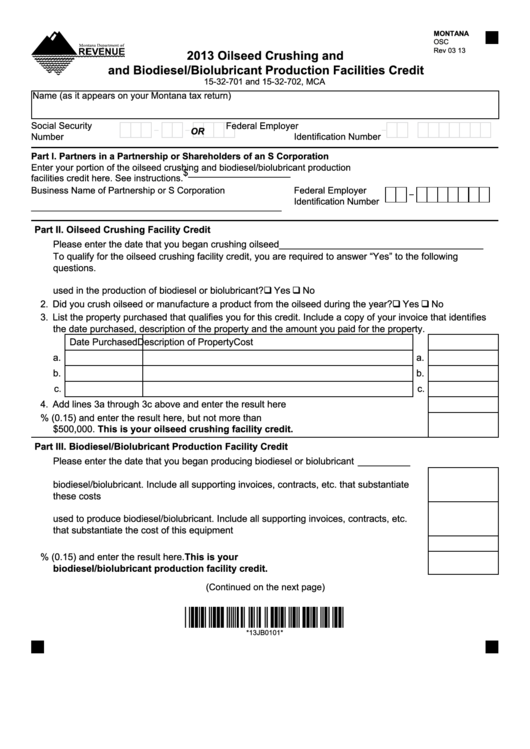

Form Osc - Oilseed Crushing And Biodiesel/biolubricant Production Facilities Credit - 2013

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

MONTANA

4

4

OSC

5

5

Rev 03 13

2013 Oilseed Crushing and

6

6

and Biodiesel/Biolubricant Production Facilities Credit

7

7

8

8

15-32-701 and 15-32-702, MCA

9

9

Name (as it appears on your Montana tax return)

10

10

100

11

11

12

12

Social Security

Federal Employer

110

120

-

-

-

X X X X X X X X X

X X X X X X X X X

13

13

OR

Number

Identification Number

14

14

15

15

Part I. Partners in a Partnership or Shareholders of an S Corporation

16

16

Enter your portion of the oilseed crushing and biodiesel/biolubricant production

150

17

17

$____________________

facilities credit here. See instructions.

18

18

Business Name of Partnership or S Corporation

Federal Employer

19

19

-

140

Identification Number

130

20

20

_________________________________________________

21

21

22

22

Part II. Oilseed Crushing Facility Credit

23

23

160

Please enter the date that you began crushing oilseed _______________________________________

24

24

25

25

To qualify for the oilseed crushing facility credit, you are required to answer “Yes” to the following

26

26

questions.

27

27

1. Is the machinery or equipment located in Montana used primarily to crush oilseed to be

28

28

170

used in the production of biodiesel or biolubricant? ........................................................ q Yes

q No

29

29

180

2. Did you crush oilseed or manufacture a product from the oilseed during the year? ....... q Yes

q No

30

30

3. List the property purchased that qualifies you for this credit. Include a copy of your invoice that identifies

31

31

32

32

the date purchased, description of the property and the amount you paid for the property.

33

33

Date Purchased

Description of Property

Cost

34

34

190

200

210

a.

a.

35

35

36

36

b.

b.

37

37

c.

c.

38

38

39

39

220

4. Add lines 3a through 3c above and enter the result here ................................................4.

40

40

5. Multiply the amount on line 4 by 15% (0.15) and enter the result here, but not more than

41

41

230

$500,000. This is your oilseed crushing facility credit...............................................5.

42

42

43

43

Part III. Biodiesel/Biolubricant Production Facility Credit

44

44

240

Please enter the date that you began producing biodiesel or biolubricant __________

45

45

46

6. Enter the total cost of constructing a facility in Montana that is used to produce

46

47

47

biodiesel/biolubricant. Include all supporting invoices, contracts, etc. that substantiate

250

48

48

these costs ......................................................................................................................6.

49

49

7. Enter the total cost of any equipment purchased to operate a facility in Montana that is

50

50

used to produce biodiesel/biolubricant. Include all supporting invoices, contracts, etc.

51

51

260

that substantiate the cost of this equipment ....................................................................7.

52

52

270

8. Add lines 6 and 7 and enter the result here ....................................................................8.

53

53

54

54

9. Multiply the amount on line 8 by 15% (0.15) and enter the result here. This is your

280

55

55

biodiesel/biolubricant production facility credit. .......................................................9.

56

56

57

(Continued on the next page)

57

58

58

59

59

*13JB0101*

60

60

61

61

*13JB0101*

62

62

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3