Form Bb-1 Instructions - Basic Business Application

ADVERTISEMENT

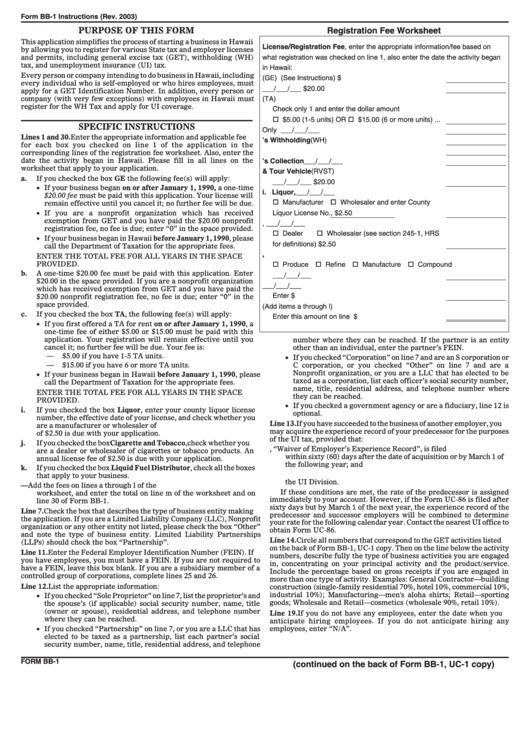

Form BB-1 Instructions (Rev. 2003)

PURPOSE OF THIS FORM

Registration Fee Worksheet

This application simplifies the process of starting a business in Hawaii

License/Registration Fee, enter the appropriate information/fee based on

by allowing you to register for various State tax and employer licenses

and permits, including general excise tax (GET), withholding (WH)

what registration was checked on line 1, also enter the date the activity began

tax, and unemployment insurance (UI) tax.

in Hawaii:

Every person or company intending to do business in Hawaii, including

a. General Excise (GE) (See Instructions) .....................

$

every individual who is self-employed or who hires employees, must

b. GE One Time Event ___/___/___...........Enter $20.00

apply for a GET Identification Number. In addition, every person or

company (with very few exceptions) with employees in Hawaii must

c. Transient Accommodations (TA)

register for the WH Tax and apply for UI coverage.

Check only 1 and enter the dollar amount

o $5.00 (1-5 units) OR o $15.00 (6 or more units) ...

SPECIFIC INSTRUCTIONS

d. Use Tax Only ___/___/___.................No fee required

-0-

Lines 1 and 30. Enter the appropriate information and applicable fee

e. Employer’s Withholding (WH) ..........No fee required

-0-

for each box you checked on line 1 of the application in the

f. Unemployment Insurance .................No fee required

-0-

corresponding lines of the registration fee worksheet. Also, enter the

date the activity began in Hawaii. Please fill in all lines on the

g. Seller’s Collection ___/___/___........No fee required

-0-

worksheet that apply to your application.

h. Rental Motor Vehicle & Tour Vehicle (RVST)

a.

If you checked the box GE the following fee(s) will apply:

___/___/___ .............................................Enter $20.00

• If your business began on or after January 1, 1990, a one-time

i. Liquor,

___/___/___ .......................................Check

$20.00 fee must be paid with this application. Your license will

o Manufacturer o Wholesaler and enter County

remain effective until you cancel it; no further fee will be due.

• If you are a nonprofit organization which has received

Liquor License No.

, ...Enter $2.50

exemption from GET and you have paid the $20.00 nonprofit

j. Cigarette and Tobacco, ___/___/___ .....check only 1

registration fee, no fee is due; enter “0” in the space provided.

o Dealer

o Wholesaler (see section 245-1, HRS

• If your business began in Hawaii before January 1, 1990, please

for definitions).............................................Enter $2.50

call the Department of Taxation for the appropriate fees.

k. Liquid Fuel Distributor, ...............check all that apply

ENTER THE TOTAL FEE FOR ALL YEARS IN THE SPACE

o Produce o Refine o Manufacture o Compound

PROVIDED.

b.

A one-time $20.00 fee must be paid with this application. Enter

___/___/___ .........................................No fee required

-0-

$20.00 in the space provided. If you are a nonprofit organization

l. Liquid Fuel Retail Dealer ___/___/___

which has received exemption from GET and you have paid the

Enter $5.00 ...................................................................

