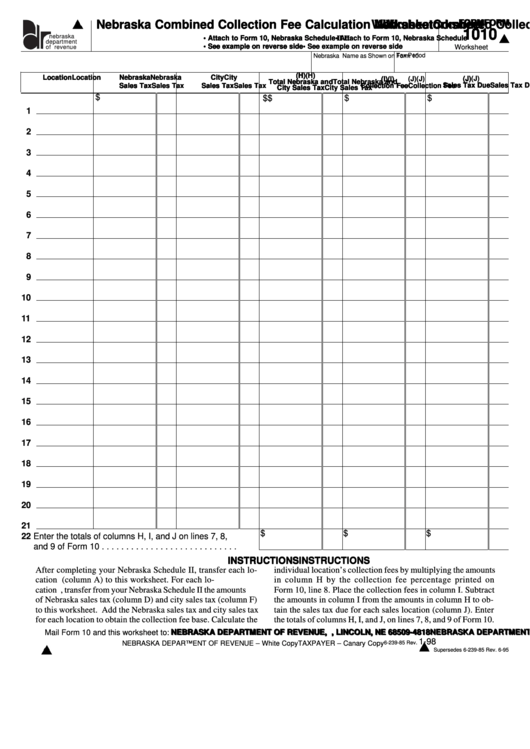

Nebraska Combined Collection Fee Calculation

Nebraska Combined Collection Fee Calculation W W W W W orksheet

Nebraska Combined Collection Fee Calculation

orksheet

orksheet

FORM

FORM

FORM

FORM

FORM

Nebraska Combined Collection Fee Calculation

Nebraska Combined Collection Fee Calculation

orksheet

orksheet

10

10

10

10

10

nebraska

• Attach to Form 10, Nebraska Schedule

• Attach to Form 10, Nebraska Schedule

• Attach to Form 10, Nebraska Schedule

• Attach to Form 10, Nebraska Schedule

• Attach to Form 10, Nebraska Schedule II II II II II

department

• See example on reverse side

• See example on reverse side

• See example on reverse side

• See example on reverse side

• See example on reverse side

Worksheet

of revenue

Tax Period

Name as Shown on Form 10

Nebraska I.D. Number

(H)

(H)

(H)

(H)

(H)

Location

Location

Nebraska

Nebraska

Nebraska

Nebraska

Nebraska

City

City

City

City

City

Location

Location

Location

(I) (I) (I) (I) (I)

(J)

(J)

(J)

(J)

(J)

Total Nebraska and

Total Nebraska and

Total Nebraska and

Total Nebraska and

Total Nebraska and

Sales Tax Due

Sales Tax Due

Sales Tax Due

Sales Tax Due

Sales Tax Due

I.D. Number

I.D. Number

I.D. Number

Sales Tax

Sales Tax

Sales Tax

Sales Tax

Sales Tax

Sales Tax

Sales Tax

Sales Tax

Sales Tax

Sales Tax

Collection Fee

Collection Fee

Collection Fee

Collection Fee

Collection Fee

I.D. Number

I.D. Number

City Sales Tax

City Sales Tax

City Sales Tax

City Sales Tax

City Sales Tax

$

$

$

$

$

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

$

$

$

22 Enter the totals of columns H, I, and J on lines 7, 8,

and 9 of Form 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

INSTRUCTIONS

INSTRUCTIONS

INSTRUCTIONS

INSTRUCTIONS

INSTRUCTIONS

After completing your Nebraska Schedule II, transfer each lo-

individual location’s collection fees by multiplying the amounts

cation I.D. number (column A) to this worksheet. For each lo-

in column H by the collection fee percentage printed on

cation I.D., transfer from your Nebraska Schedule II the amounts

Form 10, line 8. Place the collection fees in column I. Subtract

of Nebraska sales tax (column D) and city sales tax (column F)

the amounts in column I from the amounts in column H to ob-

to this worksheet. Add the Nebraska sales tax and city sales tax

tain the sales tax due for each sales location (column J). Enter

for each location to obtain the collection fee base. Calculate the

the totals of columns H, I, and J, on lines 7, 8, and 9 of Form 10.

NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

Mail Form 10 and this worksheet to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

1-98

NEBRASKA DEPARTMENT OF REVENUE – White Copy

TAXPAYER – Canary Copy

6-239-85 Rev.

Supersedes 6-239-85 Rev. 6-95

1

1