Jobs And Investment Tax Credit Worksheet For Tax Year 2013

ADVERTISEMENT

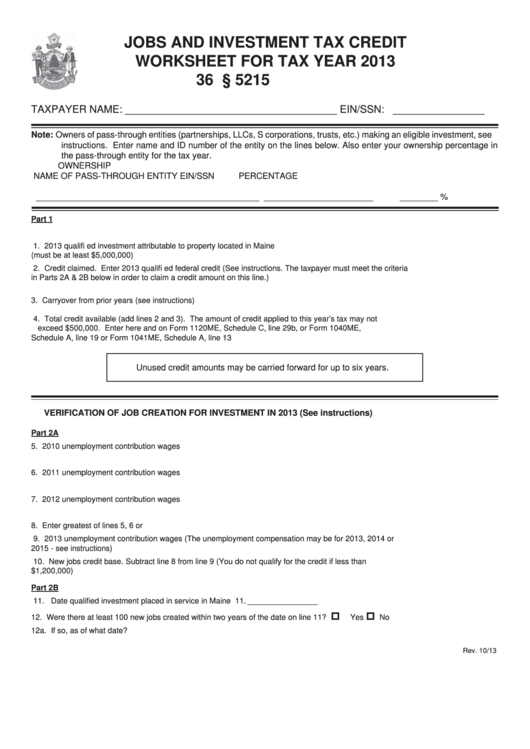

JOBS AND INVESTMENT TAX CREDIT

WORKSHEET FOR TAX YEAR 2013

36 M.R.S.A. § 5215

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible investment, see

instructions. Enter name and ID number of the entity on the lines below. Also enter your ownership percentage in

the pass-through entity for the tax year.

OWNERSHIP

NAME OF PASS-THROUGH ENTITY

EIN/SSN

PERCENTAGE

_______________________________________________

_______________________

________ %

Part 1

1. 2013 qualifi ed investment attributable to property located in Maine

(must be at least $5,000,000) ........................................................................................................................... 1. ________________

2. Credit claimed. Enter 2013 qualifi ed federal credit (See instructions. The taxpayer must meet the criteria

in Parts 2A & 2B below in order to claim a credit amount on this line.) ............................................................. 2. ________________

3. Carryover from prior years (see instructions) ................................................................................................... 3. ________________

4. Total credit available (add lines 2 and 3). The amount of credit applied to this year’s tax may not

exceed $500,000. Enter here and on Form 1120ME, Schedule C, line 29b, or Form 1040ME,

Schedule A, line 19 or Form 1041ME, Schedule A, line 13 ............................................................................... 4. ________________

Unused credit amounts may be carried forward for up to six years.

VERIFICATION OF JOB CREATION FOR INVESTMENT IN 2013 (See instructions)

Part 2A

5. 2010 unemployment contribution wages .......................................................................................................... 5. ________________

6. 2011 unemployment contribution wages .......................................................................................................... 6. ________________

7. 2012 unemployment contribution wages ......................................................................................................... 7. ________________

8. Enter greatest of lines 5, 6 or 7......................................................................................................................... 8. ________________

9. 2013 unemployment contribution wages (The unemployment compensation may be for 2013, 2014 or

2015 - see instructions) .................................................................................................................................... 9. ________________

10. New jobs credit base. Subtract line 8 from line 9 (You do not qualify for the credit if less than

$1,200,000)...................................................................................................................................................... 10. ________________

Part 2B

11. Date qualifi ed investment placed in service in Maine ..................................................................................... 11. ________________

12. Were there at least 100 new jobs created within two years of the date on line 11? ........................................ 12.

Yes

No

12a. If so, as of what date?.......................................................................................................................... 12a. ________________

Rev. 10/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1