Form Tob: Otp - Monthly State Tobacco Tax Return By Resident Distributors - Alabama Department Of Revenue

ADVERTISEMENT

TOB: OTP

7/02

A

D

R

OFFICE USE ONLY

LABAMA

EPARTMENT OF

EVENUE

Bank Deposit Date: ___________

S

, U

& B

T

D

ALES

SE

USINESS

AX

IVISION

Amount Paid: ________________

T

T

S

OBACCO

AX

ECTION

Checked By:________________

P.O. Box 327555 • Montgomery, AL 36132-7555 • (334) 242-9627

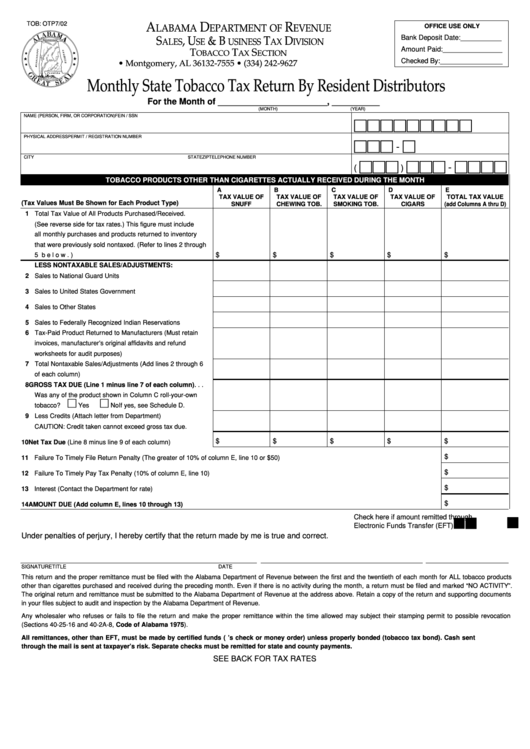

Monthly State Tobacco Tax Return By Resident Distributors

For the Month of _______________________, __________

(MONTH)

(YEAR)

NAME (PERSON, FIRM, OR CORPORATION)

FEIN / SSN

PHYSICAL ADDRESS

PERMIT / REGISTRATION NUMBER

-

CITY

STATE

ZIP

TELEPHONE NUMBER

-

(

)

TOBACCO PRODUCTS OTHER THAN CIGARETTES ACTUALLY RECEIVED DURING THE MONTH

A

B

C

D

E

TAX VALUE OF

TAX VALUE OF

TAX VALUE OF

TAX VALUE OF

TOTAL TAX VALUE

(Tax Values Must Be Shown for Each Product Type)

SNUFF

CHEWING TOB.

SMOKING TOB.

CIGARS

(add Columns A thru D)

1 Total Tax Value of All Products Purchased/Received.

(See reverse side for tax rates.) This figure must include

all monthly purchases and products returned to inventory

that were previously sold nontaxed. (Refer to lines 2 through

5 below.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

$

$

$

LESS NONTAXABLE SALES/ADJUSTMENTS:

2 Sales to National Guard Units . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Sales to United States Government. . . . . . . . . . . . . . . . . . . . . .

4 Sales to Other States. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Sales to Federally Recognized Indian Reservations . . . . . . . . .

6 Tax-Paid Product Returned to Manufacturers (Must retain

invoices, manufacturer’s original affidavits and refund

worksheets for audit purposes) . . . . . . . . . . . . . . . . . . . . . . . . .

7 Total Nontaxable Sales/Adjustments (Add lines 2 through 6

of each column) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 GROSS TAX DUE (Line 1 minus line 7 of each column) . . .

Was any of the product shown in Column C roll-your-own

tobacco?

Yes

No If yes, see Schedule D.

9 Less Credits (Attach letter from Department)

CAUTION: Credit taken cannot exceed gross tax due. . . . . . . .

10 Net Tax Due (Line 8 minus line 9 of each column) . . . . . . . . . .

$

$

$

$

$

$

11 Failure To Timely File Return Penalty (The greater of 10% of column E, line 10 or $50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Failure To Timely Pay Tax Penalty (10% of column E, line 10). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

13 Interest (Contact the Department for rate). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

14 AMOUNT DUE (Add column E, lines 10 through 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Check here if amount remitted through

Electronic Funds Transfer (EFT) . . . . . . . . . . . .

Under penalties of perjury, I hereby certify that the return made by me is true and correct.

SIGNATURE

TITLE

DATE

This return and the proper remittance must be filed with the Alabama Department of Revenue between the first and the twentieth of each month for ALL tobacco products

other than cigarettes purchased and received during the preceding month. Even if there is no activity during the month, a return must be filed and marked “NO ACTIVITY”.

The original return and remittance must be submitted to the Alabama Department of Revenue at the address above. Retain a copy of the return and supporting documents

in your files subject to audit and inspection by the Alabama Department of Revenue.

Any wholesaler who refuses or fails to file the return and make the proper remittance within the time allowed may subject their stamping permit to possible revocation

(Sections 40-25-16 and 40-2A-8, Code of Alabama 1975).

All remittances, other than EFT, must be made by certified funds (e.g. cashier’s check or money order) unless properly bonded (tobacco tax bond). Cash sent

through the mail is sent at taxpayer’s risk. Separate checks must be remitted for state and county payments.

SEE BACK FOR TAX RATES

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2