Instructions For Completing Form Si-Ptsupp - Secretary Of State

ADVERTISEMENT

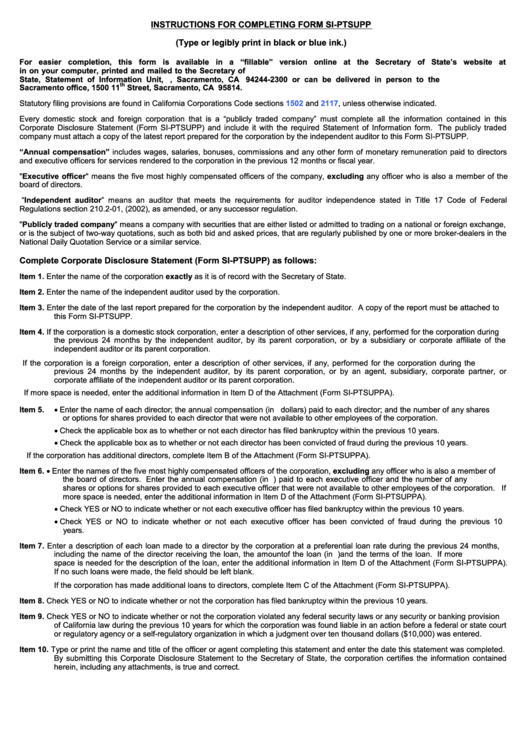

INSTRUCTIONS FOR COMPLETING FORM SI-PTSUPP

(Type or legibly print in black or blue ink.)

For easier completion, this form is available in a “fillable” version online at the Secretary of State’s website at

The form can be filled in on your computer, printed and mailed to the Secretary of

State, Statement of Information Unit, P.O. Box 944230, Sacramento, CA

94244-2300 or can be delivered in person to the

th

Sacramento office, 1500 11

Street, Sacramento, CA 95814.

Statutory filing provisions are found in California Corporations Code sections

1502

and 2117, unless otherwise indicated.

Every domestic stock and foreign corporation that is a “publicly traded company” must complete all the information contained in this

Corporate Disclosure Statement (Form SI-PTSUPP) and include it with the required Statement of Information form. The publicly traded

company must attach a copy of the latest report prepared for the corporation by the independent auditor to this Form SI-PTSUPP.

“Annual compensation” includes wages, salaries, bonuses, commissions and any other form of monetary remuneration paid to directors

and executive officers for services rendered to the corporation in the previous 12 months or fiscal year.

"Executive officer" means the five most highly compensated officers of the company, excluding any officer who is also a member of the

board of directors.

“Independent auditor” means an auditor that meets the requirements for auditor independence stated in Title 17 Code of Federal

Regulations section 210.2-01, (2002), as amended, or any successor regulation.

"Publicly traded company" means a company with securities that are either listed or admitted to trading on a national or foreign exchange,

or is the subject of two-way quotations, such as both bid and asked prices, that are regularly published by one or more broker-dealers in the

National Daily Quotation Service or a similar service.

Complete Corporate Disclosure Statement (Form SI-PTSUPP) as follows:

Item 1.

Enter the name of the corporation exactly as it is of record with the Secretary of State.

Item 2.

Enter the name of the independent auditor used by the corporation.

Item 3.

Enter the date of the last report prepared for the corporation by the independent auditor. A copy of the report must be attached to

this Form SI-PTSUPP.

Item 4.

If the corporation is a domestic stock corporation, enter a description of other services, if any, performed for the corporation during

the previous 24 months by the independent auditor, by its parent corporation, or by a subsidiary or corporate affiliate of the

independent auditor or its parent corporation.

If the corporation is a foreign corporation, enter a description of other services, if any, performed for the corporation during the

previous 24 months by the independent auditor, by its parent corporation, or by an agent, subsidiary, corporate partner, or

corporate affiliate of the independent auditor or its parent corporation.

If more space is needed, enter the additional information in Item D of the Attachment (Form SI-PTSUPPA).

• Enter the name of each director; the annual compensation (in U.S. dollars) paid to each director; and the number of any shares

Item 5.

or options for shares provided to each director that were not available to other employees of the corporation.

• Check the applicable box as to whether or not each director has filed bankruptcy within the previous 10 years.

• Check the applicable box as to whether or not each director has been convicted of fraud during the previous 10 years.

If the corporation has additional directors, complete Item B of the Attachment (Form SI-PTSUPPA).

• Enter the names of the five most highly compensated officers of the corporation, excluding any officer who is also a member of

Item 6.

the board of directors. Enter the annual compensation (in U.S. dollars) paid to each executive officer and the number of any

shares or options for shares provided to each executive officer that were not available to other employees of the corporation. If

more space is needed, enter the additional information in Item D of the Attachment (Form SI-PTSUPPA).

• Check YES or NO to indicate whether or not each executive officer has filed bankruptcy within the previous 10 years.

• Check YES or NO to indicate whether or not each executive officer has been convicted of fraud during the previous 10

years.

Item 7.

Enter a description of each loan made to a director by the corporation at a preferential loan rate during the previous 24 months,

including the name of the director receiving the loan, the amount of the loan (in U.S. dollars) and the terms of the loan. If more

space is needed for the description of the loan, enter the additional information in Item D of the Attachment (Form SI-PTSUPPA).

If no such loans were made, the field should be left blank.

If the corporation has made additional loans to directors, complete Item C of the Attachment (Form SI-PTSUPPA).

Item 8.

Check YES or NO to indicate whether or not the corporation has filed bankruptcy within the previous 10 years.

Item 9.

Check YES or NO to indicate whether or not the corporation violated any federal security laws or any security or banking provision

of California law during the previous 10 years for which the corporation was found liable in an action before a federal or state court

or regulatory agency or a self-regulatory organization in which a judgment over ten thousand dollars ($10,000) was entered.

Item 10. Type or print the name and title of the officer or agent completing this statement and enter the date this statement was completed.

By submitting this Corporate Disclosure Statement to the Secretary of State, the corporation certifies the information contained

herein, including any attachments, is true and correct.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2