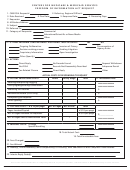

Filing Instructions For The 2015 Mlr Reporting Year - Centers For Medicare & Medicaid Services (Cms) Page 33

ADVERTISEMENT

• Any overpayment that has already been received from providers should not be reported as

a paid claim

• Prescription drug rebates, refunds, incentive payments, bonuses, discounts charge backs,

coupons, grants, direct or indirect subsidies, direct or indirect remuneration, upfront

payments, goods in kinds or similar benefits received by the issuer

• Market stabilization receipts by issuers that are directly tied to claims incurred and other

claims based or census based assessments

• Payment from unsubsidized State programs designed to address distribution of health risks

across issuers via charges to low risk issuers that are distributed to high risk issuers must

be deducted from incurred claims

Line 2.2 – Direct claim liability (MLR reporting year)

2.2a – 12/31 Column – liability as of 12/31 of MLR reporting year for all claims regardless of

incurred date.

2.2b – 3/31 Column – liability based on claims incurred only during the MLR reporting year, and

unpaid as of 3/31 of the following year.

Include:

• Unpaid claims, including claims reported in the process of adjustment, percentage

withholds from payments made to contracted providers, recoverable for anticipated

coordination of benefits (COB) and subrogation (including third party liability)

• Incurred but not reported – report claims incurred only during the MLR reporting year and

not reported by 3/31 of the following year. Except where inapplicable, the reserve

included in these lines should be based on past experience, modified to reflect current

conditions, such as changes in exposure

Line 2.3 – Direct claim liability prior year (year preceding the MLR reporting year)

12/31 Column – liability as of 12/31 of the year preceding the MLR reporting year, as reported to

the regulatory authority in the issuer’s State of domicile or as reported on the NAIC SHCE

filing for the year preceding the MLR reporting year.

Line 2.4 – Direct claim reserves (MLR reporting year)

2.4a – 12/31 Column – reserves as of 12/31 of MLR reporting year for all claims regardless of

incurred date.

2.4b – 3/31 Column – reserves based on experience incurred only in the MLR reporting year,

calculated as of 3/31 of the following year.

Report reserves related to healthcare services for present value of amounts not yet due on claims.

Line 2.5 – Direct claim reserves prior year (year preceding the MLR reporting year)

12/31 Column – reserves as of 12/31 of the year preceding the MLR reporting year, as reported to

the regulatory authority in the issuer’s State of domicile or as reported on the NAIC SHCE

filing for the year preceding the MLR reporting year.

32

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57