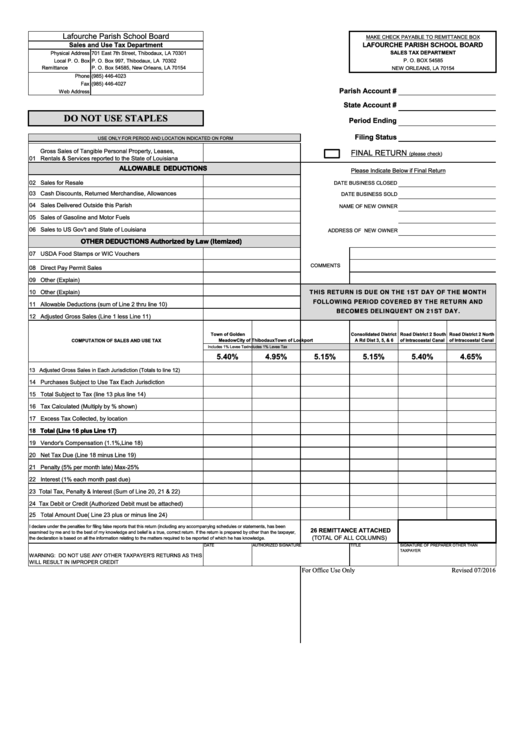

Sales Tax Return Worksheet - Lafourche Parish School Board

ADVERTISEMENT

Lafourche Parish School Board

MAKE CHECK PAYABLE TO REMITTANCE BOX

Sales and Use Tax Department

LAFOURCHE PARISH SCHOOL BOARD

SALES TAX DEPARTMENT

Physical Address

701 East 7th Street, Thibodaux, LA 70301

Local P. O. Box

P. O. Box 997, Thibodaux, LA 70302

P. O. BOX 54585

Remittance P.O. Box

P. O. Box 54585, New Orleans, LA 70154

NEW ORLEANS, LA 70154

Phone

(985) 446-4023

Fax

(985) 446-4027

Parish Account #

Web Address

State Account #

DO NOT USE STAPLES

Period Ending

Filing Status

USE ONLY FOR PERIOD AND LOCATION INDICATED ON FORM

Gross Sales of Tangible Personal Property, Leases,

FINAL RETURN

(please check)

01 Rentals & Services reported to the State of Louisiana

ALLOWABLE DEDUCTIONS

Please Indicate Below if Final Return

02 Sales for Resale

DATE BUSINESS CLOSED

03 Cash Discounts, Returned Merchandise, Allowances

DATE BUSINESS SOLD

04 Sales Delivered Outside this Parish

NAME OF NEW OWNER

05 Sales of Gasoline and Motor Fuels

06 Sales to US Gov't and State of Louisiana

ADDRESS OF NEW OWNER

OTHER DEDUCTIONS Authorized by Law (Itemized)

07 USDA Food Stamps or WIC Vouchers

COMMENTS

08 Direct Pay Permit Sales

09 Other (Explain)

THIS RETURN IS DUE ON THE 1ST DAY OF THE MONTH

10 Other (Explain)

FOLLOWING PERIOD COVERED BY THE RETURN AND

11 Allowable Deductions (sum of Line 2 thru line 10)

BECOMES DELINQUENT ON 21ST DAY.

12 Adjusted Gross Sales (Line 1 less Line 11)

Town of Golden

Consolidated District

Road District 2 South

Road District 2 North

COMPUTATION OF SALES AND USE TAX

Meadow

City of Thibodaux

Town of Lockport

A Rd Dist 3, 5, & 6

of Intracoastal Canal

of Intracoastal Canal

Includes 1% Levee Tax

Includes 1% Levee Tax

5.40%

4.95%

5.15%

5.15%

5.40%

4.65%

13 Adjusted Gross Sales in Each Jurisdiction (Totals to line 12)

14 Purchases Subject to Use Tax Each Jurisdiction

15 Total Subject to Tax (line 13 plus line 14)

16 Tax Calculated (Multiply by % shown)

17 Excess Tax Collected, by location

18 Total (Line 16 plus Line 17)

19 Vendor's Compensation (1.1%,Line 18)

20 Net Tax Due (Line 18 minus Line 19)

21 Penalty (5% per month late) Max-25%

22 Interest (1% each month past due)

23 Total Tax, Penalty & Interest (Sum of Line 20, 21 & 22)

24 Tax Debit or Credit (Authorized Debit must be attached)

25 Total Amount Due( Line 23 plus or minus line 24)

I declare under the penalties for filing false reports that this return (including any accompanying schedules or statements, has been

26 REMITTANCE ATTACHED

examined by me and to the best of my knowledge and belief is a true, correct return. If the return is prepared by other than the taxpayer,

(TOTAL OF ALL COLUMNS)

the declaration is based on all the information relating to the matters required to be reported of which he has knowledge.

DATE

AUTHORIZED SIGNATURE

TITLE

SIGNATURE OF PREPARER OTHER THAN

TAXPAYER

WARNING: DO NOT USE ANY OTHER TAXPAYER'S RETURNS AS THIS

WILL RESULT IN IMPROPER CREDIT

For Office Use Only

Revised 07/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1