Instructions For Completing The Certificate Of Dissolution Form

ADVERTISEMENT

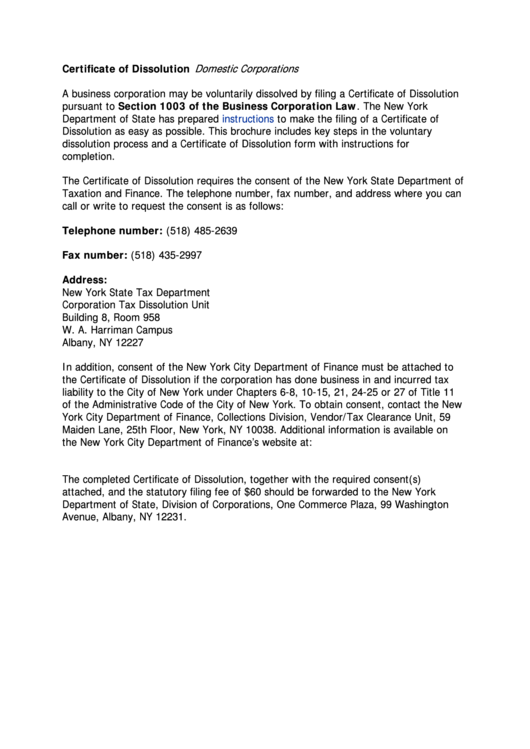

Domestic Corporations

Certificate of Dissolution

A business corporation may be voluntarily dissolved by filing a Certificate of Dissolution

pursuant to Section 1003 of the Business Corporation Law. The New York

Department of State has prepared

instructions

to make the filing of a Certificate of

Dissolution as easy as possible. This brochure includes key steps in the voluntary

dissolution process and a Certificate of Dissolution form with instructions for

completion.

The Certificate of Dissolution requires the consent of the New York State Department of

Taxation and Finance. The telephone number, fax number, and address where you can

call or write to request the consent is as follows:

Telephone number: (518) 485-2639

Fax number: (518) 435-2997

Address:

New York State Tax Department

Corporation Tax Dissolution Unit

Building 8, Room 958

W. A. Harriman Campus

Albany, NY 12227

In addition, consent of the New York City Department of Finance must be attached to

the Certificate of Dissolution if the corporation has done business in and incurred tax

liability to the City of New York under Chapters 6-8, 10-15, 21, 24-25 or 27 of Title 11

of the Administrative Code of the City of New York. To obtain consent, contact the New

York City Department of Finance, Collections Division, Vendor/Tax Clearance Unit, 59

Maiden Lane, 25th Floor, New York, NY 10038. Additional information is available on

the New York City Department of Finance’s website at:

The completed Certificate of Dissolution, together with the required consent(s)

attached, and the statutory filing fee of $60 should be forwarded to the New York

Department of State, Division of Corporations, One Commerce Plaza, 99 Washington

Avenue, Albany, NY 12231.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4