Instructions For Completing Consolidated Special Fuel Amended Monthly Return (Sf-900x)

ADVERTISEMENT

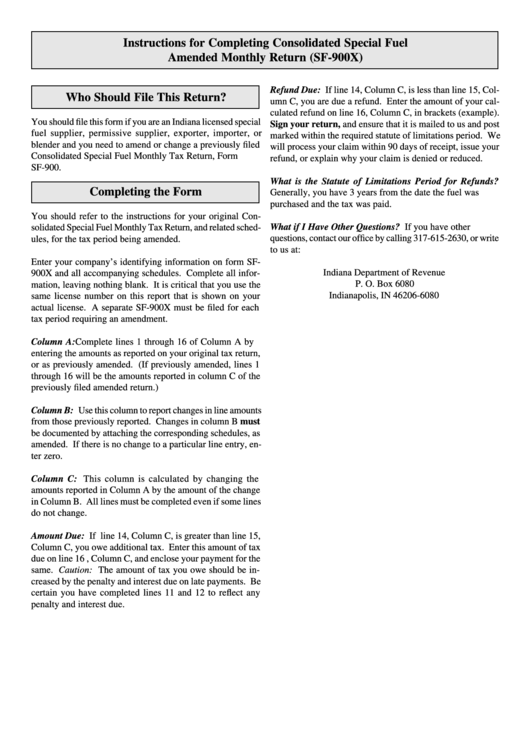

Instructions for Completing Consolidated Special Fuel

Amended Monthly Return (SF-900X)

Refund Due: If line 14, Column C, is less than line 15, Col-

Who Should File This Return?

umn C, you are due a refund. Enter the amount of your cal-

culated refund on line 16, Column C, in brackets (example).

You should file this form if you are an Indiana licensed special

Sign your return, and ensure that it is mailed to us and post

fuel supplier, permissive supplier, exporter, importer, or

marked within the required statute of limitations period. We

blender and you need to amend or change a previously filed

will process your claim within 90 days of receipt, issue your

Consolidated Special Fuel Monthly Tax Return, Form

refund, or explain why your claim is denied or reduced.

SF-900.

What is the Statute of Limitations Period for Refunds?

Completing the Form

Generally, you have 3 years from the date the fuel was

purchased and the tax was paid.

You should refer to the instructions for your original Con-

What if I Have Other Questions? If you have other

solidated Special Fuel Monthly Tax Return, and related sched-

questions, contact our office by calling 317-615-2630, or write

ules, for the tax period being amended.

to us at:

Enter your company’s identifying information on form SF-

Indiana Department of Revenue

900X and all accompanying schedules. Complete all infor-

P. O. Box 6080

mation, leaving nothing blank. It is critical that you use the

Indianapolis, IN 46206-6080

same license number on this report that is shown on your

actual license. A separate SF-900X must be filed for each

tax period requiring an amendment.

Column A: Complete lines 1 through 16 of Column A by

entering the amounts as reported on your original tax return,

or as previously amended. (If previously amended, lines 1

through 16 will be the amounts reported in column C of the

previously filed amended return.)

Column B: Use this column to report changes in line amounts

from those previously reported. Changes in column B must

be documented by attaching the corresponding schedules, as

amended. If there is no change to a particular line entry, en-

ter zero.

Column C: This column is calculated by changing the

amounts reported in Column A by the amount of the change

in Column B. All lines must be completed even if some lines

do not change.

Amount Due: If line 14, Column C, is greater than line 15,

Column C, you owe additional tax. Enter this amount of tax

due on line 16 , Column C, and enclose your payment for the

same. Caution: The amount of tax you owe should be in-

creased by the penalty and interest due on late payments. Be

certain you have completed lines 11 and 12 to reflect any

penalty and interest due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1