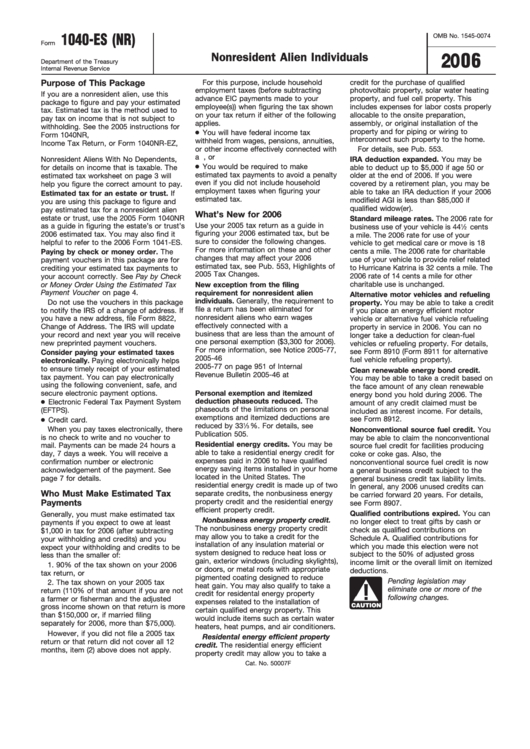

1040-ES (NR)

OMB No. 1545-0074

Form

U.S. Estimated Tax for

Nonresident Alien Individuals

2006

Department of the Treasury

Internal Revenue Service

Purpose of This Package

For this purpose, include household

credit for the purchase of qualified

employment taxes (before subtracting

photovoltaic property, solar water heating

If you are a nonresident alien, use this

advance EIC payments made to your

property, and fuel cell property. This

package to figure and pay your estimated

employee(s)) when figuring the tax shown

includes expenses for labor costs properly

tax. Estimated tax is the method used to

on your tax return if either of the following

allocable to the onsite preparation,

pay tax on income that is not subject to

applies.

assembly, or original installation of the

withholding. See the 2005 instructions for

● You will have federal income tax

property and for piping or wiring to

Form 1040NR, U.S. Nonresident Alien

interconnect such property to the home.

withheld from wages, pensions, annuities,

Income Tax Return, or Form 1040NR-EZ,

or other income effectively connected with

For details, see Pub. 553.

U.S. Income Tax Return for Certain

a U.S. trade or business, or

Nonresident Aliens With No Dependents,

IRA deduction expanded. You may be

● You would be required to make

able to deduct up to $5,000 if age 50 or

for details on income that is taxable. The

estimated tax payments to avoid a penalty

estimated tax worksheet on page 3 will

older at the end of 2006. If you were

even if you did not include household

help you figure the correct amount to pay.

covered by a retirement plan, you may be

employment taxes when figuring your

able to take an IRA deduction if your 2006

Estimated tax for an estate or trust. If

estimated tax.

modifield AGI is less than $85,000 if

you are using this package to figure and

qualified widow(er).

pay estimated tax for a nonresident alien

What’s New for 2006

estate or trust, use the 2005 Form 1040NR

Standard mileage rates. The 2006 rate for

Use your 2005 tax return as a guide in

as a guide in figuring the estate’s or trust’s

business use of your vehicle is 44

1

⁄

cents

2

figuring your 2006 estimated tax, but be

2006 estimated tax. You may also find it

a mile. The 2006 rate for use of your

sure to consider the following changes.

helpful to refer to the 2006 Form 1041-ES.

vehicle to get medical care or move is 18

For more information on these and other

cents a mile. The 2006 rate for charitable

Paying by check or money order. The

changes that may affect your 2006

use of your vehicle to provide relief related

payment vouchers in this package are for

estimated tax, see Pub. 553, Highlights of

to Hurricane Katrina is 32 cents a mile. The

crediting your estimated tax payments to

2005 Tax Changes.

2006 rate of 14 cents a mile for other

your account correctly. See Pay by Check

charitable use is unchanged.

