Instruction For Form 3800n - Nebraska Schedule I Enterprise Zone Credit Computation - 2004

ADVERTISEMENT

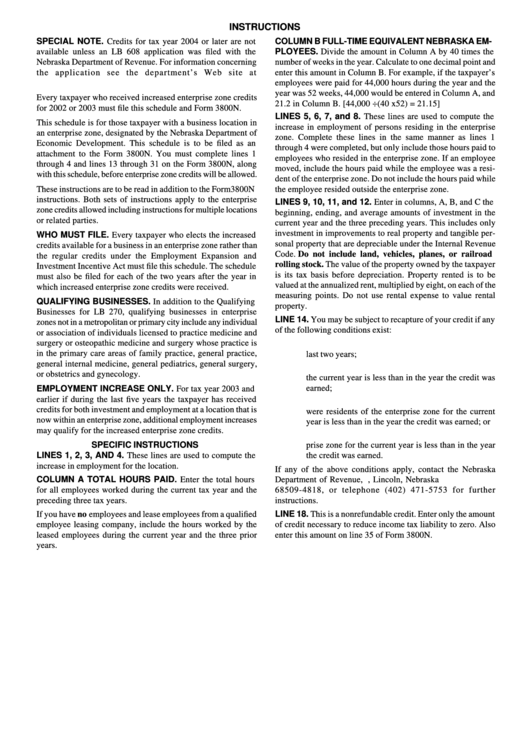

INSTRUCTIONS

SPECIAL NOTE. Credits for tax year 2004 or later are not

COLUMN B FULL-TIME EQUIVALENT NEBRASKA EM-

available unless an LB 608 application was filed with the

PLOYEES. Divide the amount in Column A by 40 times the

Nebraska Department of Revenue. For information concerning

number of weeks in the year. Calculate to one decimal point and

the application see the department’s Web site at

enter this amount in Column B. For example, if the taxpayer’s

employees were paid for 44,000 hours during the year and the

year was 52 weeks, 44,000 would be entered in Column A, and

Every taxpayer who received increased enterprise zone credits

21.2 in Column B. [44,000 ÷ (40 x 52) = 21.15]

for 2002 or 2003 must file this schedule and Form 3800N.

LINES 5, 6, 7, and 8. These lines are used to compute the

This schedule is for those taxpayer with a business location in

increase in employment of persons residing in the enterprise

an enterprise zone, designated by the Nebraska Department of

zone. Complete these lines in the same manner as lines 1

Economic Development. This schedule is to be filed as an

through 4 were completed, but only include those hours paid to

attachment to the Form 3800N. You must complete lines 1

employees who resided in the enterprise zone. If an employee

through 4 and lines 13 through 31 on the Form 3800N, along

moved, include the hours paid while the employee was a resi-

with this schedule, before enterprise zone credits will be allowed.

dent of the enterprise zone. Do not include the hours paid while

These instructions are to be read in addition to the Form 3800N

the employee resided outside the enterprise zone.

instructions. Both sets of instructions apply to the enterprise

LINES 9, 10, 11, and 12. Enter in columns, A, B, and C the

zone credits allowed including instructions for multiple locations

beginning, ending, and average amounts of investment in the

or related parties.

current year and the three preceding years. This includes only

investment in improvements to real property and tangible per-

WHO MUST FILE. Every taxpayer who elects the increased

sonal property that are depreciable under the Internal Revenue

credits available for a business in an enterprise zone rather than

Code. Do not include land, vehicles, planes, or railroad

the regular credits under the Employment Expansion and

rolling stock. The value of the property owned by the taxpayer

Investment Incentive Act must file this schedule. The schedule

is its tax basis before depreciation. Property rented is to be

must also be filed for each of the two years after the year in

valued at the annualized rent, multiplied by eight, on each of the

which increased enterprise zone credits were received.

measuring points. Do not use rental expense to value rental

QUALIFYING BUSINESSES. In addition to the Qualifying

property.

Businesses for LB 270, qualifying businesses in enterprise

LINE 14. You may be subject to recapture of your credit if any

zones not in a metropolitan or primary city include any individual

of the following conditions exist:

or association of individuals licensed to practice medicine and

surgery or osteopathic medicine and surgery whose practice is

a.

You previously had recapture of credits earned in the

in the primary care areas of family practice, general practice,

last two years;

general internal medicine, general pediatrics, general surgery,

b. Your number of employees in the enterprise zone for

or obstetrics and gynecology.

the current year is less than in the year the credit was

earned;

EMPLOYMENT INCREASE ONLY. For tax year 2003 and

earlier if during the last five years the taxpayer has received

c.

Your number of employees in the enterprise zone who

credits for both investment and employment at a location that is

were residents of the enterprise zone for the current

now within an enterprise zone, additional employment increases

year is less than in the year the credit was earned; or

may qualify for the increased enterprise zone credits.

d. The end of the year qualified investment in the enter-

SPECIFIC INSTRUCTIONS

prise zone for the current year is less than in the year

LINES 1, 2, 3, AND 4. These lines are used to compute the

the credit was earned.

increase in employment for the location.

If any of the above conditions apply, contact the Nebraska

COLUMN A TOTAL HOURS PAID. Enter the total hours

Department of Revenue, P.O. Box 94818, Lincoln, Nebraska

for all employees worked during the current tax year and the

68509-4818, or telephone (402) 471-5753 for further

preceding three tax years.

instructions.

LINE 18. This is a nonrefundable credit. Enter only the amount

If you have no employees and lease employees from a qualified

employee leasing company, include the hours worked by the

of credit necessary to reduce income tax liability to zero. Also

leased employees during the current year and the three prior

enter this amount on line 35 of Form 3800N.

years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1