Form PTAX-343 General Information

What is the Homestead Exemption for Persons with

you are receiving a pension for a non-service connected

Disabilities?

disability.

•

Proof of Railroad or Civil Service disability benefits which

The Homestead Exemption for Persons with Disabilities (HEPD)

(35 ILCS 200/15-168) provides an annual $2,000 reduction in the

includes an award letter or verification letter of total (100%) dis-

equalized assessed value (EAV) of the property owned and oc-

ability.

cupied as the primary residence on January 1 of the assessment

•

If you are unable to provide any of the items listed above

year by a person with a disability who is liable for the payment of

as proof of your disability, each year you must submit Form

property taxes.

PTAX 343-A, Physician’s Statement for the Homestead

Exemption for Persons with Disabilities to your Chief County

Who is eligible?

Assessment Officer (CCAO). This form must be completed

To qualify for the HEPD you must

by a physician. You may be required to provide additional

•

have a disability during the assessment year (i.e., cannot

documentation. You are responsible for any physicians’

participate in any “substantial gainful activity by reason of a

costs.

medically determinable physical or mental impairment” which

Can I estimate the amount of my exemption?

will result in the person’s death or that will last for at least 12

Yes. Multiply the $2,000 reduction in EAV by the total tax rate

continuous months),

shown on your most recent property tax bill.

•

own or have a legal or equitable interest in the property on

Example: $2,000 EAV X 7% = $140 estimated exemption

which single-family residence is occupied as your primary

residence on January 1 of the assessment year, and

When will I receive my exemption?

•

be liable for the payment of the property taxes.

The year you apply for this exemption is referred to as the as-

sessment year. The County Board of Review while in session for

If you previously received the HEPD and now reside in a facility

the assessment year has the final authority to grant your exemp-

licensed under the ID/DD (intellectually disabled/developmen-

tion. If your exemption is granted, it will be applied to the property

tally disabled) Community Care Act, Nursing Home Care Act,

tax bill that is paid the year following the assessment year.

Specialized Mental Health Rehabilitation Act of 2013,

or MC/DD

you are

(Medically Complex for the Developmentally Disabled) Act

When and where must I file this Form PTAX-343?

still eligible to receive the HEPD provided your property

Contact your CCAO at the telephone number or address below

•

is occupied by your spouse; or

for assistance and to verify your county’s due date.

•

remains unoccupied during the assessment year.

Note: To continue to receive this exemption, you must file

If you are a resident of a cooperative apartment building or life

Form PTAX-343-R, Annual Verification of Eligibility for the Homestead

care facility as defined under Section 2 of the Life Care Facilities

Exemption for Persons with Disabilities, each year with your CCAO.

Act you are still eligible to receive the HEPD provided you occupy

File or mail your completed Form PTAX-343:

the property as your primary residence and you are

_______________________________________ County, CCAO

Jennifer Gomric Minton,

St. Clair

•

liable by contract with the owner(s) of record for the payment of

the apportioned property taxes on the property; and

____________________________________________________

Disabled Persons' Department, 10 Public Square

•

an owner of record of a legal or equitable interest in the

IL

____________________________________________________

Mailing address

Belleville

62220

cooperative apartment building. Leasehold interest does not

City

ZIP

qualify for this exemption.

What documentation is required?

If you have any questions, please call:

(

)

You must provide one of the following items to qualify for the

(618) 825-2704

Can I designate another person to receive a property

HEPD. The proof of disability must be for the assessment year

tax delinquency notice for my property?

shown on Line 3 of this application.

Yes. Contact your CCAO for information on how to designate an-

•

A Class 2 Illinois Person with a Disability Identification Card

other person to receive a duplicate of a property tax delinquency

from the Illinois Secretary of State’s Office. Class 2 or Class

2A qualifies for this exemption. Class 1 or 1A does not

notice for your property.

qualify.

Are there other homestead exemptions available for

•

Proof of Social Security Administration disability benefits

a person with a disability?

which includes an award letter, verification letter or annual

Yes. However, only one of the following homestead exemptions may

Cost of Living Adjustment (COLA) letter (only COLA Form

be claimed on your property for a single assessment year

SSA-4926-SM-DI). If you are under full retirement age and

receiving Supplemental Security Income (SSI) disability ben-

• Veterans with Disabilities Exemption

efits, proof includes a letter indicating SSI payments (COLA

• Homestead Exemption for Persons with Disabilities

Forms SSA-L8151, SSA-L8155, or SSA-L8156).

• Standard Homestead Exemption for Veterans with Disabilities

•

Proof of Veterans Administration disability benefits which

includes an award letter or verification letter indicating

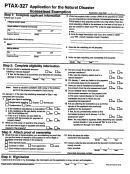

Official use. Do not write in this space.

Board of review action date: ___ ___/___ ___/___ ___ ___ ___

Date received:___ ___/___ ___/___ ___ ___ ___

Approved

Denied

Verify Proof of Disability:

1

2

3

4

5

Reason for denial ________________________________________

Expiration date:___ ___/___ ___/___ ___ ___ ___

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

PTAX-343 (R-08/15)

1

1 2

2