or Money Order Using the Estimated Tax

New exception from the filing

Payment Voucher on page 4.

requirement for nonresident alien

Alternative motor vehicles and refueling

individuals. Generally, the requirement to

Do not use the vouchers in this package

property. You may be able to take a credit

file a return has been eliminated for

to notify the IRS of a change of address. If

if you place an energy efficient motor

nonresident aliens who earn wages

you have a new address, file Form 8822,

vehicle or alternative fuel vehicle refueling

effectively connected with a U.S. trade or

Change of Address. The IRS will update

property in service in 2006. You can no

business that are less than the amount of

your record and next year you will receive

longer take a deduction for clean-fuel

one personal exemption ($3,300 for 2006).

new preprinted payment vouchers.

vehicles or refueling property. For details,

For more information, see Notice 2005-77,

see Form 8910 (Form 8911 for alternative

Consider paying your estimated taxes

2005-46 I.R.B. 951. You can find Notice

fuel vehicle refueling property).

electronically. Paying electronically helps

2005-77 on page 951 of Internal

to ensure timely receipt of your estimated

Clean renewable energy bond credit.

Revenue Bulletin 2005-46 at

tax payment. You can pay electronically

You may be able to take a credit based on

using the following convenient, safe, and

the face amount of any clean renewable

Personal exemption and itemized

secure electronic payment options.

energy bond you hold during 2006. The

● Electronic Federal Tax Payment System

deduction phaseouts reduced. The

amount of any credit claimed must be

phaseouts of the limitations on personal

(EFTPS).

included as interest income. For details,

exemptions and itemized deductions are

● Credit card.

see Form 8912.

reduced by 33

1

⁄

%. For details, see

3

When you pay taxes electronically, there

Nonconventional source fuel credit. You

Publication 505.

is no check to write and no voucher to

may be able to claim the nonconventional

Residential energy credits. You may be

mail. Payments can be made 24 hours a

source fuel credit for facilities producing

able to take a residential energy credit for

day, 7 days a week. You will receive a

coke or coke gas. Also, the

expenses paid in 2006 to have qualified

confirmation number or electronic

nonconventional source fuel credit is now

energy saving items installed in your home

acknowledgement of the payment. See

a general business credit subject to the

located in the United States. The

page 7 for details.

general business credit tax liability limits.

residential energy credit is made up of two

In general, any 2006 unused credits can

Who Must Make Estimated Tax

separate credits, the nonbusiness energy

be carried forward 20 years. For details,

property credit and the residential energy

Payments

see Form 8907.

efficient property credit.

Qualified contributions expired. You can

Generally, you must make estimated tax

Nonbusiness energy property credit.

no longer elect to treat gifts by cash or

payments if you expect to owe at least

The nonbusiness energy property credit

check as qualified contributions on

$1,000 in tax for 2006 (after subtracting

may allow you to take a credit for the

Schedule A. Qualified contributions for

your withholding and credits) and you

installation of any insulation material or

which you made this election were not

expect your withholding and credits to be

system designed to reduce heat loss or

subject to the 50% of adjusted gross

less than the smaller of:

gain, exterior windows (including skylights),

income limit or the overall limit on itemized

1. 90% of the tax shown on your 2006

or doors, or metal roofs with appropriate

deductions.

tax return, or

pigmented coating designed to reduce

Pending legislation may

2. The tax shown on your 2005 tax

heat gain. You may also qualify to take a

eliminate one or more of the

return (110% of that amount if you are not

credit for residental energy property

following changes.

a farmer or fisherman and the adjusted

expenses related to the installation of

CAUTION

gross income shown on that return is more

certain qualified energy property. This

than $150,000 or, if married filing

would include items such as certain water

separately for 2006, more than $75,000).

heaters, heat pumps, and air conditioners.

However, if you did not file a 2005 tax

Residental energy efficient property

return or that return did not cover all 12

credit. The residential energy efficient

months, item (2) above does not apply.

property credit may allow you to take a

Cat. No. 50007F

1

1 2

2 3

3 4

4 5

5 6

6