Maine Minimum Tax Worksheet Instructions Form - 1999

ADVERTISEMENT

*990910200*

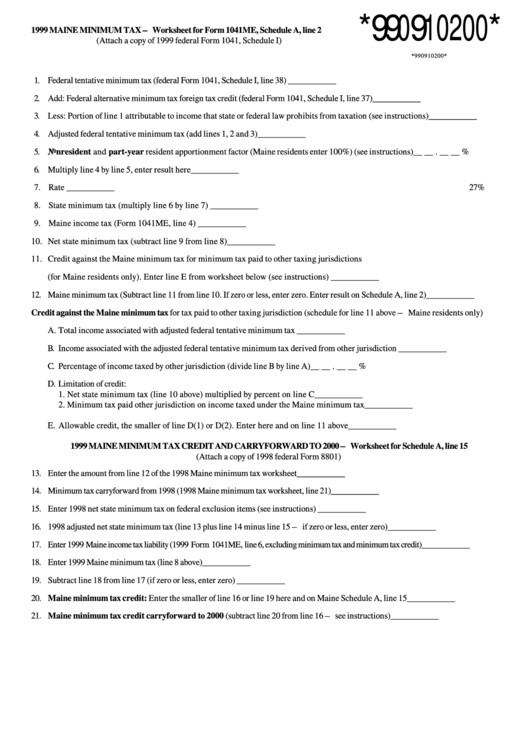

1999 MAINE MINIMUM TAX — Worksheet for Form 1041ME, Schedule A, line 2

(Attach a copy of 1999 federal Form 1041, Schedule I)

*990910200*

1. Federal tentative minimum tax (federal Form 1041, Schedule I, line 38) ....................................................................... ___________

2. Add: Federal alternative minimum tax foreign tax credit (federal Form 1041, Schedule I, line 37) ................................. ___________

3. Less: Portion of line 1 attributable to income that state or federal law prohibits from taxation (see instructions) ......... ___________

4. Adjusted federal tentative minimum tax (add lines 1, 2 and 3) ................................................................................... ___________

5. Nonresident and part-year resident apportionment factor (Maine residents enter 100%) (see instructions) ...............__ __ . __ __ %

6. Multiply line 4 by line 5, enter result here ................................................................................................................ ___________

7. Rate ....................................................................................................................................................................... ___________

27%

8. State minimum tax (multiply line 6 by line 7) ......................................................................................................... ___________

9. Maine income tax (Form 1041ME, line 4) .............................................................................................................. ___________

10. Net state minimum tax (subtract line 9 from line 8) ................................................................................................ ___________

11. Credit against the Maine minimum tax for minimum tax paid to other taxing jurisdictions

(for Maine residents only). Enter line E from worksheet below (see instructions) .................................................... ___________

12. Maine minimum tax (Subtract line 11 from line 10. If zero or less, enter zero. Enter result on Schedule A, line 2) .......... ___________

Credit against the Maine minimum tax for tax paid to other taxing jurisdiction (schedule for line 11 above — Maine residents only)

A. Total income associated with adjusted federal tentative minimum tax ................................................................... ___________

B. Income associated with the adjusted federal tentative minimum tax derived from other jurisdiction ....................... ___________

C. Percentage of income taxed by other jurisdiction (divide line B by line A) ............................................................__ __ . __ __ %

D. Limitation of credit:

1. Net state minimum tax (line 10 above) multiplied by percent on line C ................................... ___________

2. Minimum tax paid other jurisdiction on income taxed under the Maine minimum tax .............. ___________

E. Allowable credit, the smaller of line D(1) or D(2). Enter here and on line 11 above ............................................ ___________

1999 MAINE MINIMUM TAX CREDIT AND CARRYFORWARD TO 2000 — Worksheet for Schedule A, line 15

(Attach a copy of 1998 federal Form 8801)

13. Enter the amount from line 12 of the 1998 Maine minimum tax worksheet .................................................................. ___________

14. Minimum tax carryforward from 1998 (1998 Maine minimum tax worksheet, line 21) ................................................... ___________

15. Enter 1998 net state minimum tax on federal exclusion items (see instructions) .......................................................... ___________

16. 1998 adjusted net state minimum tax (line 13 plus line 14 minus line 15 — if zero or less, enter zero) ........................... ___________

17. Enter 1999 Maine income tax liability (1999 Form 1041ME, line 6, excluding minimum tax and minimum tax credit) .............. ___________

18. Enter 1999 Maine minimum tax (line 8 above) ........................................................................................................... ___________

19. Subtract line 18 from line 17 (if zero or less, enter zero) ............................................................................................. ___________

20. Maine minimum tax credit: Enter the smaller of line 16 or line 19 here and on Maine Schedule A, line 15 .................. ___________

21. Maine minimum tax credit carryforward to 2000 (subtract line 20 from line 16 — see instructions) .......................... ___________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2