Save

Reset

Print

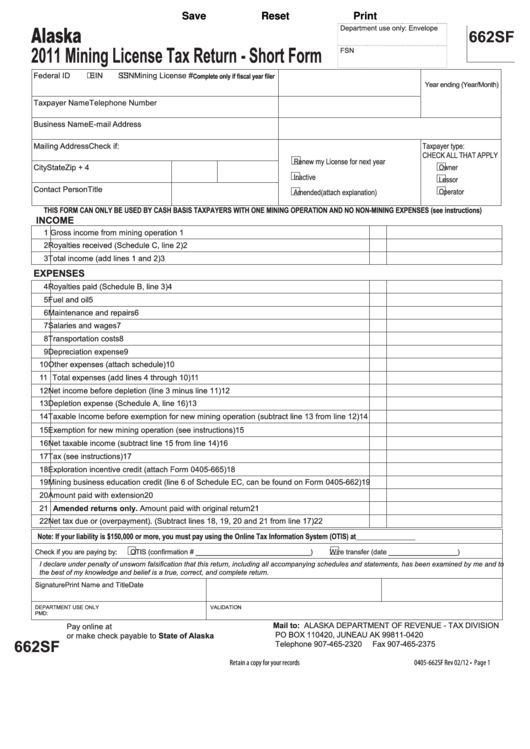

Alaska

Department use only: Envelope

662SF

2011 Mining License Tax Return - Short Form

FSN

Federal ID

EIN

SSN

Mining License #

Complete only if fiscal year filer

Year ending (Year/Month)

Taxpayer Name

Telephone Number

Business Name

E-mail Address

Taxpayer type:

Mailing Address

Check if:

CHECK ALL THAT APPLY

Renew my License for next year

Owner

City

State

Zip + 4

Inactive

Lessor

Contact Person

Title

Operator

Amended (attach explanation)

THIS FORM CAN ONLY BE USED BY CASH BASIS TAXPAYERS WITH ONE MINING OPERATION AND NO NON-MINING EXPENSES (see instructions)

INCOME

1 Gross income from mining operation

1

2 Royalties received (Schedule C, line 2)

2

3 Total income (add lines 1 and 2)

3

EXPENSES

4 Royalties paid (Schedule B, line 3)

4

5 Fuel and oil

5

6 Maintenance and repairs

6

7 Salaries and wages

7

8 Transportation costs

8

9 Depreciation expense

9

10 Other expenses (attach schedule)

10

11 Total expenses (add lines 4 through 10)

11

12 Net income before depletion (line 3 minus line 11)

12

13 Depletion expense (Schedule A, line 16)

13

14 Taxable Income before exemption for new mining operation (subtract line 13 from line 12)

14

15 Exemption for new mining operation (see instructions)

15

16 Net taxable income (subtract line 15 from line 14)

16

17 Tax (see instructions)

17

18 Exploration incentive credit (attach Form 0405-665)

18

19 Mining business education credit (line 6 of Schedule EC, can be found on Form 0405-662)

19

20 Amount paid with extension

20

21 Amended returns only. Amount paid with original return

21

22 Net tax due or (overpayment). (Subtract lines 18, 19, 20 and 21 from line 17)

22

Note: If your liability is $150,000 or more, you must pay using the Online Tax Information System (OTIS) at or wire transfer.

Check if you are paying by:

OTIS (confirmation # ______________________________)

Wire transfer (date __________________)

I declare under penalty of unsworn falsification that this return, including all accompanying schedules and statements, has been examined by me and to

the best of my knowledge and belief is a true, correct, and complete return.

Signature

Print Name and Title

Date

DEPARTMENT USE ONLY

VALIDATION

PMD:

Mail to: ALASKA DEPARTMENT OF REVENUE - TAX DIVISION

Pay online at

PO BOX 110420, JUNEAU AK 99811-0420

or make check payable to State of Alaska

662SF

Telephone 907-465-2320

Fax 907-465-2375

Retain a copy for your records

0405-662SF Rev 02/12 • Page 1

1

1 2

2