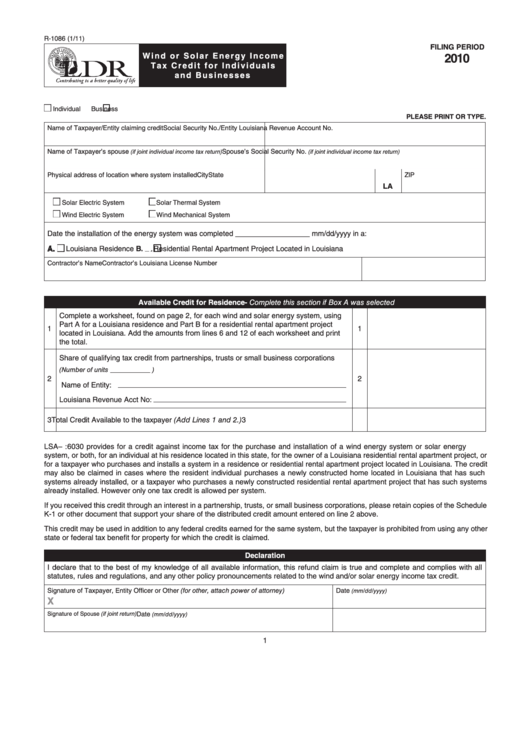

R-1086 (1/11)

FILING PERIOD

W i n d o r S o l a r E n e r g y I n c o m e

2010

Ta x C r e d i t f o r I n d i v i d u a l s

a n d B u s i n e s s e s

■

■

Individual

Business

PLEASE PRINT OR TYPE.

Name of Taxpayer/Entity claiming credit

Social Security No./Entity Louisiana Revenue Account No.

Name of Taxpayer’s spouse

Spouse’s Social Security No.

(if joint individual income tax return)

(if joint individual income tax return)

Physical address of location where system installed

City

State

ZIP

LA

■

■

Solar Electric System

Solar Thermal System

■

■

Wind Electric System

Wind Mechanical System

Date the installation of the energy system was completed __________________ mm/dd/yyyy in a:

■

■

A.

Louisiana Residence

B.

Residential Rental Apartment Project Located in Louisiana

Contractor’s Name

Contractor’s Louisiana License Number

Available Credit for Residence- Complete this section if Box A was selected

Complete a worksheet, found on page 2, for each wind and solar energy system, using

Part A for a Louisiana residence and Part B for a residential rental apartment project

1

1

located in Louisiana. Add the amounts from lines 6 and 12 of each worksheet and print

the total.

Share of qualifying tax credit from partnerships, trusts or small business corporations

(Number of units ____________ )

2

2

Name of Entity:

Louisiana Revenue Acct No:

3 Total Credit Available to the taxpayer (Add Lines 1 and 2.)

3

LSA–R.S. 47:6030 provides for a credit against income tax for the purchase and installation of a wind energy system or solar energy

system, or both, for an individual at his residence located in this state, for the owner of a Louisiana residential rental apartment project, or

for a taxpayer who purchases and installs a system in a residence or residential rental apartment project located in Louisiana. The credit

may also be claimed in cases where the resident individual purchases a newly constructed home located in Louisiana that has such

systems already installed, or a taxpayer who purchases a newly constructed residential rental apartment project that has such systems

already installed. However only one tax credit is allowed per system.

If you received this credit through an interest in a partnership, trusts, or small business corporations, please retain copies of the Schedule

K-1 or other document that support your share of the distributed credit amount entered on line 2 above.

This credit may be used in addition to any federal credits earned for the same system, but the taxpayer is prohibited from using any other

state or federal tax benefit for property for which the credit is claimed.

Declaration

I declare that to the best of my knowledge of all available information, this refund claim is true and complete and complies with all

statutes, rules and regulations, and any other policy pronouncements related to the wind and/or solar energy income tax credit.

Signature of Taxpayer, Entity Officer or Other (for other, attach power of attorney)

Date

(mm/dd/yyyy)

X

Signature of Spouse (if joint return)

Date

(mm/dd/yyyy)

1

1

1 2

2 3

3