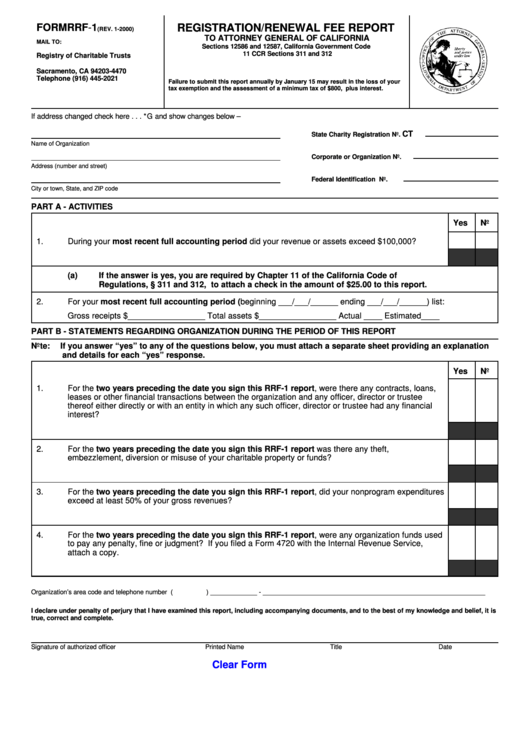

FORM RRF-1

REGISTRATION/RENEWAL FEE REPORT

(REV. 1-2000)

TO ATTORNEY GENERAL OF CALIFORNIA

MAIL TO:

Sections 12586 and 12587, California Government Code

11 CCR Sections 311 and 312

Registry of Charitable Trusts

P.O. Box 903447

Sacramento, CA 94203-4470

Telephone (916) 445-2021

Failure to submit this report annually by January 15 may result in the loss of your

tax exemption and the assessment of a minimum tax of $800, plus interest.

If address changed check here . . . *G and show changes below –

CT

State Charity Registration No.

Name of Organization

Corporate or Organization No.

Address (number and street)

Federal Identification No.

City or town, State, and ZIP code

PART A - ACTIVITIES

Yes

No

1.

During your most recent full accounting period did your revenue or assets exceed $100,000?

(a)

If the answer is yes, you are required by Chapter 11 of the California Code of

Regulations, § 311 and 312, to attach a check in the amount of $25.00 to this report.

2.

For your most recent full accounting period (beginning ___/___/______ ending ___/___/______) list:

Gross receipts $_________________ Total assets $_________________ Actual ____ Estimated____

PART B - STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note:

If you answer “yes” to any of the questions below, you must attach a separate sheet providing an explanation

and details for each “yes” response.

Yes

No

1.

For the two years preceding the date you sign this RRF-1 report, were there any contracts, loans,

leases or other financial transactions between the organization and any officer, director or trustee

thereof either directly or with an entity in which any such officer, director or trustee had any financial

interest?

2.

For the two years preceding the date you sign this RRF-1 report was there any theft,

embezzlement, diversion or misuse of your charitable property or funds?

3.

For the two years preceding the date you sign this RRF-1 report, did your nonprogram expenditures

exceed at least 50% of your gross revenues?

4.

For the two years preceding the date you sign this RRF-1 report, were any organization funds used

to pay any penalty, fine or judgment? If you filed a Form 4720 with the Internal Revenue Service,

attach a copy.

Organization’s area code and telephone number (

) _____________ - ______________________________________________________________

I declare under penalty of perjury that I have examined this report, including accompanying documents, and to the best of my knowledge and belief, it is

true, correct and complete.

Signature of authorized officer

Printed Name

Title

Date

Clear Form

1

1