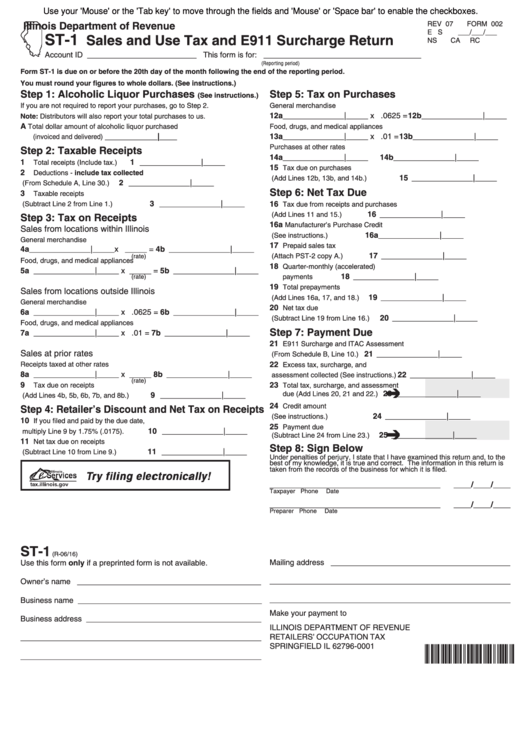

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

REV 07

FORM 002

E S

___/___/___

ST-1

Sales and Use Tax and E911 Surcharge Return

NS

CA

RC

Account ID _________________________ This form is for: ____________________________________

(Reporting period)

Form ST-1 is due on or before the 20th day of the month following the end of the reporting period.

You must round your figures to whole dollars. (See instructions.)

Step 1: Alcoholic Liquor Purchases

Step 5: Tax on Purchases

(See instructions.)

If you are not required to report your purchases, go to Step 2.

General merchandise

12a______________|_____ x .0625

= 12b______________|_____

Note: Distributors will also report your total purchases to us.

A

Total dollar amount of alcoholic liquor purchased

Food, drugs, and medical appliances

____________|____

13a______________|_____ x .01

= 13b______________|_____

(invoiced and delivered)

Purchases at other rates

Step 2: Taxable Receipts

14a______________|_____

14b______________|_____

1

1

______________|_____

Total receipts (Include tax.)

15

Tax due on purchases

2

Deductions - include tax collected

15 ______________|_____

(Add Lines 12b, 13b, and 14b.)

2

______________|_____

(From Schedule A, Line 30.)

Step 6: Net Tax Due

3

Taxable receipts

3

______________|_____

16

(Subtract Line 2 from Line 1.)

Tax due from receipts and purchases

16 ______________|_____

(Add Lines 11 and 15.)

Step 3: Tax on Receipts

16a

Manufacturer’s Purchase Credit

Sales from locations within Illinois

16a______________|_____

(See instructions.)

General merchandise

17

Prepaid sales tax

4a ______________|_____x _____

= 4b ______________|_____

17 ______________|_____

(Attach PST-2 copy A.)

(rate)

Food, drugs, and medical appliances

18

Quarter-monthly (accelerated)

5a ______________|_____ x _____

= 5b ______________|_____

18 ______________|_____

payments

(rate)

19

Total prepayments

Sales from locations outside Illinois

19 ______________|_____

(Add Lines 16a, 17, and 18.)

General merchandise

20

Net tax due

6a ______________|_____ x .0625

= 6b ______________|_____

20 ______________|_____

(Subtract Line 19 from Line 16.)

Food, drugs, and medical appliances

Step 7: Payment Due

7a ______________|_____ x .01

= 7b ______________|_____

21

E911 Surcharge and ITAC Assessment

Sales at prior rates

21 ______________|_____

(From Schedule B, Line 10.)

22

Receipts taxed at other rates

Excess tax, surcharge, and

8a ______________|_____ x _____

8b ______________|_____

22 ______________|_____

assessment collected (See instructions.)

(rate)

9

23

Tax due on receipts

Total tax, surcharge, and assessment

9

______________|_____

23 ______________|_____

(Add Lines 4b, 5b, 6b, 7b, and 8b.)

due (Add Lines 20, 21 and 22.)

24

Credit amount

Step 4: Retailer’s Discount and Net Tax on Receipts

24 ______________|_____

(See instructions.)

10

If you filed and paid by the due date,

25

Payment due

10

______________|_____

multiply Line 9 by 1.75% (.0175).

25 ______________|_____

(Subtract Line 24 from Line 23.)

11

Net tax due on receipts

Step 8: Sign Below

11

______________|_____

(Subtract Line 10 from Line 9.)

Under penalties of perjury, I state that I have examined this return and, to the

best of my knowledge, it is true and correct. The information in this return is

taken from the records of the business for which it is filed.

_______________________________________

____/____/____

Taxpayer

Phone

Date

_______________________________________

____/____/____

Preparer

Phone

Date

ST-1

(R-06/16)

Use this form only if a preprinted form is not available.

Mailing address _________________________________________

_______________________________________________________

Owner’s name __________________________________________

_______________________________________________________

Business name __________________________________________

Make your payment to

Business address ________________________________________

ILLINOIS DEPARTMENT OF REVENUE

RETAILERS’ OCCUPATION TAX

_______________________________________________________

SPRINGFIELD IL 62796-0001

IDOR ST-1

_______________________________________________________

1

1 2

2 3

3