Form It-540b - Louisiana Nonresident And Part-Year Resident - 1999

ADVERTISEMENT

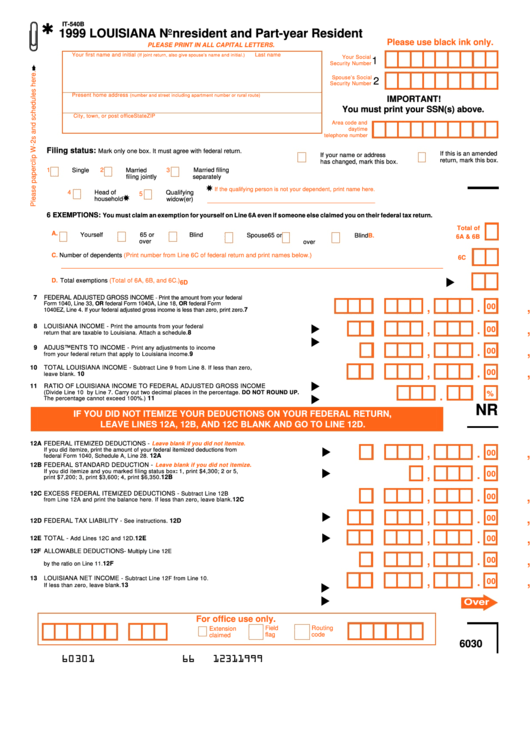

IT-540B

1999 LOUISIANA Nonresident and Part-year Resident

Please use black ink only.

PLEASE PRINT IN ALL CAPITAL LETTERS.

Your first name and initial

Last name

(If joint return, also give spouse’s name and initial.)

Your Social

1

Security Number

Spouse’s Social

2

Security Number

Present home address

(number and street including apartment number or rural route)

IMPORTANT!

You must print your SSN(s) above.

City, town, or post office

State

ZIP

Area code and

daytime

telephone number

Filing status:

Mark only one box. It must agree with federal return.

If this is an amended

If your name or address

return, mark this box.

has changed, mark this box.

1

2

Married

3

Married filing

Single

filing jointly

separately

If the qualifying person is not your dependent, print name here.

4

Head of

Qualifying

5

household

widow(er)

_____________________________________________________

6 EXEMPTIONS:

You must claim an exemption for yourself on Line 6A even if someone else claimed you on their federal tax return.

Total of

A.

Yourself

65 or

Blind

B.

Spouse

65 or

Blind

6A & 6B

over

over

C.

Number of dependents

(Print number from Line 6C of federal return and print names below.) .........................................................................

6C

________________________________________________________________________________________________________________

D.

Total exemptions

(Total of 6A, 6B, and 6C.) ..................................................................................................................................................

6D

07

FEDERAL ADJUSTED GROSS INCOME

Print the amount from your federal

-

,

,

.

Form 1040, Line 33, OR federal Form 1040A, Line 18, OR federal Form

00

1040EZ, Line 4. If your federal adjusted gross income is less than zero, print zero.

.............................. 7

,

,

.

08

LOUISIANA INCOME -

Print the amounts from your federal

00

return that are taxable to Louisiana. Attach a schedule. ....................................................................

8

,

,

.

09

ADJUSTMENTS TO INCOME -

Print any adjustments to income

00

from your federal return that apply to Louisiana income.

............................................................... 9

10

TOTAL LOUISIANA INCOME -

Subtract Line 9 from Line 8. If less than zero,

,

,

.

00

................................................................................................................................. 10

leave blank.

11

RATIO OF LOUISIANA INCOME TO FEDERAL ADJUSTED GROSS INCOME

.

(Divide Line 10 by Line 7. Carry out two decimal places in the percentage. DO NOT ROUND UP.

%

The percentage cannot exceed 100%.)

..................................................................................................................................... 11

NR

IF YOU DID NOT ITEMIZE YOUR DEDUCTIONS ON YOUR FEDERAL RETURN,

LEAVE LINES 12A, 12B, AND 12C BLANK AND GO TO LINE 12D.

12A FEDERAL ITEMIZED DEDUCTIONS -

Leave blank if you did not itemize.

,

,

.

If you did itemize, print the amount of your federal itemized deductions from

00

federal Form 1040, Schedule A, Line 28.

........................................................................................ 12A

12B FEDERAL STANDARD DEDUCTION -

Leave blank if you did not itemize.

,

.

If you did itemize and you marked filing status box: 1, print $4,300; 2 or 5,

00

print $7,200; 3, print $3,600; 4, print $6,350.

................................................................................. 12B

,

,

.

12C EXCESS FEDERAL ITEMIZED DEDUCTIONS -

Subtract Line 12B

00

..................................... 12C

from Line 12A and print the balance here. If less than zero, leave blank.

,

,

.

00

12D FEDERAL TAX LIABILITY -

............................................................................ 12D

See instructions.

,

,

.

00

12E TOTAL -

................................................................................................ 12E

Add Lines 12C and 12D.

12F ALLOWABLE DEDUCTIONS -

Multiply Line 12E

,

,

.

00

by the ratio on Line 11.

................................................................................................................... 12F

,

,

.

13

LOUISIANA NET INCOME -

Subtract Line 12F from Line 10.

00

If less than zero, leave blank.

........................................................................................................... 13

Over

For office use only.

Field

Routing

Extension

flag

code

claimed

6030

6 03 01

6 6

1 2 3 1 1 9 9 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3