Publication 4286 - Sarsep Checklist

ADVERTISEMENT

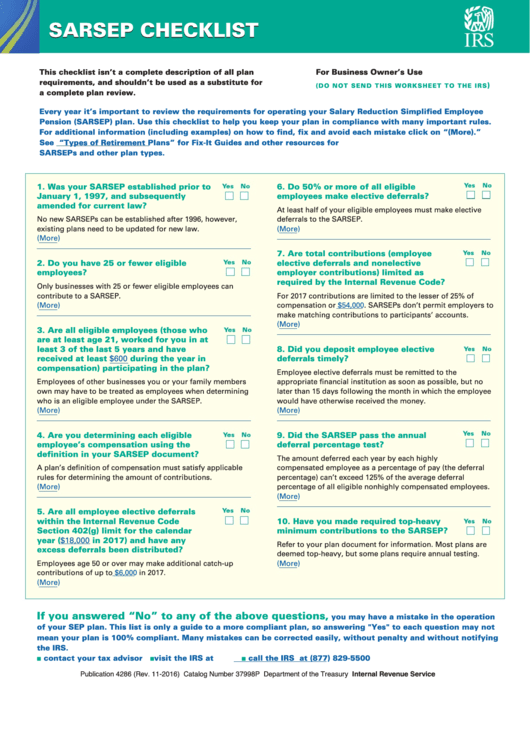

SARSEP CHECKLIST

SARSEP CHECKLIST

This checklist isn’t a complete description of all plan

For Business Owner’s Use

requirements, and shouldn’t be used as a substitute for

)

( DO NOT SEND THI S WORKSH EET TO TH E I R S

a complete plan review.

Every year it’s important to review the requirements for operating your Salary Reduction Simplified Employee

Pension (SARSEP) plan. Use this checklist to help you keep your plan in compliance with many important rules.

For additional information (including examples) on how to find, fix and avoid each mistake click on “(More). ”

See and click on “Types of Retirement Plans” for Fix-It Guides and other resources for

SARSEPs and other plan types.

1. Was your SARSEP established prior to

6. Do 50% or more of all eligible

January 1, 1997, and subsequently

employees make elective deferrals?

amended for current law?

At least half of your eligible employees must make elective

No new SARSEPs can be established after 1996, however,

deferrals to the SARSEP .

existing plans need to be updated for new law.

(More)

(More)

7. Are total contributions (employee

2. Do you have 25 or fewer eligible

elective deferrals and nonelective

employees?

employer contributions) limited as

required by the Internal Revenue Code?

Only businesses with 25 or fewer eligible employees can

contribute to a SARSEP .

For 2017 contributions are limited to the lesser of 25% of

(More)

compensation or $54,000. SARSEPs don’t permit employers to

make matching contributions to participants’ accounts.

(More)

3. Are all eligible employees (those who

are at least age 21, worked for you in at

least 3 of the last 5 years and have

8. Did you deposit employee elective

received at least

during the year in

deferrals timely?

$600

compensation) participating in the plan?

Employee elective deferrals must be remitted to the

Employees of other businesses you or your family members

appropriate financial institution as soon as possible, but no

own may have to be treated as employees when determining

later than 15 days following the month in which the employee

who is an eligible employee under the SARSEP .

would have otherwise received the money.

(More)

(More)

4. Are you determining each eligible

9. Did the SARSEP pass the annual

employee’s compensation using the

deferral percentage test?

definition in your SARSEP document?

The amount deferred each year by each highly

A plan’s definition of compensation must satisfy applicable

compensated employee as a percentage of pay (the deferral

rules for determining the amount of contributions.

percentage) can’t exceed 125% of the average deferral

(More)

percentage of all eligible nonhighly compensated employees.

(More)

5. Are all employee elective deferrals

within the Internal Revenue Code

10. Have you made required top-heavy

Section 402(g) limit for the calendar

minimum contributions to the SARSEP?

year

($18,000

in 2017) and have any

Refer to your plan document for information. Most plans are

excess deferrals been distributed?

deemed top-heavy, but some plans require annual testing.

Employees age 50 or over may make additional catch-up

(More)

contributions of up to

$6,000

in 2017 .

(More)

If you answered “No” to any of the above questions,

you may have a mistake in the operation

of your SEP plan. This list is only a guide to a more compliant plan, so answering "Yes" to each question may not

mean your plan is 100% compliant. Many mistakes can be corrected easily, without penalty and without notifying

the IRS.

contact your tax advisor

visit the IRS at

call the IRS at (877) 829-5500

■

■

■

Publication 4286 (Rev. 11-2016) Catalog Number 37998P Department of the Treasury Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1