Instructions For Form 1041n - Electing Small Business Trust (Esbt) Tax Calculation Worksheet - Nebraska

ADVERTISEMENT

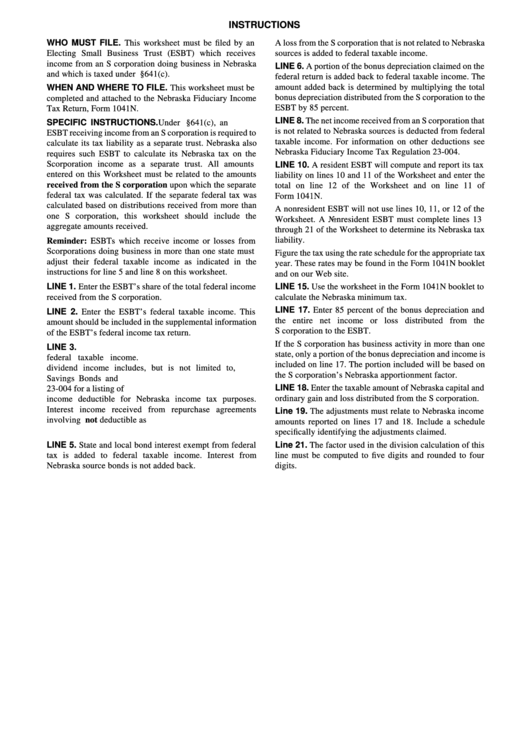

INSTRUCTIONS

WHO MUST FILE. This worksheet must be filed by an

A loss from the S corporation that is not related to Nebraska

Electing Small Business Trust (ESBT) which receives

sources is added to federal taxable income.

income from an S corporation doing business in Nebraska

LINE 6. A portion of the bonus depreciation claimed on the

and which is taxed under I.R.C. §641(c).

federal return is added back to federal taxable income. The

amount added back is determined by multiplying the total

WHEN AND WHERE TO FILE. This worksheet must be

bonus depreciation distributed from the S corporation to the

completed and attached to the Nebraska Fiduciary Income

ESBT by 85 percent.

Tax Return, Form 1041N.

LINE 8. The net income received from an S corporation that

SPECIFIC INSTRUCTIONS. Under I.R.C. §641(c), an

is not related to Nebraska sources is deducted from federal

ESBT receiving income from an S corporation is required to

taxable income. For information on other deductions see

calculate its tax liability as a separate trust. Nebraska also

Nebraska Fiduciary Income Tax Regulation 23-004.

requires such ESBT to calculate its Nebraska tax on the

S corporation income as a separate trust. All amounts

LINE 10. A resident ESBT will compute and report its tax

entered on this Worksheet must be related to the amounts

liability on lines 10 and 11 of the Worksheet and enter the

received from the S corporation upon which the separate

total on line 12 of the Worksheet and on line 11 of

federal tax was calculated. If the separate federal tax was

Form 1041N.

calculated based on distributions received from more than

A nonresident ESBT will not use lines 10, 11, or 12 of the

one S corporation, this worksheet should include the

Worksheet. A Nonresident ESBT must complete lines 13

aggregate amounts received.

through 21 of the Worksheet to determine its Nebraska tax

liability.

Reminder: ESBTs which receive income or losses from

S corporations doing business in more than one state must

Figure the tax using the rate schedule for the appropriate tax

adjust their federal taxable income as indicated in the

year. These rates may be found in the Form 1041N booklet

instructions for line 5 and line 8 on this worksheet.

and on our Web site.

LINE 1. Enter the ESBT’s share of the total federal income

LINE 15. Use the worksheet in the Form 1041N booklet to

received from the S corporation.

calculate the Nebraska minimum tax.

LINE 17. Enter 85 percent of the bonus depreciation and

LINE 2. Enter the ESBT’s federal taxable income. This

the entire net income or loss distributed from the

amount should be included in the supplemental information

S corporation to the ESBT.

of the ESBT’s federal income tax return.

If the S corporation has business activity in more than one

LINE 3. U.S. government bond interest is subtracted from

state, only a portion of the bonus depreciation and income is

federal taxable income. U.S. government interest or

included on line 17. The portion included will be based on

dividend income includes, but is not limited to, U.S.

the S corporation’s Nebraska apportionment factor.

Savings Bonds and U.S. Treasury Bills. See Regulation

LINE 18. Enter the taxable amount of Nebraska capital and

23-004 for a listing of U.S. government interest or dividend

ordinary gain and loss distributed from the S corporation.

income deductible for Nebraska income tax purposes.

Interest income received from repurchase agreements

Line 19. The adjustments must relate to Nebraska income

involving U.S. government obligations is not deductible as

amounts reported on lines 17 and 18. Include a schedule

U.S. government interest.

specifically identifying the adjustments claimed.

LINE 5. State and local bond interest exempt from federal

Line 21. The factor used in the division calculation of this

tax is added to federal taxable income. Interest from

line must be computed to five digits and rounded to four

Nebraska source bonds is not added back.

digits.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1