Revert

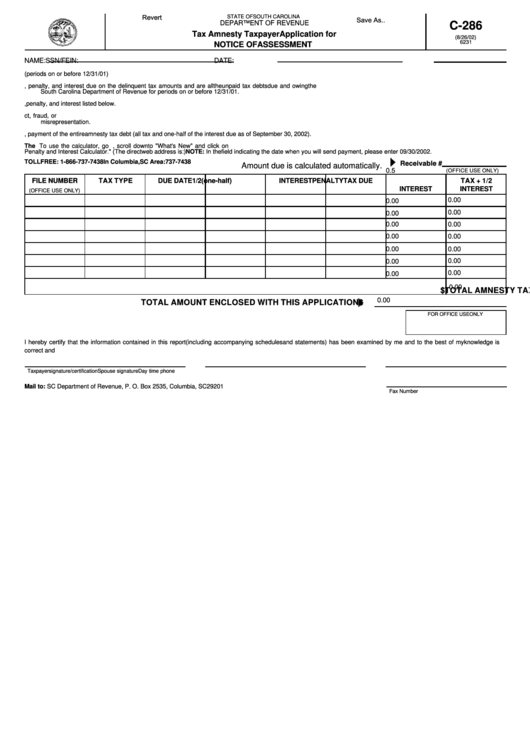

STATE OF SOUTH CAROLINA

Save As..

DEPARTMENT OF REVENUE

C-286

Tax Amnesty Taxpayer Application for

(8/26/02)

6231

NOTICE OF ASSESSMENT

NAME:

SSN/FEIN:

DATE:

1.

Taxpayer attaches to this application every return or amended return being filed on which amnesty is sought. (periods on or before 12/31/01)

2.

Taxpayer certifies that the amounts listed below are the tax, penalty, and interest due on the delinquent tax amounts and are all the unpaid tax debts due and owing the

South Carolina Department of Revenue for periods on or before 12/31/01.

3.

Taxpayer waives any and all right to contest liability for the tax, penalty, and interest listed below.

4.

Taxpayer agrees the South Carolina Department of Revenue may rescind this grant of amnesty should it determine such was based on mutual mistake of fact, fraud, or

misrepresentation.

5.

Taxpayer encloses with this application and the returns, payment of the entire amnesty tax debt (all tax and one-half of the interest due as of September 30, 2002).

The S.C. Department of Revenue Web Site has an Interest and Penalty Calculator. To use the calculator, go to , scroll down to "What's New" and click on

Penalty and Interest Calculator." (The direct web address is: /picalc/) NOTE: In the field indicating the date when you will send payment, please enter 09/30/2002.

TOLL FREE: 1-866-737-7438

In Columbia, SC Area: 737-7438

Receivable #

Amount due is calculated automatically.

0.5

(OFFICE USE ONLY)

FILE NUMBER

TAX TYPE

DUE DATE

TAX DUE

INTEREST

PENALTY

1/2 (one-half)

TAX + 1/2

INTEREST

INTEREST

(OFFICE USE ONLY)

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

TOTAL AMNESTY TAX DEBT

$

(Add "Tax + 1/2 Interest" Column)

0.00

TOTAL AMOUNT ENCLOSED WITH THIS APPLICATION

$

FOR OFFICE USE ONLY

I hereby certify that the information contained in this report (including accompanying schedules and statements) has been examined by me and to the best of my knowledge is

correct and complete. Both spouses must sign for a joint return.

Taxpayer signature/certification

Spouse signature

Day time phone

Mail to: SC Department of Revenue, P. O. Box 2535, Columbia, SC 29201

Fax Number

1

1