Instructions For Form Cf-1040es - Quarterly Estimated Income Tax Payment Vouchers - 2012

ADVERTISEMENT

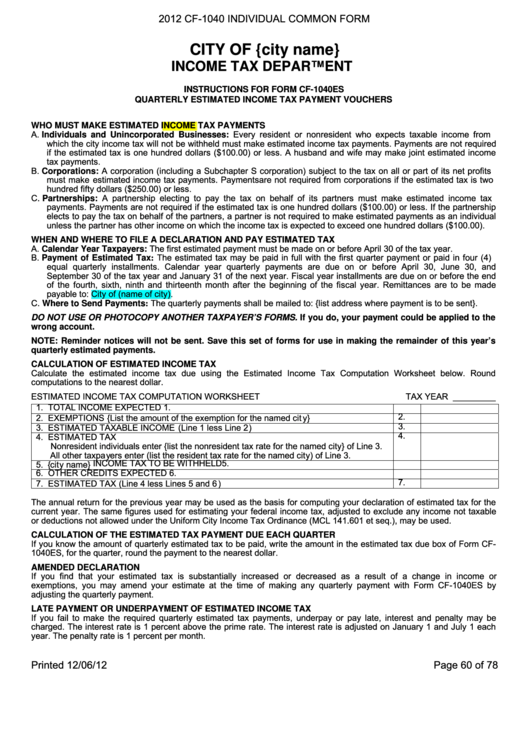

2012 CF-1040 INDIVIDUAL COMMON FORM

CITY OF {city name}

INCOME TAX DEPARTMENT

INSTRUCTIONS FOR FORM CF-1040ES

QUARTERLY ESTIMATED INCOME TAX PAYMENT VOUCHERS

WHO MUST MAKE ESTIMATED INCOME TAX PAYMENTS

A. Individuals and Unincorporated Businesses: Every resident or nonresident

who expects taxable income from

which the city income tax will not be withheld must make estimated income tax payments. Payments are not required

if the estimated tax is one hundred dollars ($100.00) or le ss. A husband and wife may make joint estimated income

tax payments.

B. Corporations: A corporation (including a Subchapter S corporation) subject to the tax on all or part of its net profits

must make estimated income tax payments. Payments are not required from corporations if the estimated tax is two

hundred fifty dollars ($250.00) or less.

C. Partnerships: A partnership electing to pay the tax on behalf

of its partners must make estimated income tax

payments. Payments are not required if the estimated tax is one hundred dollars ($100.00) or less. If the partnership

elects to pay the tax on behalf of the partners, a partner is not required to make estimated payments as an individual

unless the partner has other income on which the income tax is expected to exceed one hundred dollars ($100.00).

WHEN AND WHERE TO FILE A DECLARATION AND PAY ESTIMATED TAX

A. Calendar Year Taxpayers: The first estimated payment must be made on or before April 30 of the tax year.

B. Payment of Estimated Tax: The estimated tax may be paid in full with the first quarter payment or paid

in four (4)

equal quarterly installments. Calendar year quarterly

payments are due on or before April 30,

June 30, and

September 30 of the tax year and January 31 of the next year. Fiscal year installments are due on or before the end

of the fourth, sixth, ninth and thirt eenth month after the beginning of the fi scal year. Remittances are to be made

payable to: City of (name of city).

C. Where to Send Payments: The quarterly payments shall be mailed to: {list address where payment is to be sent}.

DO NOT USE OR PHOTOCOPY ANOTHER TAXPAYER’S FORMS. If you do, your payment could be applied to the

wrong account.

NOTE: Reminder notices will not be sent. Save this set of forms for use in making the remainder of this year’s

quarterly estimated payments.

CALCULATION OF ESTIMATED INCOME TAX

Calculate the estimated income tax due using the Esti

mated Income Tax Computation Worksheet

below. Round

computations to the nearest dollar.

ESTIMATED INCOME TAX COMPUTATION WORKSHEET

TAX YEAR _________

1. TOTAL INCOME EXPECTED

1.

2. EXEMPTIONS {List the amount of the exemption for the named city}

2.

3. ESTIMATED TAXABLE INCOME (Line 1 less Line 2)

3.

4. ESTIMATED TAX

4.

Nonresident individuals enter {list the nonresident tax rate for the named city} of Line 3.

All other taxpayers enter (list the resident tax rate for the named city) of Line 3.

5. {city name} INCOME TAX TO BE WITHHELD

5.

6. OTHER CREDITS EXPECTED

6.

7. ESTIMATED TAX (Line 4 less Lines 5 and 6)

7.

The annual return for the previous year may be used as the bas is for computing your declaration of estimated tax for the

current year. The same figures used for estimating your feder al income tax, adjusted to exclude any income not taxable

or deductions not allowed under the Uniform City Income Tax Ordinance (MCL 141.601 et seq.), may be used.

CALCULATION OF THE ESTIMATED TAX PAYMENT DUE EACH QUARTER

If you know the amount of quarterly estimated tax to be paid, write the amount in the estimated tax due box of Form CF-

1040ES, for the quarter, round the payment to the nearest dollar.

AMENDED DECLARATION

If you find that your estimated tax

is substantially increased or decreased as

a result of a change in income or

exemptions, you may amend your estimate at the time

of making any quarterly payment

with Form CF-1040ES by

adjusting the quarterly payment.

LATE PAYMENT OR UNDERPAYMENT OF ESTIMATED INCOME TAX

If you fail to make the required quarterly estimated tax

payments, underpay or pay late, interest and penalty may be

charged. The interest rate is 1 percent above the prime rate . The interest rate is adjusted on January 1 and July 1 each

year. The penalty rate is 1 percent per month.

Printed 12/06/12

Page 60 of 78

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3