$20.00 nonprofit registration fee, no fee is due; enter “0” in the

space provided.

m. TOTAL AMOUNT DUE (Add items a through l)

c.

If you checked the box TA, the following fee(s) will apply:

Enter this amount on line 30 .........................................

$

• If you first offered a TA for rent on or after January 1, 1990, a

one-time fee of either $5.00 or $15.00 must be paid with this

application. Your registration will remain effective until you

number where they can be reached. If the partner is an entity

cancel it; no further fee will be due. Your fee is:

other than an individual, enter the partner’s FEIN.

$5.00 if you have 1-5 TA units.

• If you checked “Corporation” on line 7 and are an S corporation or

—

—

$15.00 if you have 6 or more TA units.

C corporation, or you checked “Other” on line 7 and are a

Nonprofit organization, or you are a LLC that has elected to be

• If your business began in Hawaii before January 1, 1990, please

taxed as a corporation, list each officer’s social security number,

call the Department of Taxation for the appropriate fees.

name, title, residential address, and telephone number where

ENTER THE TOTAL FEE FOR ALL YEARS IN THE SPACE

they can be reached.

PROVIDED.

• If you checked a government agency or are a fiduciary, line 12 is

i.

If you checked the box Liquor, enter your county liquor license

optional.

number, the effective date of your license, and check whether you

Line 13. If you have succeeded to the business of another employer, you

are a manufacturer or wholesaler of liquor. An annual permit fee

may acquire the experience record of your predecessor for the purposes

of $2.50 is due with your application.

of the UI tax, provided that:

j.

If you checked the box Cigarette and Tobacco, check whether you

1.

Form UC-86, “Waiver of Employer’s Experience Record”, is filed

are a dealer or wholesaler of cigarettes or tobacco products. An

within sixty (60) days after the date of acquisition or by March 1 of

annual license fee of $2.50 is due with your application.

the following year; and

k.

If you checked the box Liquid Fuel Distributor, check all the boxes

2.

The predecessor has cleared all contributions and reports due to

that apply to your business.

the UI Division.

m. TOTAL AMOUNT DUE — Add the fees on lines a through l of the

If these conditions are met, the rate of the predecessor is assigned

worksheet, and enter the total on line m of the worksheet and on

immediately to your account. However, if the Form UC-86 is filed after

line 30 of Form BB-1.

sixty days but by March 1 of the next year, the experience record of the

Line 7. Check the box that describes the type of business entity making

predecessor and successor employers will be combined to determine

the application. If you are a Limited Liability Company (LLC), Nonprofit

your rate for the following calendar year. Contact the nearest UI office to

organization or any other entity not listed, please check the box “Other”

obtain Form UC-86.

and note the type of business entity. Limited Liability Partnerships

Line 14. Circle all numbers that correspond to the GET activities listed

(LLPs) should check the box “Partnership”.

on the back of Form BB-1, UC-1 copy. Then on the line below the activity

Line 11. Enter the Federal Employer Identification Number (FEIN). If

numbers, describe fully the type of business activities you are engaged

you have employees, you must have a FEIN. If you are not required to

in, concentrating on your principal activity and the product/service.

have a FEIN, leave this box blank. If you are a subsidiary member of a

Include the percentage based on gross receipts if you are engaged in

controlled group of corporations, complete lines 25 and 26.

more than one type of activity. Examples: General Contractor—building

Line 12. List the appropriate information:

construction (single-family residential 70%, hotel 10%, commercial 10%,

• If you checked “Sole Proprietor” on line 7, list the proprietor’s and

industrial 10%); Manufacturing—men's aloha shirts; Retail—sporting

goods; Wholesale and Retail—cosmetics (wholesale 90%, retail 10%).

the spouse’s (if applicable) social security number, name, title

(owner or spouse), residential address, and telephone number

Line 19. If you do not have any employees, enter the date when you

where they can be reached.

anticipate hiring employees. If you do not anticipate hiring any

• If you checked “Partnership” on line 7, or you are a LLC that has

employees, enter “N/A”.

elected to be taxed as a partnership, list each partner’s social

security number, name, title, residential address, and telephone

FORM BB-1

(continued on the back of Form BB-1, UC-1 copy)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2