Instructions For Schedule 42 - Supplemental Schedule For Multistate/multinational Business - Idaho State Tax Commission

ADVERTISEMENT

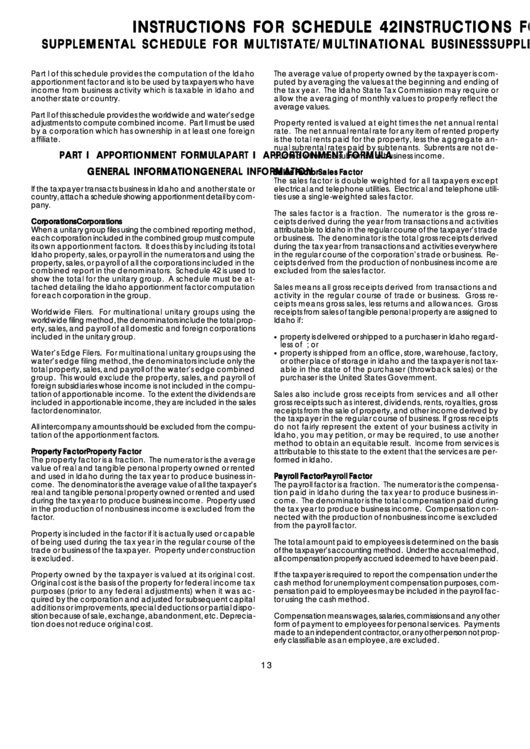

INSTRUCTIONS FOR SCHEDULE 42

INSTRUCTIONS FOR SCHEDULE 42

INSTRUCTIONS FOR SCHEDULE 42

INSTRUCTIONS FOR SCHEDULE 42

INSTRUCTIONS FOR SCHEDULE 42

SUPPLEMENTAL SCHEDULE FOR MULTISTATE/MULTINATIONAL BUSINESS

SUPPLEMENTAL SCHEDULE FOR MULTISTATE/MULTINATIONAL BUSINESS

SUPPLEMENTAL SCHEDULE FOR MULTISTATE/MULTINATIONAL BUSINESS

SUPPLEMENTAL SCHEDULE FOR MULTISTATE/MULTINATIONAL BUSINESS

SUPPLEMENTAL SCHEDULE FOR MULTISTATE/MULTINATIONAL BUSINESS

Part I of this schedule provides the computation of the Idaho

The average value of property owned by the taxpayer is com-

apportionment factor and is to be used by taxpayers who have

puted by averaging the values at the beginning and ending of

income from business activity which is taxable in Idaho and

the tax year. The Idaho State Tax Commission may require or

another state or country.

allow the averaging of monthly values to properly reflect the

average values.

Part II of this schedule provides the worldwide and water’s edge

adjustments to compute combined income. Part II must be used

Property rented is valued at eight times the net annual rental

by a corporation which has ownership in at least one foreign

rate. The net annual rental rate for any item of rented property

affiliate.

is the total rents paid for the property, less the aggregate an-

nual subrental rates paid by subtenants. Subrents are not de-

PART I APPORTIONMENT FORMULA

PART I APPORTIONMENT FORMULA

PART I APPORTIONMENT FORMULA

PART I APPORTIONMENT FORMULA

PART I APPORTIONMENT FORMULA

ducted when the subrents are business income.

GENERAL INFORMATION

GENERAL INFORMATION

GENERAL INFORMATION

GENERAL INFORMATION

GENERAL INFORMATION

Sales Factor

Sales Factor

Sales Factor

Sales Factor

Sales Factor

The sales factor is double weighted for all taxpayers except

If the taxpayer transacts business in Idaho and another state or

electrical and telephone utilities. Electrical and telephone utili-

country, attach a schedule showing apportionment detail by com-

ties use a single-weighted sales factor.

pany.

