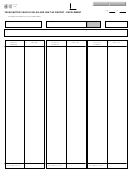

INSTRUCTIONS FOR DEALER

A) Fill out report in duplicate.

B) Print or type report.

C) Complete all information.

D) Retain copy for your files.

E) Send original to:

New Jersey Division of Taxation

PO Box 267

Trenton, NJ 08695-0267

The ST-10 as revised must be used to support a sales tax exemption claimed by the purchaser/lessee of a motor vehicle in this State

on and after June 1, 1988.

Subsection N.J.S.A. 54:32B-10(a) of the New Jersey Sales and Use Tax Act provides as follows:

“Receipts from any sale of a motor vehicle shall not be subject to the retail sales tax imposed under subsection (a) of section 3, despite

the taking of physical possession by the purchaser within this State, provided that the purchaser, at the time of taking delivery:

(1) is a nonresident of this State,

(2) has no permanent place of abode in this State,

(3) is not engaged in carrying on in this State any employment, trade, business or profession in which the motor vehicle will

be used in this State. . . . .”

For the purposes of this subsection, any person who maintains a place of abode in New Jersey is a resident individual.

A place of abode is a dwelling place maintained by a person, or by another for them, whether or not owned by such person, on other

than a temporary or transient basis. The dwelling may be a house, apartment or flat; a room including a room at a hotel, motel,

boarding house or club, or at a residence hall operated by an educational or charitable or other institution, or a trailer, mobile home,

houseboat or any other premises.

Corporations:

Any corporation incorporated under the laws of New Jersey, and any corporation, association, partnership or other entity doing

business in this State, or operating a hotel, place of amusement or social or athletic club in the state is a resident.

Trade or Business:

Any person while engaged in any manner in carrying on in this State any employment, trade, business or profession shall be deemed

a resident with respect to the use in this State of tangible personal property or services in such employment, trade, business or

profession.

Military Personnel:

Any person serving in the Armed Forces of the United States whose home or record is a state other than New Jersey is a resident of

this State whether his place of abode is located on or off a military reservation and within the territorial limits of New Jersey.

Any person serving in the Armed Forces of the United States whose home of record is the State of New Jersey is a resident of this

State whether his place of abode is located on or off a military reservation situated in this State or another state of the United States

or a foreign nation.

VOIDANCE OF NONRESIDENT EXEMPTION:

Where a nonresident exemption is claimed by the purchaser/lessee, sales tax plus penalty and interest will be imposed on the purchase

price of the motor vehicle, if the purchaser/lessee is in fact a resident of New Jersey at the time of purchase or lease. Payment of tax

to another state does not release you of this obligation.

1

1 2

2