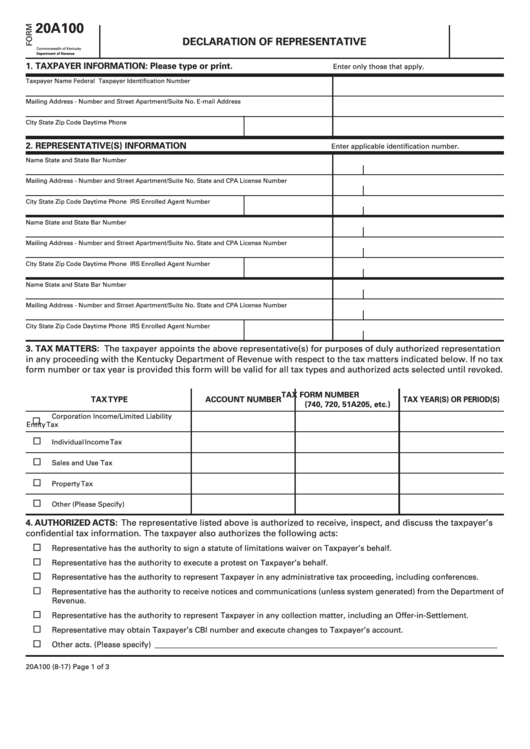

20A100

DECLARATION OF REPRESENTATIVE

Commonwealth of Kentucky

Department of Revenue

1. TAXPAYER INFORMATION: Please type or print.

Enter only those that apply.

Taxpayer Name

Federal Taxpayer Identification Number

Mailing Address - Number and Street

Apartment/Suite No.

E-mail Address

City

State

Zip Code

Daytime Phone

2. REPRESENTATIVE(S) INFORMATION

Enter applicable identification number.

Name

State and State Bar Number

Mailing Address - Number and Street

Apartment/Suite No.

State and CPA License Number

City

State

Zip Code

Daytime Phone

IRS Enrolled Agent Number

Name

State and State Bar Number

Mailing Address - Number and Street

Apartment/Suite No.

State and CPA License Number

City

State

Zip Code

Daytime Phone

IRS Enrolled Agent Number

Name

State and State Bar Number

Mailing Address - Number and Street

Apartment/Suite No.

State and CPA License Number

City

State

Zip Code

Daytime Phone

IRS Enrolled Agent Number

3. TAX MATTERS: The taxpayer appoints the above representative(s) for purposes of duly authorized representation

in any proceeding with the Kentucky Department of Revenue with respect to the tax matters indicated below. If no tax

form number or tax year is provided this form will be valid for all tax types and authorized acts selected until revoked.

TAX FORM NUMBER

TAX TYPE

ACCOUNT NUMBER

TAX YEAR(S) OR PERIOD(S)

(740, 720, 51A205, etc.)

Corporation Income/Limited Liability

¨

Entity Tax

¨

Individual Income Tax

¨

Sales and Use Tax

¨

Property Tax

¨

Other (Please Specify)

4. AUTHORIZED ACTS: The representative listed above is authorized to receive, inspect, and discuss the taxpayer’s

confidential tax information. The taxpayer also authorizes the following acts:

¨

Representative has the authority to sign a statute of limitations waiver on Taxpayer’s behalf.

¨

Representative has the authority to execute a protest on Taxpayer’s behalf.

¨

Representative has the authority to represent Taxpayer in any administrative tax proceeding, including conferences.

¨

Representative has the authority to receive notices and communications (unless system generated) from the Department of

Revenue.

¨

Representative has the authority to represent Taxpayer in any collection matter, including an Offer-in-Settlement.

¨

Representative may obtain Taxpayer’s CBI number and execute changes to Taxpayer’s account.

¨

Other acts. (Please specify) ________________________________________________________________________________________

20A100 (8-17)

Page 1 of 3

1

1 2

2 3

3