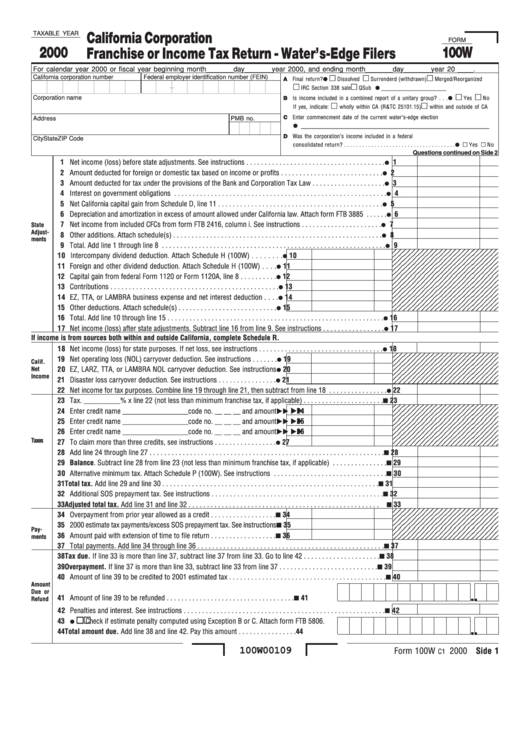

TAXABLE YEAR

California Corporation

FORM

2000

100W

Franchise or Income Tax Return — Water’s-Edge Filers

For calendar year 2000 or fiscal year beginning month _______ day _______ year 2000, and ending month _______ day _______ year 20 ____ .

California corporation number

Federal employer identification number (FEIN)

A Final return?

Dissolved

Surrenderd (withdrawn)

Merged/Reorganized

-

IRC Section 338 sale

QSub election. Enter date

____________________

Corporation name

B Is income included in a combined report of a unitary group? . . .

Yes

No

If yes, indicate:

wholly within CA (R&TC 25101.15)

within and outside of CA

C Enter commencment date of the current water’s-edge election

Address

PMB no.

___________________________________________

D Was the corporation’s income included in a federal

City

State

ZIP Code

consolidated return? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Questions continued on Side 2

1 Net income (loss) before state adjustments. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Amount deducted for foreign or domestic tax based on income or profits . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Amount deducted for tax under the provisions of the Bank and Corporation Tax Law . . . . . . . . . . . . . . . . . . . .

3

4 Interest on government obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Net California capital gain from Schedule D, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Depreciation and amortization in excess of amount allowed under California law. Attach form FTB 3885 . . . . . .

6

7 Net income from included CFCs from form FTB 2416, column i. See instructions . . . . . . . . . . . . . . . . . . . . . .

7

State

Adjust-

8 Other additions. Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

ments

9 Total. Add line 1 through line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

10 Intercompany dividend deduction. Attach Schedule H (100W) . . . . . . . .

10

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

11 Foreign and other dividend deduction. Attach Schedule H (100W) . . . .

11

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

12 Capital gain from federal Form 1120 or Form 1120A, line 8 . . . . . . . . . .

12

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

13 Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

14 EZ, TTA, or LAMBRA business expense and net interest deduction . . . .

14

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

15 Other deductions. Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

16 Total. Add line 10 through line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Net income (loss) after state adjustments. Subtract line 16 from line 9. See instructions . . . . . . . . . . . . . . . . .

17

If income is from sources both within and outside California, complete Schedule R.

18 Net income (loss) for state purposes. If net loss, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

19 Net operating loss (NOL) carryover deduction. See instructions . . . . . . .

19

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

Calif.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

Net

20 EZ, LARZ, TTA, or LAMBRA NOL carryover deduction. See instructions

20

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

Income

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

21 Disaster loss carryover deduction. See instructions . . . . . . . . . . . . . . . .

21

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

22 Net income for tax purposes. Combine line 19 through line 21, then subtract from line 18 . . . . . . . . . . . . . . . .

22

23 Tax. __________% x line 22 (not less than minimum franchise tax, if applicable) . . . . . . . . . . . . . . . . . . . . . .

23

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

24 Enter credit name __________________code no. __ __ __ and amount

24

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

25 Enter credit name __________________code no. __ __ __ and amount

25

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

26 Enter credit name __________________code no. __ __ __ and amount

26

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

Taxes

27 To claim more than three credits, see instructions . . . . . . . . . . . . . . . . .

27

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

28 Add line 24 through line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29 Balance. Subtract line 28 from line 23 (not less than minimum franchise tax, if applicable) . . . . . . . . . . . . . . .

29

30 Alternative minimum tax. Attach Schedule P (100W). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

31 Total tax. Add line 29 and line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

32 Additional SOS prepayment tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

33 Adjusted total tax. Add line 31 and line 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

34 Overpayment from prior year allowed as a credit . . . . . . . . . . . . . . . . . .

34

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

35 2000 estimate tax payments/excess SOS prepayment tax. See instructions

35

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

Pay-

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

36 Amount paid with extension of time to file return . . . . . . . . . . . . . . . . . .

36

ments

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

37 Total payments. Add line 34 through line 36 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

38 Tax due. If line 33 is more than line 37, subtract line 37 from line 33. Go to line 42 . . . . . . . . . . . . . . . . . . . . .

38

39 Overpayment. If line 37 is more than line 33, subtract line 33 from line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . .

39

40 Amount of line 39 to be credited to 2001 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

40

Amount

Due or

. . . . .

41 Amount of line 39 to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

41

Refund

42 Penalties and interest. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42

43

Check if estimate penalty computed using Exception B or C. Attach form FTB 5806.

. . . . .

44 Total amount due. Add line 38 and line 42. Pay this amount . . . . . . . . . . . . . . . .

44

100W00109

Form 100W

2000 Side 1

C1

1

1 2

2 3

3 4

4