Form St-160 - Indiana State Gross Retail And Use Taxes

ADVERTISEMENT

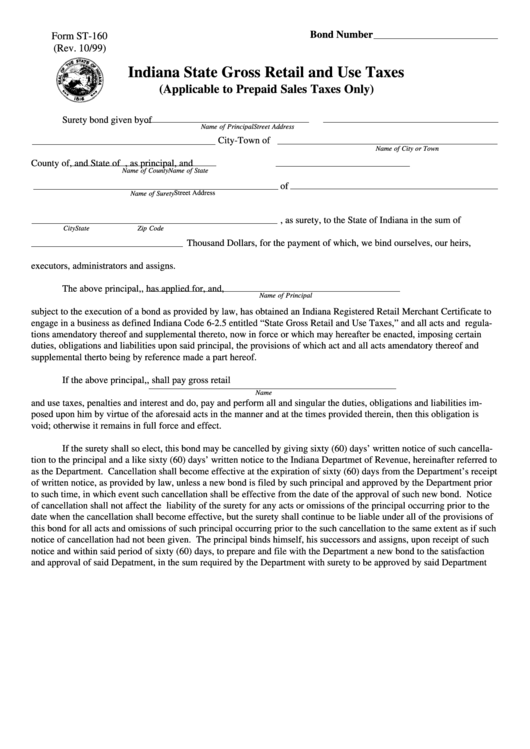

Bond Number

Form ST-160

(Rev. 10/99)

Indiana State Gross Retail and Use Taxes

(Applicable to Prepaid Sales Taxes Only)

Surety bond given by

of

Name of Principal

Street Address

City-Town of

Name of City or Town

County of

, and State of

, as principal, and

Name of County

Name of State

of

Street Address

Name of Surety

, as surety, to the State of Indiana in the sum of

City

State

Zip Code

Thousand Dollars, for the payment of which, we bind ourselves, our heirs,

executors, administrators and assigns.

The above principal,

, has applied for, and,

Name of Principal

subject to the execution of a bond as provided by law, has obtained an Indiana Registered Retail Merchant Certificate to

engage in a business as defined Indiana Code 6-2.5 entitled “State Gross Retail and Use Taxes,” and all acts and regula-

tions amendatory thereof and supplemental thereto, now in force or which may hereafter be enacted, imposing certain

duties, obligations and liabilities upon said principal, the provisions of which act and all acts amendatory thereof and

supplemental therto being by reference made a part hereof.

If the above principal,

, shall pay gross retail

Name

and use taxes, penalties and interest and do, pay and perform all and singular the duties, obligations and liabilities im-

posed upon him by virtue of the aforesaid acts in the manner and at the times provided therein, then this obligation is

void; otherwise it remains in full force and effect.

If the surety shall so elect, this bond may be cancelled by giving sixty (60) days’ written notice of such cancella-

tion to the principal and a like sixty (60) days’ written notice to the Indiana Departmet of Revenue, hereinafter referred to

as the Department. Cancellation shall become effective at the expiration of sixty (60) days from the Department’s receipt

of written notice, as provided by law, unless a new bond is filed by such principal and approved by the Department prior

to such time, in which event such cancellation shall be effective from the date of the approval of such new bond. Notice

of cancellation shall not affect the liability of the surety for any acts or omissions of the principal occurring prior to the

date when the cancellation shall become effective, but the surety shall continue to be liable under all of the provisions of

this bond for all acts and omissions of such principal occurring prior to the such cancellation to the same extent as if such

notice of cancellation had not been given. The principal binds himself, his successors and assigns, upon receipt of such

notice and within said period of sixty (60) days, to prepare and file with the Department a new bond to the satisfaction

and approval of said Depatment, in the sum required by the Department with surety to be approved by said Department

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2