmarked Funds on the Statement of Changes in Net Position do not agree with the Cumulative Results of Operations for

Earmarked Funds reported on the Balance Sheet because the Cumulative Results of Operations on the Balance Sheet are

presented net of eliminations. The summation for Military Retirement Fund (MRF), Medicare-Eligible Retiree Health Care

Fund (MERHCF), and Other Earmarked Funds is equivalent to the gross amount presented on the Statement of Changes in Net

Position.

Military Retirement Fund, 10 United States Code (USC) 1461. The MRF accumulates funds in order to finance, on an

actuarially sound basis, the liabilities of the Department’s military retirement and survivor benefit programs. Financing

sources for the MRF are interest earnings on Fund assets, monthly Department contributions, and annual contributions from

the U.S. Treasury. The monthly Department contributions are calculated as a percentage of basic pay. The contribution

from the U.S. Treasury represents the amortization of the unfunded liability for service performed prior to October 1, 1984,

plus the amortization of actuarial gains and losses that have arisen since then. The U.S. Treasury annual contribution also

includes the normal cost amount for the concurrent receipt provisions of the FY 2004 National Defense Authorization Act.

Medicare-Eligible Retiree Health Care Fund, 10 USC 1111. The MERHCF accumulates funds to finance, on an actuarially

sound basis, liabilities of the Department and the uniformed services health care programs for qualified Medicare-eligible

beneficiaries. Financing sources for MERHCF are provided primarily through an annual actuarial liability payment from

the U.S. Treasury, annual contributions from the Military Services and other Uniformed Services (the U.S. Coast Guard, the

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78 79

79 80

80 81

81 82

82