Form Dol-129 - Retailer Application

ADVERTISEMENT

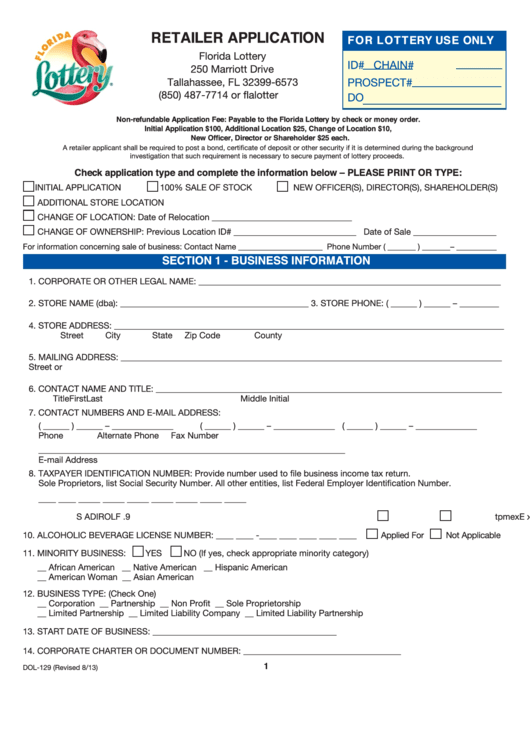

RETAILER APPLICATION

FOR LOTTERY USE ONLY

Florida Lottery

ID#

CHAIN#

250 Marriott Drive

PROSPECT#

Tallahassee, FL 32399-6573

(850) 487-7714 or

DO

Non-refundable Application Fee: Payable to the Florida Lottery by check or money order.

Initial Application $100, Additional Location $25, Change of Location $10,

New Officer, Director or Shareholder $25 each.

A retailer applicant shall be required to post a bond, certificate of deposit or other security if it is determined during the background

investigation that such requirement is necessary to secure payment of lottery proceeds.

Check application type and complete the information below – PLEASE PRINT OR TYPE:

INITIAL APPLICATION

100% SALE OF STOCK

NEW OFFICER(S), DIRECTOR(S), SHAREHOLDER(S)

ADDITIONAL STORE LOCATION

CHANGE OF LOCATION: Date of Relocation ________________________________

CHANGE OF OWNERSHIP: Previous Location ID# ____________________________ Date of Sale ___________________

For information concerning sale of business: Contact Name _____________________ Phone Number ( _______ ) _______– __________

SECTION 1 - BUSINESS INFORMATION

1. CORPORATE OR OTHER LEGAL NAME: _____________________________________________________________________

2. STORE NAME (dba): ___________________________________________ 3. STORE PHONE: ( ______ ) ______ – _________

4. STORE ADDRESS: _______________________________________________________________________________________ __

Street

City

State

Zip Code

County

5. MAILING ADDRESS: _______________________________________________________________________________________

Street or P.O. Box

City

State

Zip Code

6. CONTACT NAME AND TITLE: _______________________________________________________________________________

First

Middle Initial

Last

Title

7. CONTACT NUMBERS AND E-MAIL ADDRESS:

( ______ ) ______ – ______________

( ______ ) ______ – ______________

( ______ ) ______ – ______________

Phone

Alternate Phone

Fax Number

_____________________________________________________________________ _

E-mail Address

8. TAXPAYER IDENTIFICATION NUMBER: Provide number used to file business income tax return.

Sole Proprietors, list Social Security Number. All other entities, list Federal Employer Identification Number.

____ ____ _____ _____ _____ _____ _____ _____ _____

. 9

F

L

O

R

D I

A

S

A

L

E

S

T

A

X

N

U

M

B

E

R

_ :

_ _

_

_ _

_ -

_ _

_

_ _

_

_ _

_

_ _

_

_ _

_

_ _

_

_ _

_

_ _

_

_ _

_

_ _

-

_

_ _

A

p

p

e i l

d

F

r o

T

x a

E

e x

m

t p

10. ALCOHOLIC BEVERAGE LICENSE NUMBER: ____ ____ -____ ____ ____ ____ ____

Applied For

Not Applicable

11. MINORITY BUSINESS:

YES

NO (If yes, check appropriate minority category)

__ African American

__ Native American

__ Hispanic American

__ American Woman

__ Asian American

12. BUSINESS TYPE: (Check One)

__ Corporation

__ Partnership

__ Non Profit

__ Sole Proprietorship

__ Limited Partnership

__ Limited Liability Company

__ Limited Liability Partnership

13. START DATE OF BUSINESS: __________________________________________

14. CORPORATE CHARTER OR DOCUMENT NUMBER: ____________________________________

1

DOL-129 (Revised 8/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4