Form 801 - Virginia Surplus Lines Brokers Quarterly Tax Report - 2016

ADVERTISEMENT

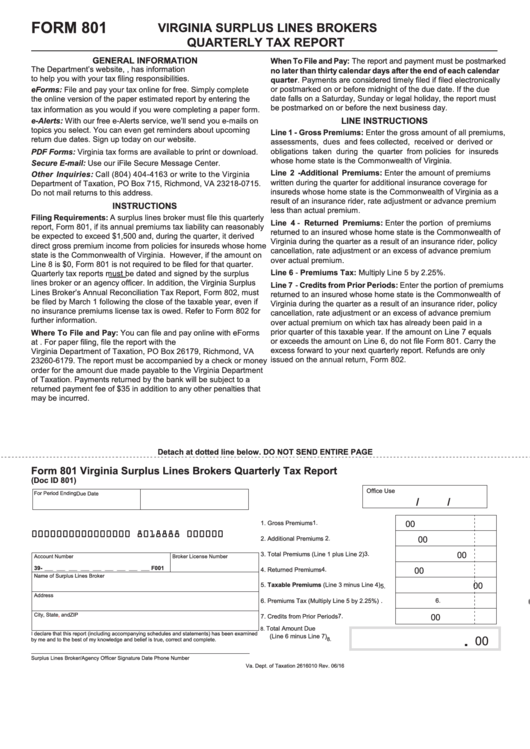

FORM 801

VIRGINIA SURPLUS LINES BROKERS

QUARTERLY TAX REPORT

GENERAL INFORMATION

When To File and Pay: The report and payment must be postmarked

The Department’s website, , has information

no later than thirty calendar days after the end of each calendar

to help you with your tax filing responsibilities.

quarter. Payments are considered timely filed if filed electronically

eForms: File and pay your tax online for free. Simply complete

or postmarked on or before midnight of the due date. If the due

date falls on a Saturday, Sunday or legal holiday, the report must

the online version of the paper estimated report by entering the

be postmarked on or before the next business day.

tax information as you would if you were completing a paper form.

e-Alerts: With our free e-Alerts service, we’ll send you e-mails on

LINE INSTRUCTIONS

topics you select. You can even get reminders about upcoming

Line 1 - Gross Premiums: Enter the gross amount of all premiums,

return due dates. Sign up today on our website.

assessments, dues and fees collected, received or derived or

obligations taken during the quarter from policies for insureds

PDF Forms: Virginia tax forms are available to print or download.

whose home state is the Commonwealth of Virginia.

Secure E-mail: Use our iFile Secure Message Center.

Line 2 - Additional Premiums: Enter the amount of premiums

Other Inquiries: Call (804) 404-4163 or write to the Virginia

written during the quarter for additional insurance coverage for

Department of Taxation, PO Box 715, Richmond, VA 23218-0715.

insureds whose home state is the Commonwealth of Virginia as a

Do not mail returns to this address.

result of an insurance rider, rate adjustment or advance premium

INSTRUCTIONS

less than actual premium.

Filing Requirements: A surplus lines broker must file this quarterly

Line 4 - Returned Premiums: Enter the portion of premiums

report, Form 801, if its annual premiums tax liability can reasonably

returned to an insured whose home state is the Commonwealth of

be expected to exceed $1,500 and, during the quarter, it derived

Virginia during the quarter as a result of an insurance rider, policy

direct gross premium income from policies for insureds whose home

cancellation, rate adjustment or an excess of advance premium

state is the Commonwealth of Virginia. However, if the amount on

over actual premium.

Line 8 is $0, Form 801 is not required to be filed for that quarter.

Line 6 - Premiums Tax: Multiply Line 5 by 2.25%.

Quarterly tax reports must be dated and signed by the surplus

lines broker or an agency officer. In addition, the Virginia Surplus

Line 7 - Credits from Prior Periods: Enter the portion of premiums

Lines Broker’s Annual Reconciliation Tax Report, Form 802, must

returned to an insured whose home state is the Commonwealth of

be filed by March 1 following the close of the taxable year, even if

Virginia during the quarter as a result of an insurance rider, policy

no insurance premiums license tax is owed. Refer to Form 802 for

cancellation, rate adjustment or an excess of advance premium

further information.

over actual premium on which tax has already been paid in a

prior quarter of this taxable year. If the amount on Line 7 equals

Where To File and Pay: You can file and pay online with eForms

or exceeds the amount on Line 6, do not file Form 801. Carry the

at . For paper filing, file the report with the

excess forward to your next quarterly report. Refunds are only

Virginia Department of Taxation, PO Box 26179, Richmond, VA

issued on the annual return, Form 802.

23260-6179. The report must be accompanied by a check or money

order for the amount due made payable to the Virginia Department

of Taxation. Payments returned by the bank will be subject to a

returned payment fee of $35 in addition to any other penalties that

may be incurred.

Detach at dotted line below. DO NOT SEND ENTIRE PAGE

Form 801

Virginia Surplus Lines Brokers Quarterly Tax Report

(Doc ID 801)

Office Use

For Period Ending

Due Date

/

/

. . . . . . . . . . . . . . . . .

00

1.

1. Gross Premiums

0000000000000000 8018888 000000

. . . . . . . . . . . . . .

00

2.

2. Additional Premiums

. . . .

00

3. Total Premiums (Line 1 plus Line 2)

3.

Account Number

Broker License Number

39- ___ ___ ___ ___ ___ ___ ___ ___ ___ F001

. . . . . . . . . . . . . .

00

4. Returned Premiums

4.

Name of Surplus Lines Broker

00

5. Taxable Premiums (Line 3 minus Line 4)

5.

Address

.

00

6. Premiums Tax (Multiply Line 5 by 2.25%)

6.

City,

State,

and ZIP

. . . . . . . . . . .

00

7. Credits from Prior Periods

7.

Total Amount Due

8.

I declare that this report (including accompanying schedules and statements) has been examined

(Line 6 minus Line 7)

00

by me and to the best of my knowledge and belief is true, correct and complete.

8.

.

Surplus Lines Broker/Agency Officer Signature

Date

Phone Number

Va. Dept. of Taxation 2616010 Rev. 06/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1