Form Ifta-101 - Ifta Quarterly Fuel Use Tax Schedule

ADVERTISEMENT

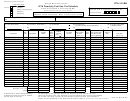

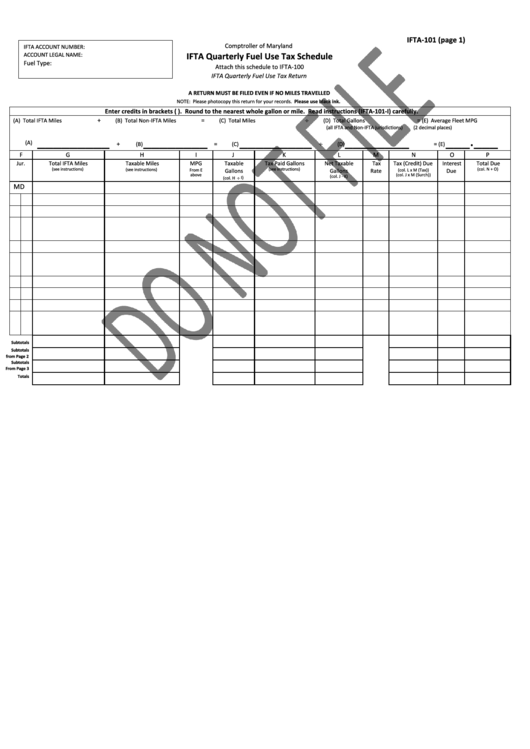

IFTA-101 (page 1)

Comptroller of Maryland

IFTA ACCOUNT NUMBER:

IFTA Quarterly Fuel Use Tax Schedule

ACCOUNT LEGAL NAME:

Fuel Type:

Attach this schedule to IFTA-100

IFTA Quarterly Fuel Use Tax Return

A RETURN MUST BE FILED EVEN IF NO MILES TRAVELLED

NOTE: Please photocopy this return for your records. Please use black ink.

Enter credits in brackets ( ). Round to the nearest whole gallon or mile. Read instructions (IFTA-101-I) carefully.

+

=

÷

=

(A) Total IFTA Miles

(B) Total Non-IFTA Miles

(C) Total Miles

(D) Total Gallons

(E) Average Fleet MPG

(all IFTA and Non-IFTA jurisdictions)

(2 decimal places)

_________

________

_________

________

___.___

+

=

÷

=

(A)

(B)

(C)

(D)

(E)

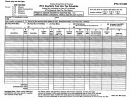

F

G

H

I

J

K

L

M

N

O

P

Jur.

Total IFTA Miles

Taxable Miles

MPG

Taxable

Tax Paid Gallons

Net Taxable

Tax

Tax (Credit) Due

Interest

Total Due

(see instructions)

(see instructions)

From E

Gallons

(see instructions)

Gallons

Rate

(col. L x M (Tax))

Due

(col. N + O)

above

(col. J x M (Surch))

÷

(col. J - K)

(col. H

I)

MD

Subtotals

Subtotals

from Page 2

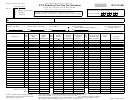

Subtotals

From Page 3

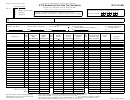

Totals

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4