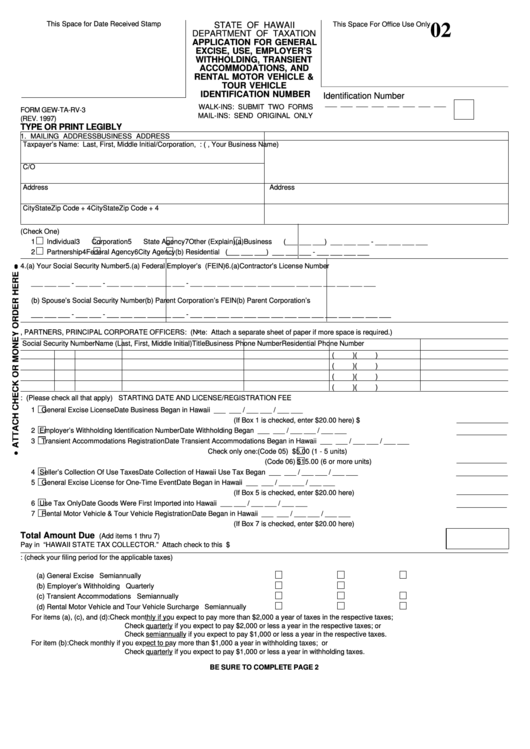

This Space for Date Received Stamp

STATE OF HAWAII

This Space For Office Use Only

02

DEPARTMENT OF TAXATION

APPLICATION FOR GENERAL

EXCISE, USE, EMPLOYER’S

WITHHOLDING, TRANSIENT

ACCOMMODATIONS, AND

RENTAL MOTOR VEHICLE &

TOUR VEHICLE

IDENTIFICATION NUMBER

Identification Number

WALK-INS: SUBMIT TWO FORMS

FORM GEW-TA-RV-3

MAIL-INS: SEND ORIGINAL ONLY

___ ___ ___ ___ ___ ___ ___ ___

(REV. 1997)

TYPE OR PRINT LEGIBLY

1. MAILING ADDRESS

BUSINESS ADDRESS

Taxpayer’s Name: Last, First, Middle Initial/Corporation, etc.

DBA Name: (i.e., Your Business Name)

C/O

Address

Address

City

State

Zip Code + 4

City

State

Zip Code + 4

2. TYPE OF OWNERSHIP (Check One)

3. PHONE NUMBER

1

Individual

3

Corporation

5

State Agency

7

Other (Explain)

(a) Business

(___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

2

Partnership 4

Federal Agency

6

City Agency

(b) Residential (___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

4. (a) Your Social Security Number

5. (a) Federal Employer’s I.D. Number (FEIN)

6.(a) Contractor’s License Number

___ ___ ___ - ___ ___ - ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___ ___ ___ ___

(b) Spouse’s Social Security Number

(b) Parent Corporation’s FEIN

(b) Parent Corporation’s G.E. I.D. Number

___ ___ ___ - ___ ___ - ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___ ___ ___ ___ ___

7. OWNERS, PARTNERS, PRINCIPAL CORPORATE OFFICERS: (Note: Attach a separate sheet of paper if more space is required.)

Social Security Number

Name (Last, First, Middle Initial)

Title

Business Phone Number

Residential Phone Number

(

)

(

)

(

)

(

)

(

)

(

)

(

)

(

)

8. APPLICATION IS HEREBY MADE FOR: (Please check all that apply) STARTING DATE AND LICENSE/REGISTRATION FEE

1

General Excise License

Date Business Began in Hawaii ___ ___ / ___ ___ / ___ ___

(If Box 1 is checked, enter $20.00 here) ............................................... 1 $

2

Employer’s Withholding Identification Number

Date Withholding Began ___ ___ / ___ ___ / ___ ___ .................................... 2

- 0 -

3

Transient Accommodations Registration

Date Transient Accommodations Began in Hawaii ___ ___ / ___ ___ / ___ ___

Check only one: (Code 05)

$5.00 (1 - 5 units)

(Code 06)

$15.00 (6 or more units).................................. 3

4

Seller’s Collection Of Use Taxes

Date Collection of Hawaii Use Tax Began ___ ___ / ___ ___ / ___ ___ ......... 4

- 0 -

5

General Excise License for One-Time Event

Date Began in Hawaii ___ ___ / ___ ___ / ___ ___

(If Box 5 is checked, enter $20.00 here) ............................................... 5

6

Use Tax Only

Date Goods Were First Imported into Hawaii ___ ___ / ___ ___ / ___ ___...... 6

- 0 -

7

Rental Motor Vehicle & Tour Vehicle Registration

Date Began in Hawaii ___ ___ / ___ ___ / ___ ___

(If Box 7 is checked, enter $20.00 here) ............................................... 7

Total Amount Due

(Add items 1 thru 7)

Pay in U.S. dollars on U.S. Bank to “HAWAII STATE TAX COLLECTOR.” Attach check to this form............................................................. $

9. FILING PERIOD FOR: (check your filing period for the applicable taxes)

(a) General Excise Tax....................................................................................

Monthly ...........

Quarterly .........

Semiannually

(b) Employer’s Withholding Tax.......................................................................

Monthly ...........

Quarterly

(c) Transient Accommodations Tax.................................................................

Monthly ...........

Quarterly .........

Semiannually

(d) Rental Motor Vehicle and Tour Vehicle Surcharge Tax .............................

Monthly ...........

Quarterly .........

Semiannually

For items (a), (c), and (d):

Check monthly if you expect to pay more than $2,000 a year of taxes in the respective taxes;

Check quarterly if you expect to pay $2,000 or less a year in the respective taxes; or

Check semiannually if you expect to pay $1,000 or less a year in the respective taxes.

For item (b):

Check monthly if you expect to pay more than $1,000 a year in withholding taxes; or

Check quarterly if you expect to pay $1,000 or less a year in withholding taxes.

BE SURE TO COMPLETE PAGE 2

1

1 2

2