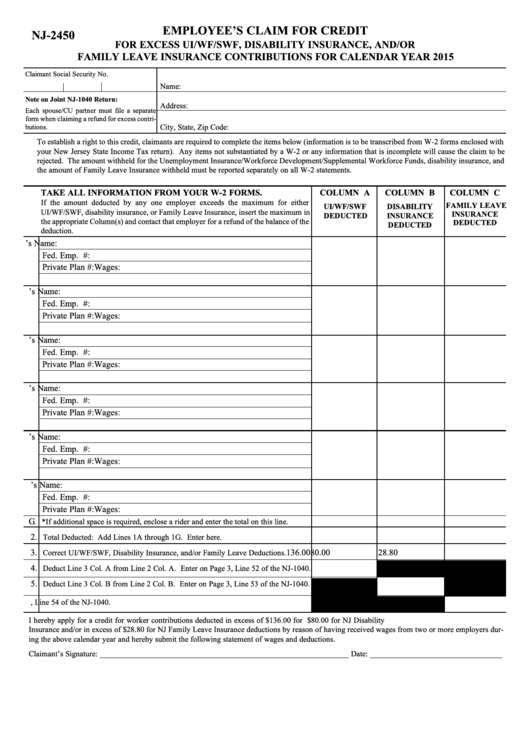

Form Nj-2450 - Employee'S Claim For Credit - 2015

ADVERTISEMENT

EMPLOYEE’S CLAIM FOR CREDIT

NJ-2450

FOR EXCESS UI/WF/SWF, DISABILITY INSURANCE, AND/OR

FAMILY LEAVE INSURANCE CONTRIBUTIONS FOR CALENDAR YEAR 2015

Claimant Social Security No.

Name:

Note on Joint NJ-1040 Return:

Address:

Each spouse/CU partner must file a separate

form when claiming a refund for excess contri-

butions.

City, State, Zip Code:

To establish a right to this credit, claimants are required to complete the items below (information is to be transcribed from W-2 forms enclosed with

your New Jersey State Income Tax return). Any items not substantiated by a W-2 or any information that is incomplete will cause the claim to be

rejected. The amount withheld for the Unemployment Insurance/Workforce Development/Supplemental Workforce Funds, disability insurance, and

the amount of Family Leave Insurance withheld must be reported separately on all W-2 statements.

TAKE ALL INFORMATION FROM YOUR W-2 FORMS.

COLUMN A

COLUMN B

COLUMN C

If the amount deducted by any one employer exceeds the maximum for either

FAMILY LEAVE

UI/WF/SWF

DISABILITY

UI/WF/SWF, disability insurance, or Family Leave Insurance, insert the maximum in

INSURANCE

DEDUCTED

INSURANCE

the appropriate Column(s) and contact that employer for a refund of the balance of the

DEDUCTED

DEDUCTED

deduction.

1A. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

B. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

C. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

D. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

E. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

F. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

G.

*If additional space is required, enclose a rider and enter the total on this line.

2.

Total Deducted: Add Lines 1A through 1G. Enter here.

3.

136.00

80.00

28.80

Correct UI/WF/SWF, Disability Insurance, and/or Family Leave Deductions.

4.

Deduct Line 3 Col. A from Line 2 Col. A. Enter on Page 3, Line 52 of the NJ-1040.

5.

Deduct Line 3 Col. B from Line 2 Col. B. Enter on Page 3, Line 53 of the NJ-1040.

6. Deduct Line 3 Col. C from Line 2 Col. C. Enter on Page 3, Line 54 of the NJ-1040.

I hereby apply for a credit for worker contributions deducted in excess of $136.00 for N.J. UI/WF/SWF and/or in excess of $80.00 for NJ Disability

Insurance and/or in excess of $28.80 for NJ Family Leave Insurance deductions by reason of having received wages from two or more employers dur-

ing the above calendar year and hereby submit the following statement of wages and deductions.

Claimant’s Signature: ______________________________________________________________ Date: _________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2