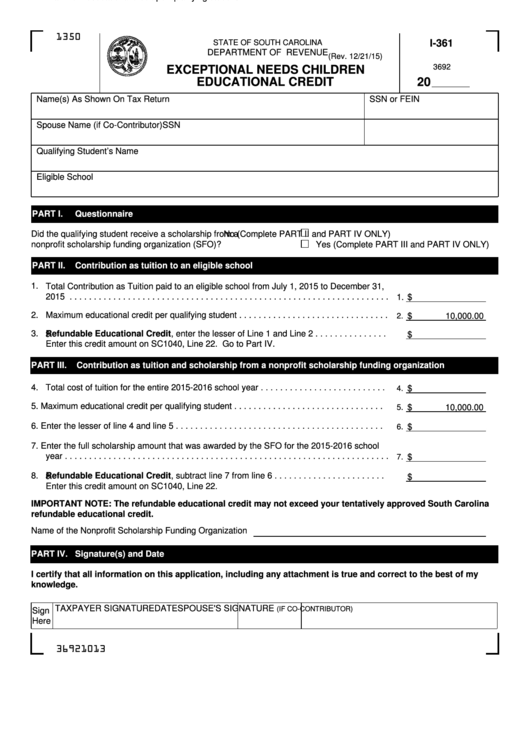

Form I-361 - Exceptional Needs Children Educational Credit

ADVERTISEMENT

2.

Maximum educational credit per qualifying student . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

…………………………………………………… . . . . . . . .

1350

STATE OF SOUTH CAROLINA

I-361

DEPARTMENT OF REVENUE

(Rev. 12/21/15)

3692

EXCEPTIONAL NEEDS CHILDREN

EDUCATIONAL CREDIT

20

Name(s) As Shown On Tax Return

SSN or FEIN

Spouse Name (if Co-Contributor)

SSN

Qualifying Student’s Name

Eligible School

PART I.

Questionnaire

Did the qualifying student receive a scholarship from a

No (Complete PART II and PART IV ONLY)

nonprofit scholarship funding organization (SFO)?

Yes (Complete PART III and PART IV ONLY)

PART II.

Contribution as tuition to an eligible school

1.

Total Contribution as Tuition paid to an eligible school from July 1, 2015 to December 31,

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

$

2.

Maximum educational credit per qualifying student . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

$

10,000.00

3.

Refundable Educational Credit, enter the lesser of Line 1 and Line 2 . . . . . . . . . . . . . . .

3.

$

Enter this credit amount on SC1040, Line 22. Go to Part IV.

PART III.

Contribution as tuition and scholarship from a nonprofit scholarship funding organization

4. Total cost of tuition for the entire 2015-2016 school year . . . . . . . . . . . . . . . . . . . . . . . . . .

$

4.

5. Maximum educational credit per qualifying student . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

$

10,000.00

6. Enter the lesser of line 4 and line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

6.

7. Enter the full scholarship amount that was awarded by the SFO for the 2015-2016 school

year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

7.

8.

Refundable Educational Credit, subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . .

8.

$

Enter this credit amount on SC1040, Line 22.

IMPORTANT NOTE: The refundable educational credit may not exceed your tentatively approved South Carolina

refundable educational credit.

Name of the Nonprofit Scholarship Funding Organization

PART IV. Signature(s) and Date

I certify that all information on this application, including any attachment is true and correct to the best of my

knowledge.

TAXPAYER SIGNATURE

DATE

SPOUSE'S SIGNATURE

(IF CO-CONTRIBUTOR)

Sign

Here

36921013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1