Record Of Employment - New York State Department Of Labor

ADVERTISEMENT

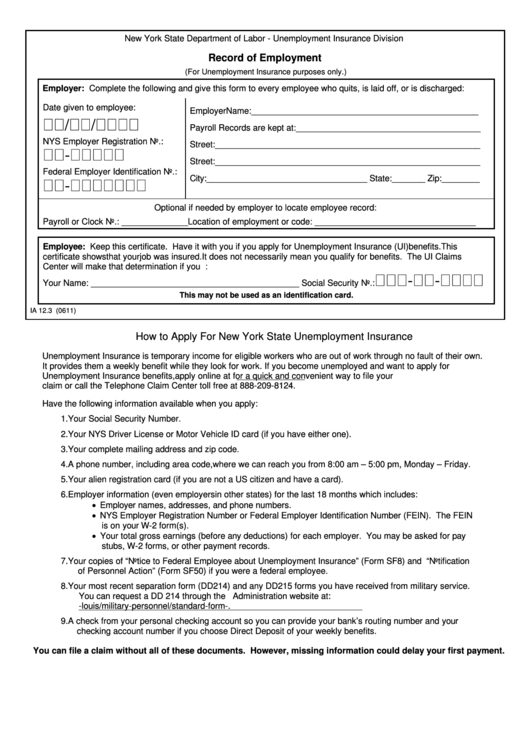

New York State Department of Labor - Unemployment Insurance Division

Record of Employment

(For Unemployment Insurance purposes only.)

Employer: Complete the following and give this form to every employee who quits, is laid off, or is discharged:

Date given to employee:

Employer Name:________________________________________________

//

Payroll Records are kept at:_______________________________________

NYS Employer Registration No.:

Street:________________________________________________________

-

Street:________________________________________________________

Federal Employer Identification No.:

City:__________________________________ State:_______ Zip:________

-

Optional if needed by employer to locate employee record:

Payroll or Clock No.: ______________ Location of employment or code: __________________________________

Employee: Keep this certificate. Have it with you if you apply for Unemployment Insurance (UI) benefits. This

certificate shows that your job was insured. It does not necessarily mean you qualify for benefits. The UI Claims

Center will make that determination if you apply. Please complete the following:

--

Your Name: ____________________________________________ Social Security No.:

This may not be used as an identification card.

IA 12.3 (0611)

How to Apply For New York State Unemployment Insurance

Unemployment Insurance is temporary income for eligible workers who are out of work through no fault of their own.

It provides them a weekly benefit while they look for work. If you become unemployed and want to apply for

Unemployment Insurance benefits, apply online at for a quick and convenient way to file your

claim or call the Telephone Claim Center toll free at 888-209-8124.

Have the following information available when you apply:

1.

Your Social Security Number.

2.

Your NYS Driver License or Motor Vehicle ID card (if you have either one).

3.

Your complete mailing address and zip code.

4.

A phone number, including area code, where we can reach you from 8:00 am – 5:00 pm, Monday – Friday.

5.

Your alien registration card (if you are not a US citizen and have a card).

6.

Employer information (even employers in other states) for the last 18 months which includes:

• Employer names, addresses, and phone numbers.

• NYS Employer Registration Number or Federal Employer Identification Number (FEIN). The FEIN

is on your W-2 form(s).

• Your total gross earnings (before any deductions) for each employer. You may be asked for pay

stubs, W-2 forms, or other payment records.

7.

Your copies of “Notice to Federal Employee about Unemployment Insurance” (Form SF8) and “Notification

of Personnel Action” (Form SF50) if you were a federal employee.

8. Your most recent separation form (DD214) and any DD215 forms you have received from military service.

You can request a DD 214 through the U.S. National Archives and Records Administration website at:

9.

A check from your personal checking account so you can provide your bank’s routing number and your

checking account number if you choose Direct Deposit of your weekly benefits.

You can file a claim without all of these documents. However, missing information could delay your first payment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1