Form Ct-1 - Instructions For Preparing And Filing Registration Form

ADVERTISEMENT

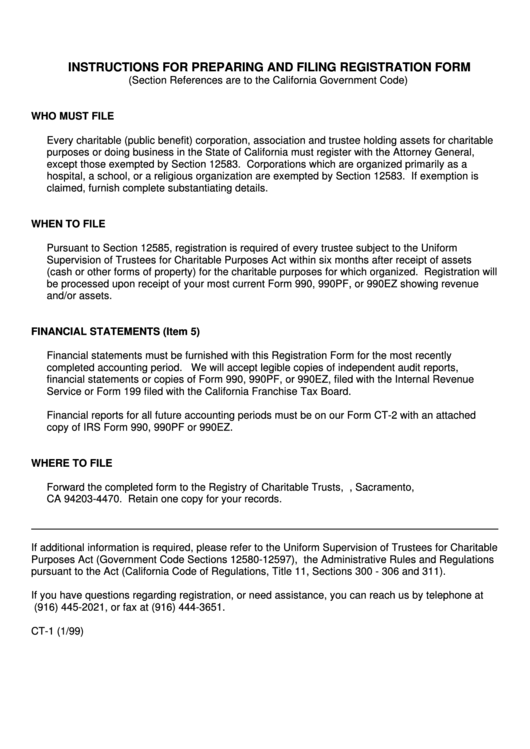

INSTRUCTIONS FOR PREPARING AND FILING REGISTRATION FORM

(Section References are to the California Government Code)

WHO MUST FILE

Every charitable (public benefit) corporation, association and trustee holding assets for charitable

purposes or doing business in the State of California must register with the Attorney General,

except those exempted by Section 12583. Corporations which are organized primarily as a

hospital, a school, or a religious organization are exempted by Section 12583. If exemption is

claimed, furnish complete substantiating details.

WHEN TO FILE

Pursuant to Section 12585, registration is required of every trustee subject to the Uniform

Supervision of Trustees for Charitable Purposes Act within six months after receipt of assets

(cash or other forms of property) for the charitable purposes for which organized. Registration will

be processed upon receipt of your most current Form 990, 990PF, or 990EZ showing revenue

and/or assets.

FINANCIAL STATEMENTS (Item 5)

Financial statements must be furnished with this Registration Form for the most recently

completed accounting period. We will accept legible copies of independent audit reports,

financial statements or copies of Form 990, 990PF, or 990EZ, filed with the Internal Revenue

Service or Form 199 filed with the California Franchise Tax Board.

Financial reports for all future accounting periods must be on our Form CT-2 with an attached

copy of IRS Form 990, 990PF or 990EZ.

WHERE TO FILE

Forward the completed form to the Registry of Charitable Trusts, P.O. Box 903447, Sacramento,

CA 94203-4470. Retain one copy for your records.

If additional information is required, please refer to the Uniform Supervision of Trustees for Charitable

Purposes Act (Government Code Sections 12580-12597), the Administrative Rules and Regulations

pursuant to the Act (California Code of Regulations, Title 11, Sections 300 - 306 and 311).

If you have questions regarding registration, or need assistance, you can reach us by telephone at

(916) 445-2021, or fax at (916) 444-3651.

CT-1 (1/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1