DR-501

R. 12/14

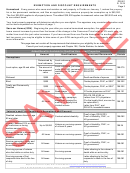

EXEMPTION AND DISCOUNT REQUIREMENTS

Page 3

Homestead Every person who owns and resides on real property in Florida on January 1, makes the property

his or her permanent residence, and files an application, may receive a property tax exemption up to $50,000.

The first $25,000 applies to all property taxes. The added $25,000 applies to assessed value over $50,000 and only

to non-school taxes.

Your local property appraiser will determine whether you are eligible. The appraiser may consider information such

as the items requested on the bottom of page 1.

Save our Homes (SOH) Beginning the year after you receive homestead exemption, the assessment on your

home cannot increase by more than the lesser of the change in the Consumer Price Index or 3% each year, no

matter how much the just value increases. If you have moved from one Florida homestead to another within the

last two years, you may be eligible to take some of your SOH savings with you. See your property appraiser for

more information.

This page does not contain all the requirements that determine your eligibility for an exemption.

Consult your local property appraiser and Chapter 196, Florida Statutes, for details.

Added Benefits Available for Qualified Homestead Properties

Amount

Qualifications

Forms and Documents*

Statute

Exemptions

Determined by

Local ordinance, limited

Proof of age

local ordinance

income

DR-501SC, household income

Local ordinance, just value

Local option, age 65 and older

196.075

The amount of

under $250,000, permanent

DR-501SC, household income,

the assessed

residency for 25 years or

DR-501PR

value

more.

Widowed

$500

Death certificate of spouse

196.202

Blind

$500

Florida physician, DVA*, or SSA**

196.202

Totally and Permanently

$500

Disabled

Florida physician, DVA*, or SSA**

196.202

Disabled

All taxes

Quadriplegic

2 Florida physicians or DVA*

196.101

DR-416, DR-416B, or

Hemiplegic, paraplegic,

Letters from 2 FL physicians

wheelchair required for

(For the legally blind, one can be

All taxes

196.101

mobility, or legally blind

an optometrist.)

Limited income

Letter from DVA*, and

DR-501A, household income

Veteran’s and First Responders Exemptions and Discount

Proof of age, DR-501DV

Disabled veteran discount, age

% of disability

Combat-related disability

Proof of disability, DVA*, or

196.082

65 and older

US government

Veteran, disabled 10% or more

Veteran or surviving spouse

Proof of disability, DVA*, or

by misfortune or during

Up to $5,000

196.24

of at least 5 years

US government

wartime service

Veteran confined to wheelchair,

Proof of disability, DVA*, or

service-connected, totally

All taxes

Veteran or surviving spouse

196.091

US government

disabled

Service-connected, totally and

Proof of disability, DVA*, or

permanently disabled veteran

All taxes

Veteran or surviving spouse

196.081

US government;

or surviving spouse

Surviving spouse of veteran

Letter attesting to the veteran’s

All taxes

Surviving spouse

196.081

who died while on active duty

death while on active duty

Surviving spouse of first

Letter attesting to the first

responder who died in the line

All taxes

Surviving spouse

responder’s death in the line of

196.081

of duty

duty

Department of Revenue (DR) forms are available at

*DVA is the US Department of Veterans Affairs or its predecessor.**SSA is the Social Security Administration.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8