Instructions For Form E-599 - A Farmer'S Certificate - North Carolina Department Of Revenue

ADVERTISEMENT

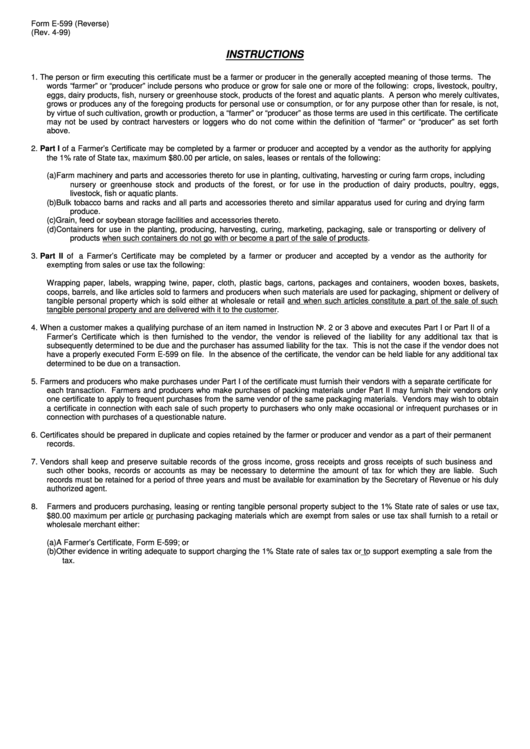

Form E-599 (Reverse)

(Rev. 4-99)

INSTRUCTIONS

1.

The person or firm executing this certificate must be a farmer or producer in the generally accepted meaning of those terms. The

words “ farmer” or “ producer” include persons who produce or grow for sale one or more of the following: crops, livestock, poultry,

eggs, dairy products, fish, nursery or greenhouse stock, products of the forest and aquatic plants. A person who merely cultivates,

grows or produces any of the foregoing products for personal use or consumption, or for any purpose other than for resale, is not,

by virtue of such cultivation, growth or production, a “ farmer” or “ producer” as those terms are used in this certificate. The certificate

may not be used by contract harvesters or loggers who do not come within the definition of “ farmer” or “ producer” as set forth

above.

2.

Part I of a Farmer’ s Certificate may be completed by a farmer or producer and accepted by a vendor as the authority for applying

the 1% rate of State tax, maximum $80.00 per article, on sales, leases or rentals of the following:

(a)

Farm machinery and parts and accessories thereto for use in planting, cultivating, harvesting or curing farm crops, including

nursery or greenhouse stock and products of the forest, or for use in the production of dairy products, poultry, eggs,

livestock, fish or aquatic plants.

(b)

Bulk tobacco barns and racks and all parts and accessories thereto and similar apparatus used for curing and drying farm

produce.

(c)

Grain, feed or soybean storage facilities and accessories thereto.

(d)

Containers for use in the planting, producing, harvesting, curing, marketing, packaging, sale or transporting or delivery of

products when such containers do not go with or become a part of the sale of products.

3.

Part II of a Farmer’ s Certificate may be completed by a farmer or producer and accepted by a vendor as the authority for

exempting from sales or use tax the following:

Wrapping paper, labels, wrapping twine, paper, cloth, plastic bags, cartons, packages and containers, wooden boxes, baskets,

coops, barrels, and like articles sold to farmers and producers when such materials are used for packaging, shipment or delivery of

tangible personal property which is sold either at wholesale or retail and when such articles constitute a part of the sale of such

tangible personal property and are delivered with it to the customer.

4.

When a customer makes a qualifying purchase of an item named in Instruction No. 2 or 3 above and executes Part I or Part II of a

Farmer’ s Certificate which is then furnished to the vendor, the vendor is relieved of the liability for any additional tax that is

subsequently determined to be due and the purchaser has assumed liability for the tax. This is not the case if the vendor does not

have a properly executed Form E-599 on file. In the absence of the certificate, the vendor can be held liable for any additional tax

determined to be due on a transaction.

5.

Farmers and producers who make purchases under Part I of the certificate must furnish their vendors with a separate certificate for

each transaction. Farmers and producers who make purchases of packing materials under Part II may furnish their vendors only

one certificate to apply to frequent purchases from the same vendor of the same packaging materials. Vendors may wish to obtain

a certificate in connection with each sale of such property to purchasers who only make occasional or infrequent purchases or in

connection with purchases of a questionable nature.

6.

Certificates should be prepared in duplicate and copies retained by the farmer or producer and vendor as a part of their permanent

records.

7.

Vendors shall keep and preserve suitable records of the gross income, gross receipts and gross receipts of such business and

such other books, records or accounts as may be necessary to determine the amount of tax for which they are liable. Such

records must be retained for a period of three years and must be available for examination by the Secretary of Revenue or his duly

authorized agent.

8.

Farmers and producers purchasing, leasing or renting tangible personal property subject to the 1% State rate of sales or use tax,

$80.00 maximum per article or purchasing packaging materials which are exempt from sales or use tax shall furnish to a retail or

wholesale merchant either:

(a) A Farmer’ s Certificate, Form E-599; or

(b) Other evidence in writing adequate to support charging the 1% State rate of sales tax or to support exempting a sale from the

tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1