Form Sa-44s - Annual Retail Trade Report 2002 - U.s. Census Bureau

ADVERTISEMENT

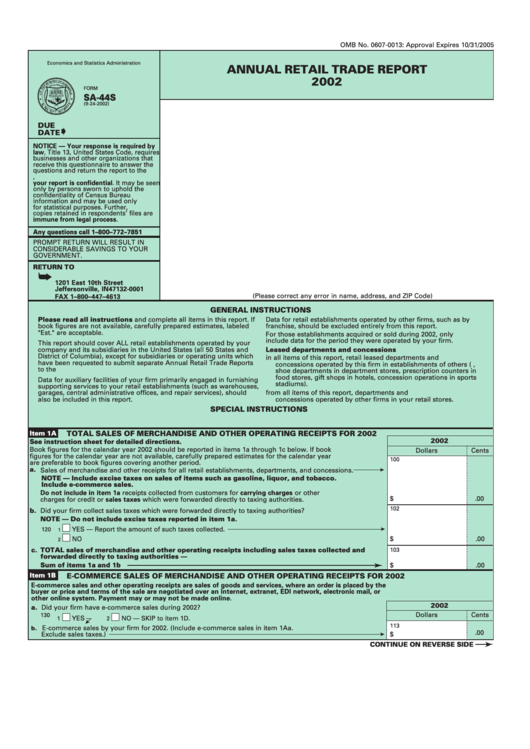

OMB No. 0607-0013: Approval Expires 10/31/2005

U.S. DEPARTMENT OF COMMERCE

Economics and Statistics Administration

ANNUAL RETAIL TRADE REPORT

U.S. CENSUS BUREAU

2002

FORM

SA-44S

(9-24-2002)

DUE

DATE

NOTICE — Your response is required by

law. Title 13, United States Code, requires

businesses and other organizations that

receive this questionnaire to answer the

questions and return the report to the

U.S. Census Bureau. By the same law,

your report is confidential. It may be seen

only by persons sworn to uphold the

confidentiality of Census Bureau

information and may be used only

for statistical purposes. Further,

copies retained in respondents’ files are

immune from legal process.

Any questions call 1–800–772–7851

PROMPT RETURN WILL RESULT IN

CONSIDERABLE SAVINGS TO YOUR

GOVERNMENT.

RETURN TO

U.S. CENSUS BUREAU

1201 East 10th Street

Jeffersonville, IN 47132-0001

(Please correct any error in name, address, and ZIP Code)

FAX 1–800–447–4613

GENERAL INSTRUCTIONS

Please read all instructions and complete all items in this report. If

Data for retail establishments operated by other firms, such as by

book figures are not available, carefully prepared estimates, labeled

franchise, should be excluded entirely from this report.

"Est." are acceptable.

For those establishments acquired or sold during 2002, only

include data for the period they were operated by your firm.

This report should cover ALL retail establishments operated by your

company and its subsidiaries in the United States (all 50 States and

Leased departments and concessions

District of Columbia), except for subsidiaries or operating units which

1. Include in all items of this report, retail leased departments and

have been requested to submit separate Annual Retail Trade Reports

concessions operated by this firm in establishments of others (e.g.,

to the U.S. Census Bureau.

shoe departments in department stores, prescription counters in

food stores, gift shops in hotels, concession operations in sports

Data for auxiliary facilities of your firm primarily engaged in furnishing

stadiums).

supporting services to your retail establishments (such as warehouses,

garages, central administrative offices, and repair services), should

2. Exclude from all items of this report, departments and

also be included in this report.

concessions operated by other firms in your retail stores.

SPECIAL INSTRUCTIONS

Item 1A

TOTAL SALES OF MERCHANDISE AND OTHER OPERATING RECEIPTS FOR 2002

2002

See instruction sheet for detailed directions.

Book figures for the calendar year 2002 should be reported in items 1a through 1c below. If book

Dollars

Cents

figures for the calendar year are not available, carefully prepared estimates for the calendar year

100

are preferable to book figures covering another period.

a.

Sales of merchandise and other receipts for all retail establishments, departments, and concessions.

NOTE — Include excise taxes on sales of items such as gasoline, liquor, and tobacco.

Include e-commerce sales.

Do not include in item 1a receipts collected from customers for carrying charges or other

$

.00

charges for credit or sales taxes which were forwarded directly to taxing authorities.

102

b.

Did your firm collect sales taxes which were forwarded directly to taxing authorities?

NOTE — Do not include excise taxes reported in item 1a.

YES — Report the amount of such taxes collected.

120

1

NO

$

.00

2

c.

TOTAL sales of merchandise and other operating receipts including sales taxes collected and

103

forwarded directly to taxing authorities —

Sum of items 1a and 1b

$

.00

Item 1B

E-COMMERCE SALES OF MERCHANDISE AND OTHER OPERATING RECEIPTS FOR 2002

E-commerce sales and other operating receipts are sales of goods and services, where an order is placed by the

buyer or price and terms of the sale are negotiated over an Internet, extranet, EDI network, electronic mail, or

other online system. Payment may or may not be made online.

2002

a.

Did your firm have e-commerce sales during 2002?

Dollars

Cents

130

YES

NO — SKIP to item 1D.

1

2

113

E-commerce sales by your firm for 2002. (Include e-commerce sales in item 1Aa.

b.

.00

Exclude sales taxes.)

$

CONTINUE ON REVERSE SIDE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4