The sales factor is a fraction. The numerator is the gross re-

Corporations

Corporations

Corporations

Corporations

Corporations

ceipts derived during the year from transactions and activities

When a unitary group files using the combined reporting method,

attributable to Idaho in the regular course of the taxpayer’s trade

each corporation included in the combined group must compute

or business. The denominator is the total gross receipts derived

its own apportionment factors. It does this by including its total

during the tax year from transactions and activities everywhere

Idaho property, sales, or payroll in the numerators and using the

in the regular course of the corporation’s trade or business. Re-

property, sales, or payroll of all the corporations included in the

ceipts derived from the production of nonbusiness income are

combined report in the denominators. Schedule 42 is used to

excluded from the sales factor.

show the total for the unitary group. A schedule must be at-

tached detailing the Idaho apportionment factor computation

Sales means all gross receipts derived from transactions and

for each corporation in the group.

activity in the regular course of trade or business. Gross re-

ceipts means gross sales, less returns and allowances. Gross

Worldwide Filers. For multinational unitary groups using the

receipts from sales of tangible personal property are assigned to

worldwide filing method, the denominators include the total prop-

Idaho if:

erty, sales, and payroll of all domestic and foreign corporations

included in the unitary group.

•

property is delivered or shipped to a purchaser in Idaho regard-

less of F.O.B. point or other conditions of sales; or

•

Water’s Edge Filers. For multinational unitary groups using the

property is shipped from an office, store, warehouse, factory,

water’s edge filing method, the denominators include only the

or other place of storage in Idaho and the taxpayer is not tax-

total property, sales, and payroll of the water’s edge combined

able in the state of the purchaser (throwback sales) or the

group. This would exclude the property, sales, and payroll of

purchaser is the United States Government.

foreign subsidiaries whose income is not included in the compu-

tation of apportionable income. To the extent the dividends are

Sales also include gross receipts from services and all other

included in apportionable income, they are included in the sales

gross receipts such as interest, dividends, rents, royalties, gross

factor denominator.

receipts from the sale of property, and other income derived by

the taxpayer in the regular course of business. If gross receipts

All intercompany amounts should be excluded from the compu-

do not fairly represent the extent of your business activity in

tation of the apportionment factors.

Idaho, you may petition, or may be required, to use another

method to obtain an equitable result. Income from services is

Property Factor

Property Factor

Property Factor

Property Factor

Property Factor

attributable to this state to the extent that the services are per-

The property factor is a fraction. The numerator is the average

formed in Idaho.

value of real and tangible personal property owned or rented

and used in Idaho during the tax year to produce business in-

Payroll Factor

Payroll Factor

Payroll Factor

Payroll Factor

Payroll Factor

come. The denominator is the average value of all the taxpayer’s

The payroll factor is a fraction. The numerator is the compensa-

real and tangible personal property owned or rented and used

tion paid in Idaho during the tax year to produce business in-

during the tax year to produce business income. Property used

come. The denominator is the total compensation paid during

in the production of nonbusiness income is excluded from the

the tax year to produce business income. Compensation con-

factor.

nected with the production of nonbusiness income is excluded

from the payroll factor.

Property is included in the factor if it is actually used or capable

of being used during the tax year in the regular course of the

The total amount paid to employees is determined on the basis

trade or business of the taxpayer. Property under construction

of the taxpayer’s accounting method. Under the accrual method,

is excluded.

all compensation properly accrued is deemed to have been paid.

Property owned by the taxpayer is valued at its original cost.

If the taxpayer is required to report the compensation under the

Original cost is the basis of the property for federal income tax

cash method for unemployment compensation purposes, com-

purposes (prior to any federal adjustments) when it was ac-

pensation paid to employees may be included in the payroll fac-

quired by the corporation and adjusted for subsequent capital

tor using the cash method.

additions or improvements, special deductions or partial dispo-

sition because of sale, exchange, abandonment, etc. Deprecia-

Compensation means wages, salaries, commissions and any other

tion does not reduce original cost.

form of payment to employees for personal services. Payments

made to an independent contractor, or any other person not prop-

erly classifiable as an employee, are excluded.

1 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4