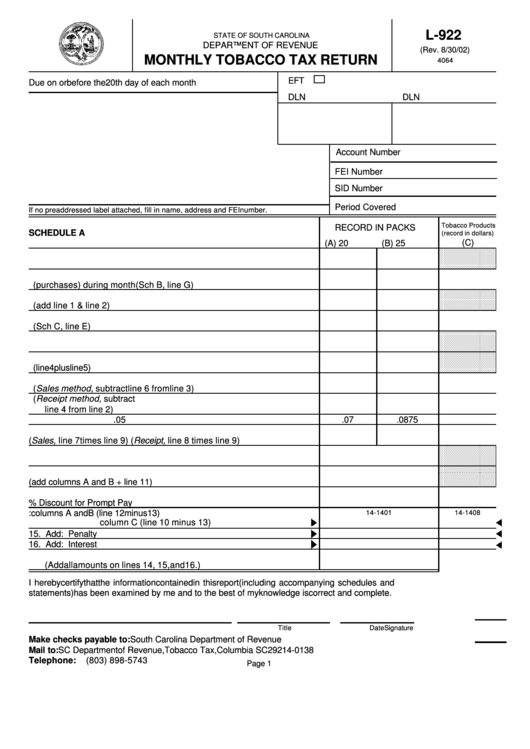

Form L-922 - Monthly Tobacco Tax Return

ADVERTISEMENT

L-922

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

(Rev. 8/30/02)

MONTHLY TOBACCO TAX RETURN

4064

EFT

Due on or before the 20th day of each month

DLN

DLN

Account Number

FEI Number

SID Number

Period Covered

If no preaddressed label attached, fill in name, address and FEI number.

Tobacco Products

RECORD IN PACKS

SCHEDULE A

(record in dollars)

(C)

(A) 20

(B) 25

1. Beginning inventory

2. Total receipts (purchases) during month (Sch B, line G)

3. Total available for distribution (add line 1 & line 2)

4. Total South Carolina tax exempt (Sch C, line E)

5. Ending inventory

6. Total tax exempt plus ending inventory (line 4 plus line 5)

7. Taxable distributions (Sales method, subtract line 6 from line 3)

8. Net total receipts from manufacturer (Receipt method, subtract

line 4 from line 2)

9. Imposition rate

.07

.0875

.05

10. Taxable (Sales, line 7 times line 9) (Receipt, line 8 times line 9)

11. Other than packs of 20 or 25 taxed at .0035 per cigarette

12. Total tax due (add columns A and B + line 11)

13. Less 3.5% Discount for Prompt Pay

14. Total tax due: columns A and B (line 12 minus 13)

14-1401

14-1408

column C (line 10 minus 13)

15. Add: Penalty

16. Add: Interest

17. AMOUNT DUE WITH THIS REPORT

(Add all amounts on lines 14, 15, and 16.)

I hereby certify that the information contained in this report (including accompanying schedules and

statements) has been examined by me and to the best of my knowledge is correct and complete.

Signature

Title

Date

Make checks payable to: South Carolina Department of Revenue

Mail to: SC Department of Revenue, Tobacco Tax, Columbia SC 29214-0138

Telephone:

(803) 898-5743

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3