Form Nc-4 Nra - Allowance Worksheet

ADVERTISEMENT

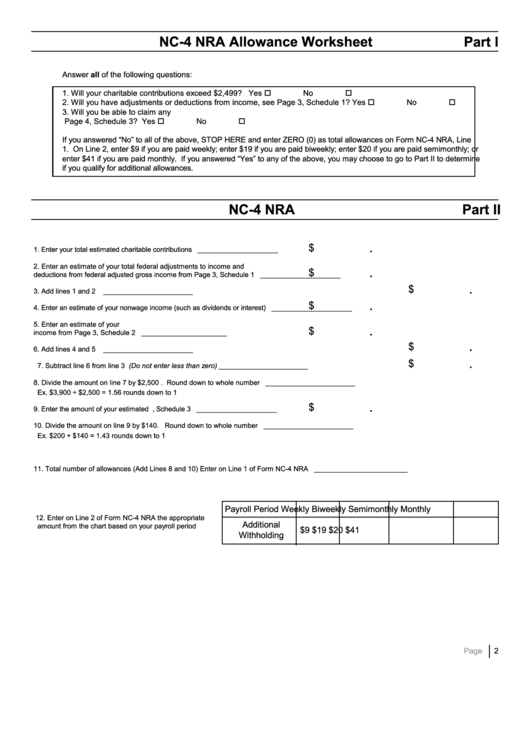

NC-4 NRA Allowance Worksheet

Part I

Answer all of the following questions:

1.

Will your charitable contributions exceed $2,499?

Yes o

No o

2.

Will you have adjustments or deductions from income, see Page 3, Schedule 1?

Yes o

No o

3.

Will you be able to claim any N.C. tax credits or tax credit carryovers from

Page 4, Schedule 3?

Yes o

No o

If you answered “No” to all of the above, STOP HERE and enter ZERO (0) as total allowances on Form NC-4 NRA, Line

1. On Line 2, enter $9 if you are paid weekly; enter $19 if you are paid biweekly; enter $20 if you are paid semimonthly; or

enter $41 if you are paid monthly. If you answered “Yes” to any of the above, you may choose to go to Part II to determine

if you qualify for additional allowances.

NC-4 NRA

Part II

$

.

1.

Enter your total estimated charitable contributions ................................................... 1. _____________________

2.

Enter an estimate of your total federal adjustments to income and N.C.

$

.

deductions from federal adjusted gross income from Page 3, Schedule 1 .............. 2. _____________________

$

.

3.

Add lines 1 and 2

................................................................................................................................................ 3. _______________________

$

.

4.

Enter an estimate of your nonwage income (such as dividends or interest) ............ 4. _____________________

5.

Enter an estimate of your N.C. additions to federal adjusted gross

$

.

income from Page 3, Schedule 2 .......................................................................... 5. ______________________

$

.

6.

Add lines 4 and 5

................................................................................................................................................ 6. _______________________

$

.

Subtract line 6 from line 3 (Do not enter less than zero) ....................................................................................... 7. _______________________

7.

8.

Divide the amount on line 7 by $2,500 . Round down to whole number ............................................................... 8. _______________________

Ex. $3,900 ÷ $2,500 = 1.56 rounds down to 1

$

.

9.

Enter the amount of your estimated N.C. tax credits from Page 4, Schedule 3 ....... 9. _____________________

10.

Divide the amount on line 9 by $140. Round down to whole number .................................................................. 10. _______________________

Ex. $200 ÷ $140 = 1.43 rounds down to 1

11.

Total number of allowances (Add Lines 8 and 10) Enter on Line 1 of Form NC-4 NRA ........................................ 11. ________________________

Payroll Period

Weekly

Biweekly

Semimonthly

Monthly

12.

Enter on Line 2 of Form NC-4 NRA the appropriate

Additional

amount from the chart based on your payroll period

$9

$19

$20

$41

Withholding

Page

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3