Instructions For Amended Individual Income Tax (Form K-40x) - Kansas Department Of Revenue

ADVERTISEMENT

INSTRUCTIONS FOR AMENDED INDIVIDUAL INCOME TAX

FEDERAL AUDIT: If you know any federal return previously

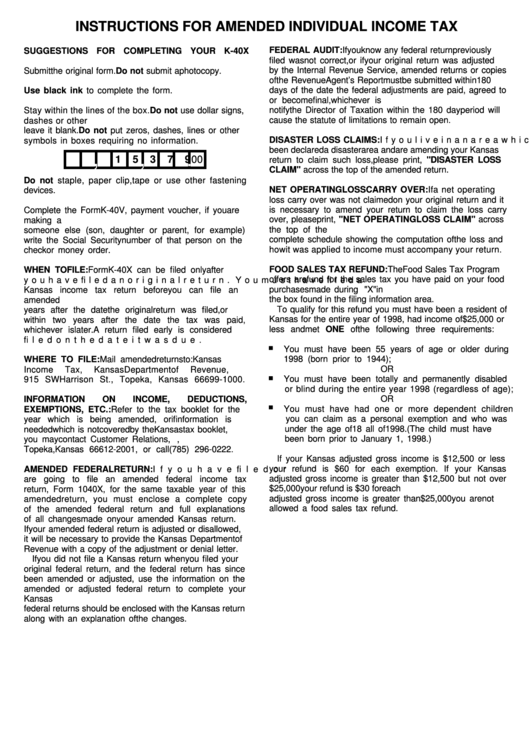

SUGGESTIONS FOR COMPLETING YOUR K-40X

filed was not correct, or if your original return was adjusted

by the Internal Revenue Service, amended returns or copies

Submit the original form. Do not submit a photocopy.

of the Revenue Agent’s Report must be submitted within 180

days of the date the federal adjustments are paid, agreed to

Use black ink to complete the form.

or become final, whichever is earlier. Failure to properly

notify the Director of Taxation within the 180 day period will

Stay within the lines of the box. Do not use dollar signs,

cause the statute of limitations to remain open.

dashes or other symbols. If a line does not apply to you

leave it blank. Do not put zeros, dashes, lines or other

DISASTER LOSS CLAIMS: If you live in an area which has

symbols in boxes requiring no information.

been declared a disaster area and are amending your Kansas

,

,

.

1

5 3

7 9

00

return to claim such loss, please print, "DISASTER LOSS

CLAIM" across the top of the amended return.

Do not staple, paper clip, tape or use other fastening

NET OPERATING LOSS CARRY OVER: If a net operating

devices.

loss carry over was not claimed on your original return and it

is necessary to amend your return to claim the loss carry

Complete the Form K-40V, payment voucher, if you are

over, please print, "NET OPERATING LOSS CLAIM" across

making a payment. If you are making a payment for

the top of the return. A copy of the federal claim and a

someone else (son, daughter or parent, for example)

complete schedule showing the computation of the loss and

write the Social Security number of that person on the

how it was applied to income must accompany your return.

check or money order.

FOOD SALES TAX REFUND: The Food Sales Tax Program

WHEN TO FILE: Form K-40X can be filed only after

offers a refund for the sales tax you have paid on your food

you have filed an original return. You must have filed a

purchases made during 1998. If you qualify mark an "X" in

Kansas income tax return before you can file an

the box found in the filing information area.

amended return. Form K-40X must be filed within three

To qualify for this refund you must have been a resident of

years after the date the original return was filed, or

Kansas for the entire year of 1998, had income of $25,000 or

within two years after the date the tax was paid,

less and met ONE of the following three requirements:

whichever is later. A return filed early is considered

.

filed on the date it was due.

You must have been 55 years of age or older during

1998 (born prior to 1944);

WHERE TO FILE: Mail amended returns to: Kansas

.

OR

Income

Tax,

Kansas

Department

of

Revenue,

You must have been totally and permanently disabled

915 SW Harrison St., Topeka, Kansas 66699-1000.

or blind during the entire year 1998 (regardless of age);

.

OR

INFORMATION

ON

INCOME,

DEDUCTIONS,

You must have had one or more dependent children

EXEMPTIONS, ETC.: Refer to the tax booklet for the

you can claim as a personal exemption and who was

year which is being amended, or if information is

under the age of 18 all of 1998. (The child must have

needed which is not covered by the Kansas tax booklet,

been born prior to January 1, 1998.)

you may contact Customer Relations, P.O. Box 12001,

Topeka, Kansas 66612-2001, or call (785) 296-0222.

If your Kansas adjusted gross income is $12,500 or less

your refund is $60 for each exemption. If your Kansas

AMENDED FEDERAL RETURN: If you have filed or

adjusted gross income is greater than $12,500 but not over

are going to file an amended federal income tax

$25,000 your refund is $30 for each exemption.If your Kansas

return, Form 1040X, for the same taxable year of this

adjusted gross income is greater than $25,000 you are not

amended return, you must enclose a complete copy

allowed a food sales tax refund.

of the amended federal return and full explanations

of all changes made on your amended Kansas return.

If your amended federal return is adjusted or disallowed,

it will be necessary to provide the Kansas Department of

Revenue with a copy of the adjustment or denial letter.

If you did not file a Kansas return when you filed your

original federal return, and the federal return has since

been amended or adjusted, use the information on the

amended or adjusted federal return to complete your

Kansas return. A copy of both the original and amended

federal returns should be enclosed with the Kansas return

along with an explanation of the changes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2