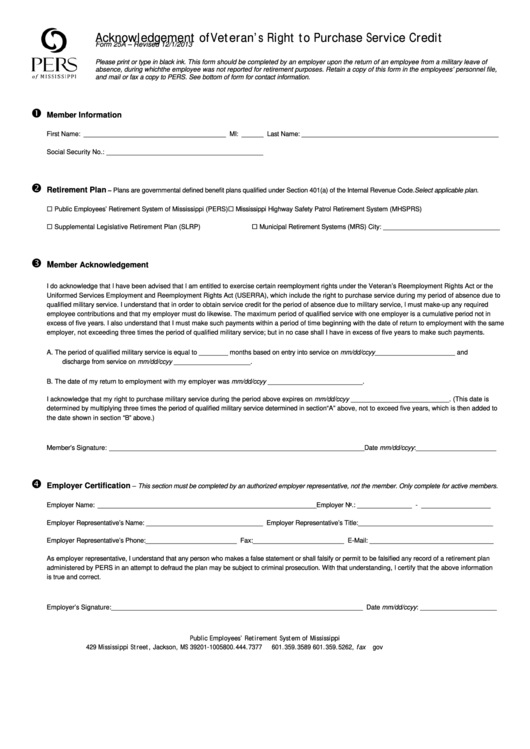

Acknowledgement of Veteran’s Right to Purchase Service Credit

Form 25A – Revised 12/1/2013

Please print or type in black ink. This form should be completed by an employer upon the return of an employee from a military leave of

absence, during which the employee was not reported for retirement purposes. Retain a copy of this form in the employees’ personnel file,

and mail or fax a copy to PERS. See bottom of form for contact information.

Member Information

First Name: _______________________________________ MI: ______ Last Name: ______________________________________________________

Social Security No.: ___________________________________________

Retirement Plan

–

Plans are governmental defined benefit plans qualified under Section 401(a) of the Internal Revenue Code. Select applicable plan.

Public Employees’ Retirement System of Mississippi (PERS)

Mississippi Highway Safety Patrol Retirement System (MHSPRS)

Supplemental Legislative Retirement Plan (SLRP)

Municipal Retirement Systems (MRS) City: ________________________________

M

ember Acknowledgement

I do acknowledge that I have been advised that I am entitled to exercise certain reemployment rights under the Veteran’s Reemployment Rights Act or the

Uniformed Services Employment and Reemployment Rights Act (USERRA), which include the right to purchase service during my period of absence due to

qualified military service. I understand that in order to obtain service credit for the period of absence due to military service, I must make-up any required

employee contributions and that my employer must do likewise. The maximum period of qualified service with one employer is a cumulative period not in

excess of five years. I also understand that I must make such payments within a period of time beginning with the date of return to employment with the same

employer, not exceeding three times the period of qualified military service; but in no case shall I have in excess of five years to make such payments.

A.

The period of qualified military service is equal to ________ months based on entry into service on mm/dd/ccyy ______________________ and

discharge from service on mm/dd/ccyy _____________________.

B.

The date of my return to employment with my employer was mm/dd/ccyy __________________________.

I acknowledge that my right to purchase military service during the period above expires on mm/dd/ccyy ___________________________. (This date is

determined by multiplying three times the period of qualified military service determined in section “A” above, not to exceed five years, which is then added to

the date shown in section “B” above.)

Member’s Signature: ______________________________________________________________________ Date mm/dd/ccyy:______________________

Employer Certification

– This section must be completed by an authorized employer representative, not the member. Only complete for active members.

Employer Name: ____________________________________________________________ Employer No.: _______________ - ___________________

Employer Representative’s Name: ________________________________ Employer Representative’s Title: _____________________________________

Employer Representative’s Phone: _________________________ Fax: _________________________ E-Mail: __________________________________

As employer representative, I understand that any person who makes a false statement or shall falsify or permit to be falsified any record of a retirement plan

administered by PERS in an attempt to defraud the plan may be subject to criminal prosecution. With that understanding, I certify that the above information

is true and correct.

Employer’s Signature: _____________________________________________________________________ Date mm/dd/ccyy: _____________________

Public Employees’ Retirement System of Mississippi

429 Mississippi Street, Jackson, MS 39201-1005

800.444.7377

601.359.3589

601.359.5262, fax

Reset Form

Print

1

1